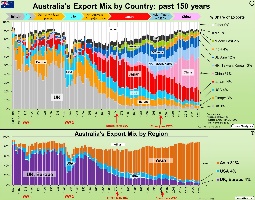

Iron is the cheapest and second most abundant metal on earth (aluminium is the most abundant, but iron ore is around 25 times cheaper.) Iron ore is found almost everywhere and is literally as cheap as dirt. So why is it so important for all Australians, and Australian investors in particular?

Iron ore has been Australia’s largest export earner since 2011, it is the largest contributor to aggregate ASX profits and dividends, the largest contributor to federal and state government revenues, and the largest contributor to the rise in living standards for Australians this century.

The iron ore price is the single most powerful factor that affects returns from the overall ASX market, and therefore it affects every Australian investor either directly or indirectly.

The Iron Age started around 3,000 years ago in the Near East, and around 2,600 years ago in China, but Australia’s iron age was born just 65 years ago (when the government lifted its ban on iron ore exports in 1960), and it started to dominate our economy and share market just 20 years ago. Ok, so we may be slow starters, but we’re really milking it now!

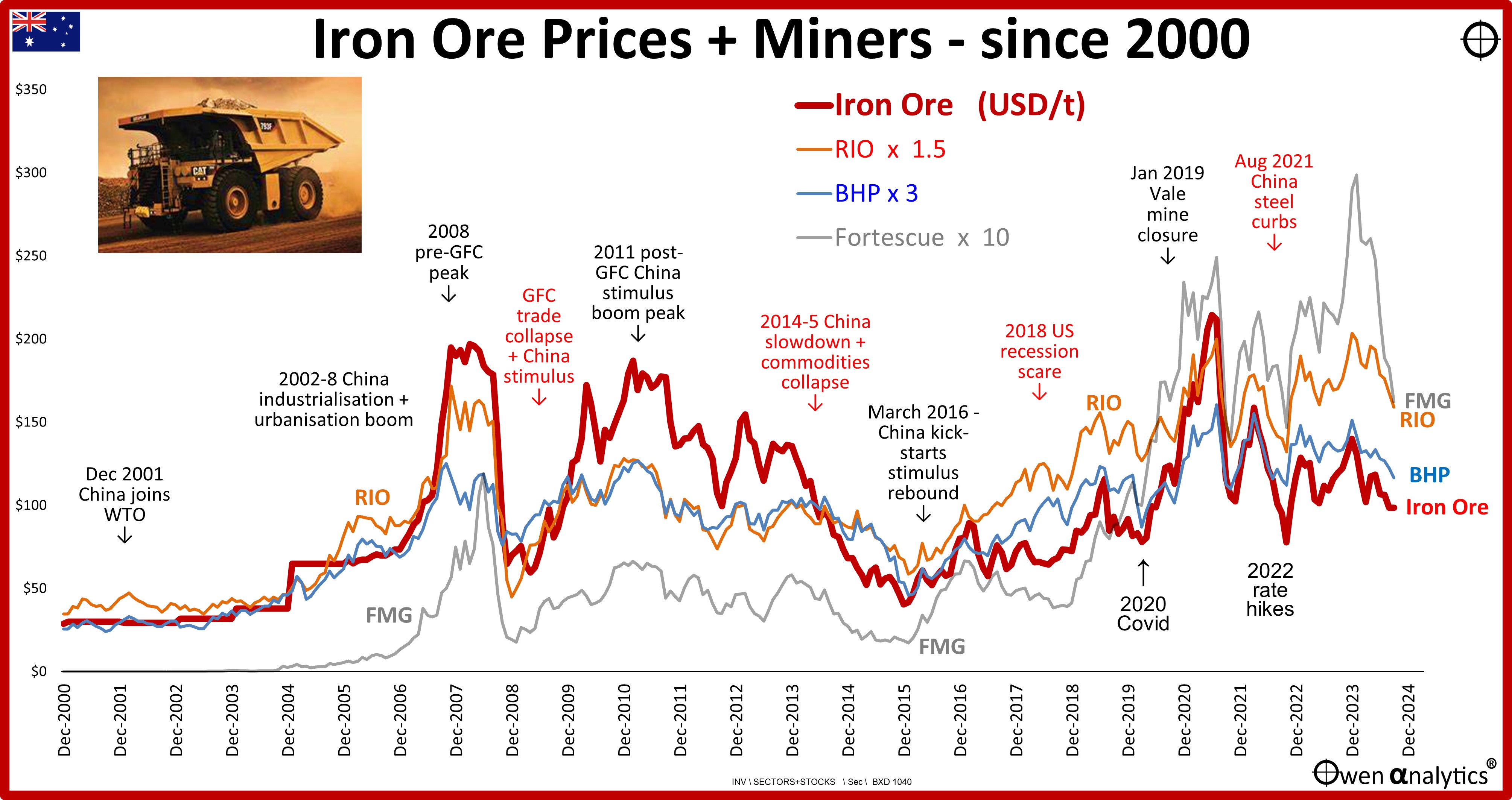

Today’s chart shows the share prices of the big three iron ore miners/exporters – BHP, RIO and Fortescue (FMG). Their share prices have been scaled in order to show them on the one chart.

