Here’s my snapshot on global markets for Aussie investors – including my Top 5 factors moving markets.

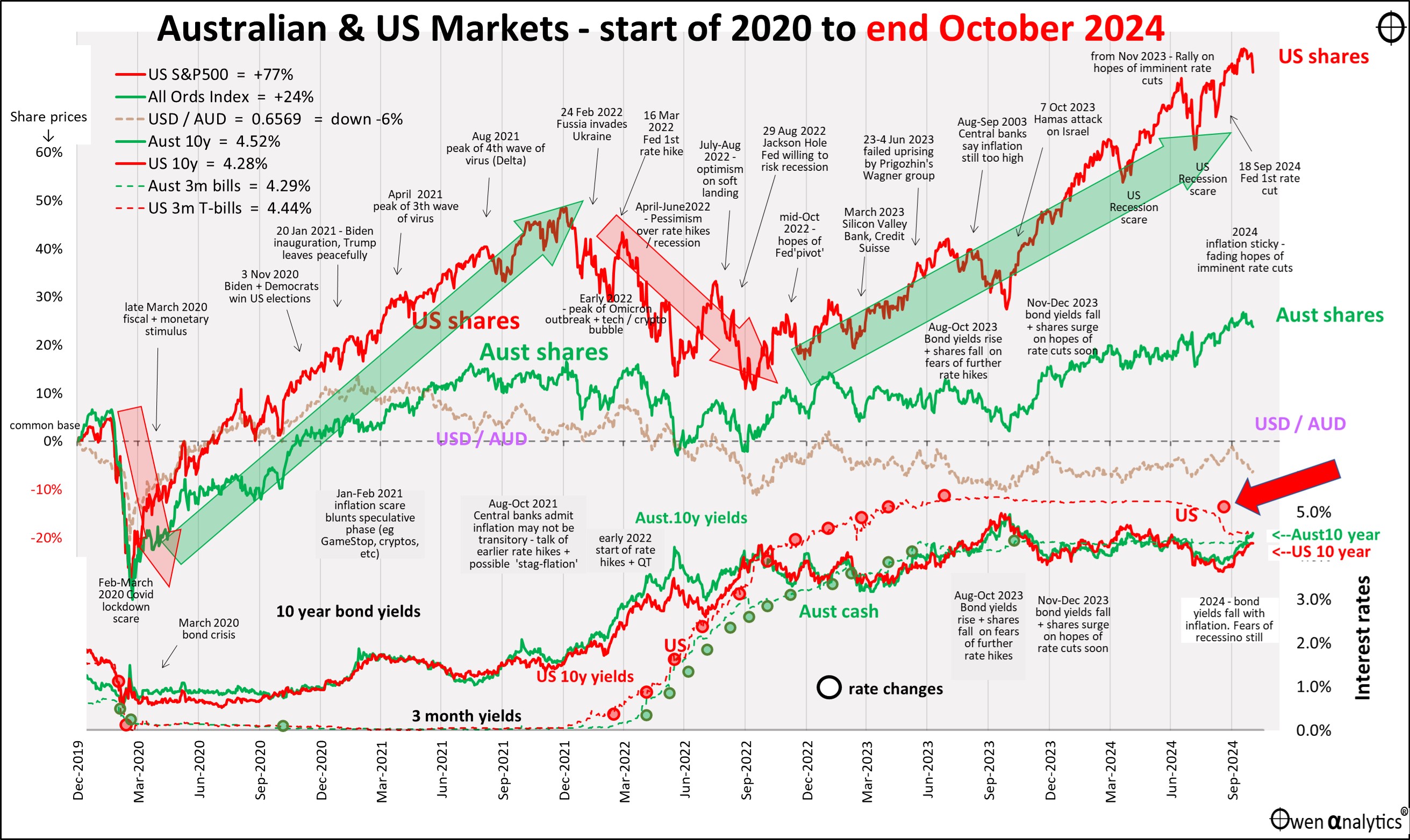

First - my essential 1-page snapshot chart - covering Australian and US share markets, short and long-term interest rates, and the AUD/USD exchange rate. There are two versions – first is the traditional version on a single chart:

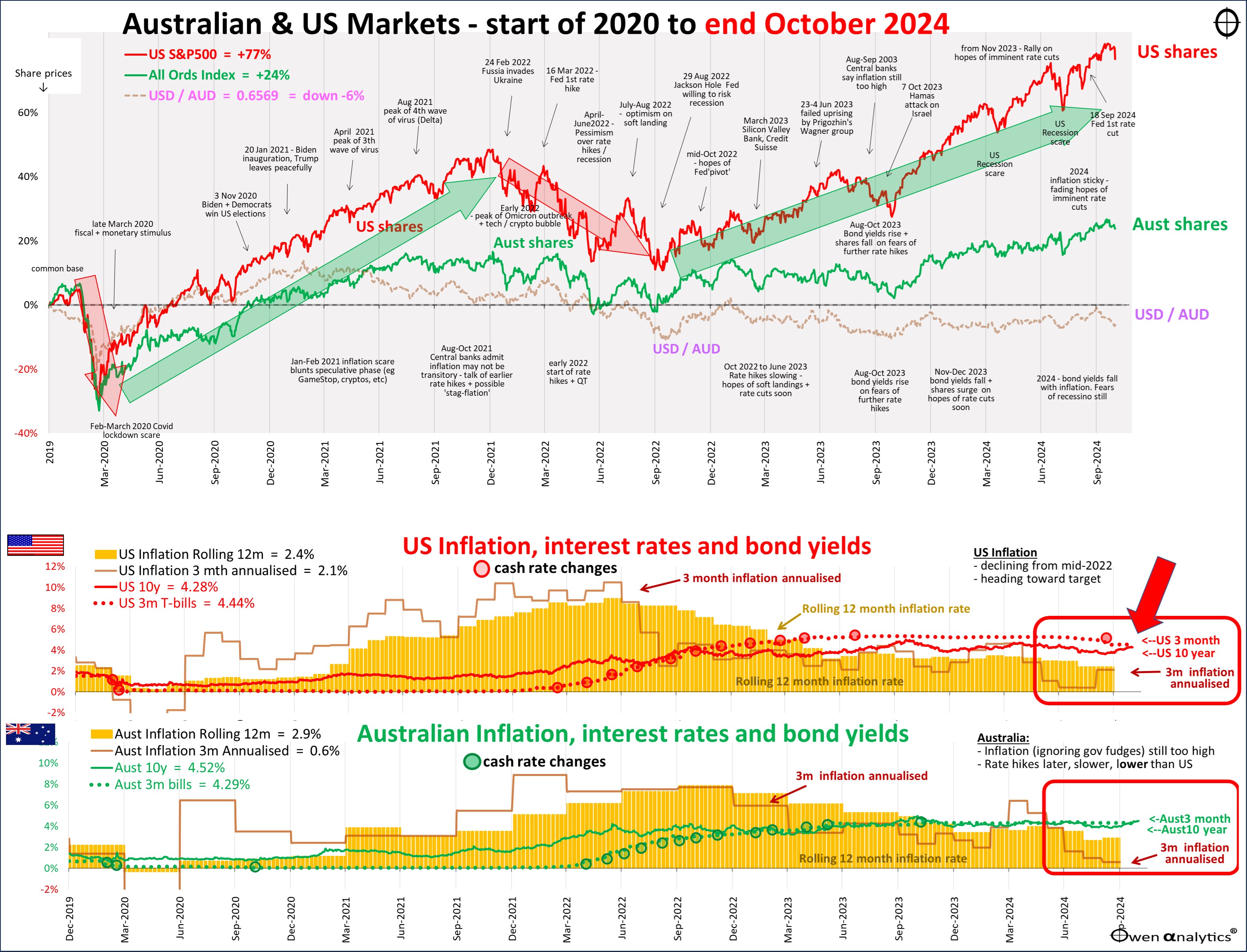

Also the alternate version below, requested and used by several advisers - showing Australian and US inflation in the lower sections.

Here are my Top 5 factors that drove investment markets in October:

1. Trump firms in polls – share and bond prices fall back

Global share and bond markets posted losses toward the end of the month as Trump firmed in the polls. The consensus appears to be that Trump’s tax cuts, spending sprees, tariff hikes, budget deficits, and ballooning government debt would be even more inflationary than Harris’s tariff hikes, spending sprees, tax hikes, budget deficits, and ballooning government debts.

All global share sectors were down for the month for the first time since October 2023. Hardest hit sectors were real estate (rising bond yields + falling values), consumer staples (mainly Coca-Cola, Proctor & Gamble, Nestle), energy (weak oil prices despite wars in the Middle East), healthcare (mainly GLP-1 giant Eli Lily, but most other big pharma down also).

Putting aside electioneering emotion and rhetoric, here is my fact-based assessment of the actual economic outcomes under the Trump and Biden presidencies, see:

The results may surprise you.

Having just returned from nearly three weeks in North America, here is my report on sentiment on the ground:

2. Bond yields rise on spending/inflation fears

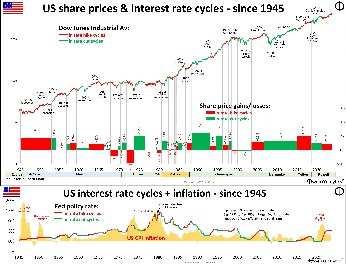

In tandem with falls in share prices, bond prices also fell back in the second half of the month, causing yields to rise. We can see this in the solid red (US) and green (Australia) lines at the right end of the lower sections of the first chart above.