Leveraged bet on commodities price

As our miners just dig up and export rocks without adding any value to them or turning them into anything useful, they are essentially just leveraged bets on the iron ore price. Operational leverage via fixed costs, plus financial leverage via debt. Consequently, the share prices of the iron ore miners follow the path of iron ore prices up and down through each boom & bust cycle – highlighted in the chart, but with greater volatility due to leverage.

FMG is the most highly leveraged of the three majors (higher operational leverage due to lower grades and lower margins, plus it also has higher financial leverage due to its high debt load). FMG is a ‘pure play’ Pilbara iron ore miner (aside from Andrew Forrest’s recent pet hobbies he is financing with FMG shareholders’ money). BHP and RIO also dig up other minerals in Australia and around the world, although most of their revenues and profits are still from iron ore from the Pilbara in Western Australia.

Cycles

Prices started to rise when China accelerated its industrialisation and urbanisation boom in 2001 after it was admitted to the World Trade Organisation (WTO). Prices peaked in 2008, then collapsed in the GFC, rebounded with China’s 2010-11 infrastructure spending spree, collapsed in the 2012-15 ‘China hard landing’ crisis, then rebounded again with China’s 2016-17 stimulus reboot.

Up to that point, iron ore prices followed the general trend of all industrial commodities prices. However, in January 2019, iron ore prices surged when the world’s largest iron exporter, Brazil’s Vale, was taken out of the market by a catastrophic tailings dam collapse that closed its main iron ore mines. The Vale mines and ports have been kept closed or restricted for much of the time since the dam collapse and Covid, and Australia overtook Brazil to become the world’s largest iron ore exporter.

With Vale out of the market and Chinese steel-making demand remaining strong, iron ore prices surged back to reach a new high of $218 per tonne in May 2021. RIO, BHP and FMG kept operating throughout the Covid crisis, and reaped windfall gains in volumes and prices.

The extraordinary bonanza was so lucrative that in 2022 and 2023, the three iron ore majors produced more profits and dividends than the rest of the 2,200+ companies listed on the ASX combined (including the banks).

Current stage of the cycle?

To the right of the chart we see that the iron ore price has been weak over the past three years with the collapse of China’s property / construction / finance boom, and Xi Jinping’s reluctance to provide yet another huge stimulus injection like in 2009 and 2016. This time around, the urbanisation boom has passed its peak (with more than half of all Chinese now urbanised), and Xi has switched China’s engine of growth away from construction and toward high-tech manufacturing exports including EVs, solar panels, wind turbines, and batteries.

Another factor affecting the demand outlook for iron ore is the increased availability and use of scrap metal in Chinese steel producers. On the supply side we have the prospect of new supply coming out of Guinea (being developed by RIO). Although it is some time away, the mere prospect of increased supply is dampening enthusiasm in the medium term outlook for prices.

In addition to these structural changes, but we also have some cyclical factors at play, including weak manufacturing in China, and increases in stockpiles of iron ore. As a result of these factors, iron ore spot and futures prices are now drifting back below $100.

Share prices?

To the right of the chart we can also see that, over the past four years, the share price of BHP has more or less tracked the iron ore price, but RIO and FMG soared well ahead for no apparent reason. Only in 2024 have prices come back to earth, but they are probably still unjustifiably high given the outlook for cyclical and structural factors facing the iron ore market.

The dramatic price falls of the iron ore majors have been the largest drag on the Australian share market this year, and the main reason for the ASX lagging US and global share markets. Iron ore has an enormous impact on every ‘diversified’ Australian investor, like it or not.

In terms of pricing - the three iron ore majors are trading on relatively modest trailing and forward multiples and dividend yields, but they are probably still based on overly-ambitious assumptions of a quick turnaround in prices and volumes.

I covered the profit reports and share price performance of the majors in my August 2024 snapshot here -

Given the wild swings in commodities price and miners’ share prices, and the outsized weighting of the resources sector in the ASX market, I have always had a keen interest in studying and understanding commodities cycles, including iron ore, and also studying the political and economic machinations in China.

I have visited the big iron ore mines in the Pilbara (north-western Western Australia, about 1,300 km north of Perth), and I have also visited the world's biggest iron ore importer and steel producer, Baosteel, in Baoshan which is literally up the Yangtze river from Shanghai.

Important disclosure – aside from relatively minor holdings in BHP and RIO at various times over the years (but not now), I was an early shareholder in FMG from 2003 (my one and probably only ‘thousand-bagger!’) - but I sold some years ago (unfortunately before it became a thousand-bagger for me!)

In my ’10-4 all-weather ETF portfolio’ I do have an Australian resources ETF approved for use (‘QRE’), as part of the Australian shares allocation for when I want to be bullish on the miners, but it is not in the portfolio at present.

On Chinese steel production see:

On Australia’s reliance on China and how it relates to geo-political risks see:

These are the facts as I see them. I hope you find this a useful input in your process in making more informed investment descisions.

‘Till next time – happy investing!

Thank you for your time – please send me feedback and/or ideas for future editions!