Both Trump and Harris want to increase spending and subsidies to ‘bring American jobs back’, but Trump’s promised tax cuts contrast to Harris’s promises to raise personal taxes (on the rich) and also raise corporate tax rates, so the fear is that a Trump win is probably going to result in larger deficits and debts than under Harris. US federal government debt is already a whopping $36 trillion (122% of national income), and is likely to rise even more quickly under Trump than Harris.

3. Gold & Bitcoin hit new highs

Fears of political unrest in the US have boosted the prices of both gold and bitcoin in October. Gold has benefited from strong buying by central banks (to reduce seizure risks associated with USD holdings, after the experience of Russia after it invaded Ukraine in 2022), and also strong buying by Chinese nationals (with the on-going collapse of Chinese property markets).

I have had gold in model portfolios this year, and it has been the best asset class so far, up +32%. On rising gold prices, see:

Bitcoin has also surged to regain its March and May 2024 highs, with Trump firming in the polls. It is up+56% in 2024 to date but I have no crypto holdings in portfolios. Trump appears to be more crypto-friendly than Harris, although there are no details or specifics on what Trump’s pro-crypto policies might actually be.

Both have probably benefited from a general rise in fears of political unrest, as well as rising US deficits, debts, and inflation. The closeness of the election race has also raised the prospect of a third possibility – a prolonged result (like 1992), and/or disputed outcome (Jan 6 2021 uprising or worse).

4. Australian share market also down a fraction

The local share market followed the global trend down in October, dragged down by weakness in healthcare (mainly CSL, Cochlear), fossil fuels (Woodside, Santos), retailers (Woollies, Coles, Wesfarmers), and CBA. The main support came from gains for iron ore miners (BHP, RIO, FMG) on hopes of more Chinese stimulus announcements at the upcoming 12th National People’s Congress Standing Committee meeting later this week.

So far in 2024, the US share market (S&500 up +20%) is leading the major global markets, while the local share market (All Ords) is near the back of the pack at just +8% for the year.

5. Fed and RBA this week

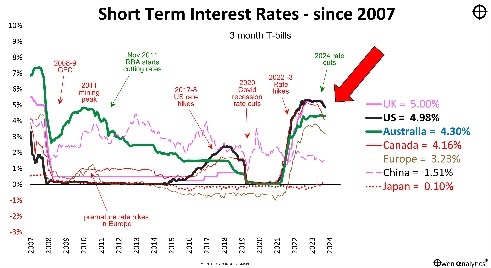

On Tuesday 5th, the RBA is expected to leave the cash rate at 4.35%, rather than make its long-awaited first cut. The RBA’s rate hikes were later, slower, and lower than the US and other major markets, so it is no surprise that inflation remains stubbornly high here, not allowing the RBA to start cutting yet.

Adding fuel to the fire, we have full employment, and strong jobs and wages growth, driven by federal and state government spending sprees.

The RBA consciously did not attack inflation as rigorously as other central banks, but opted instead to let inflation run for longer, for fear of rising unemployment if they hiked rates further.

Australian inflation (green line showing annualised 3-month rate) was a relatively low 1% pa in August and 0.6% pa in September, but these are being suppressed by temporary government energy bill rebates. The RBA is not fooled by these political tricks and is also mindful of the likely rise in government hand-outs with the federal election due early next year.

For a rundown on inflation and interest rates in Australia versus other major countries, see:

On the other hand, the US Fed is expected to make its second rate cut a couple of days after the election this week. However, any positive sentiment from the prospect of further rate cuts in the US have been outweighed by the prospects of higher inflation under Trump, especially if he puts indirect or direct pressure on the Fed to cut rates further than it otherwise would.

On the second main chart above, we can see that US inflation (red line showing annualised 3-month rate) was running at just 0.4% pa in July and August, but has now risen to 2.1% pa in September.

For my story on the history of US rate cut cycles (and rate hike cycles) and their impacts on US shares, see:

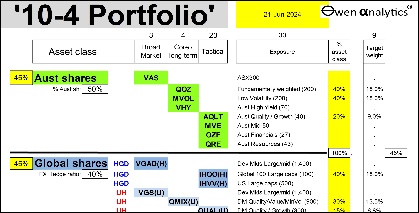

For my current views on asset classes and asset allocations in my actual long-term ETF portfolio - see:

In particular, global shares have done very well, and I have an allocation to gold, and completely out of fixed rate bonds.

Next stop: US elections tomorrow!