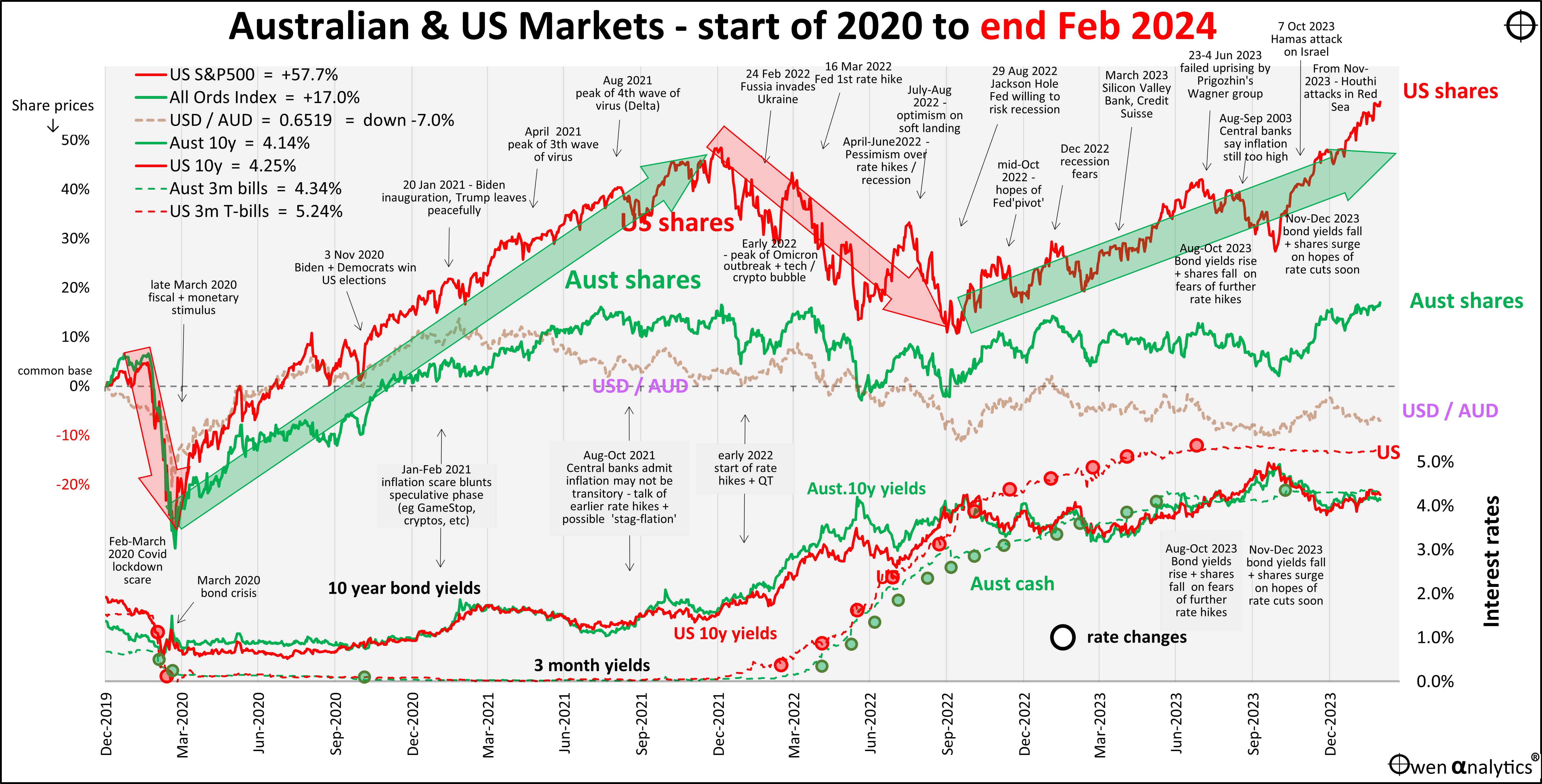

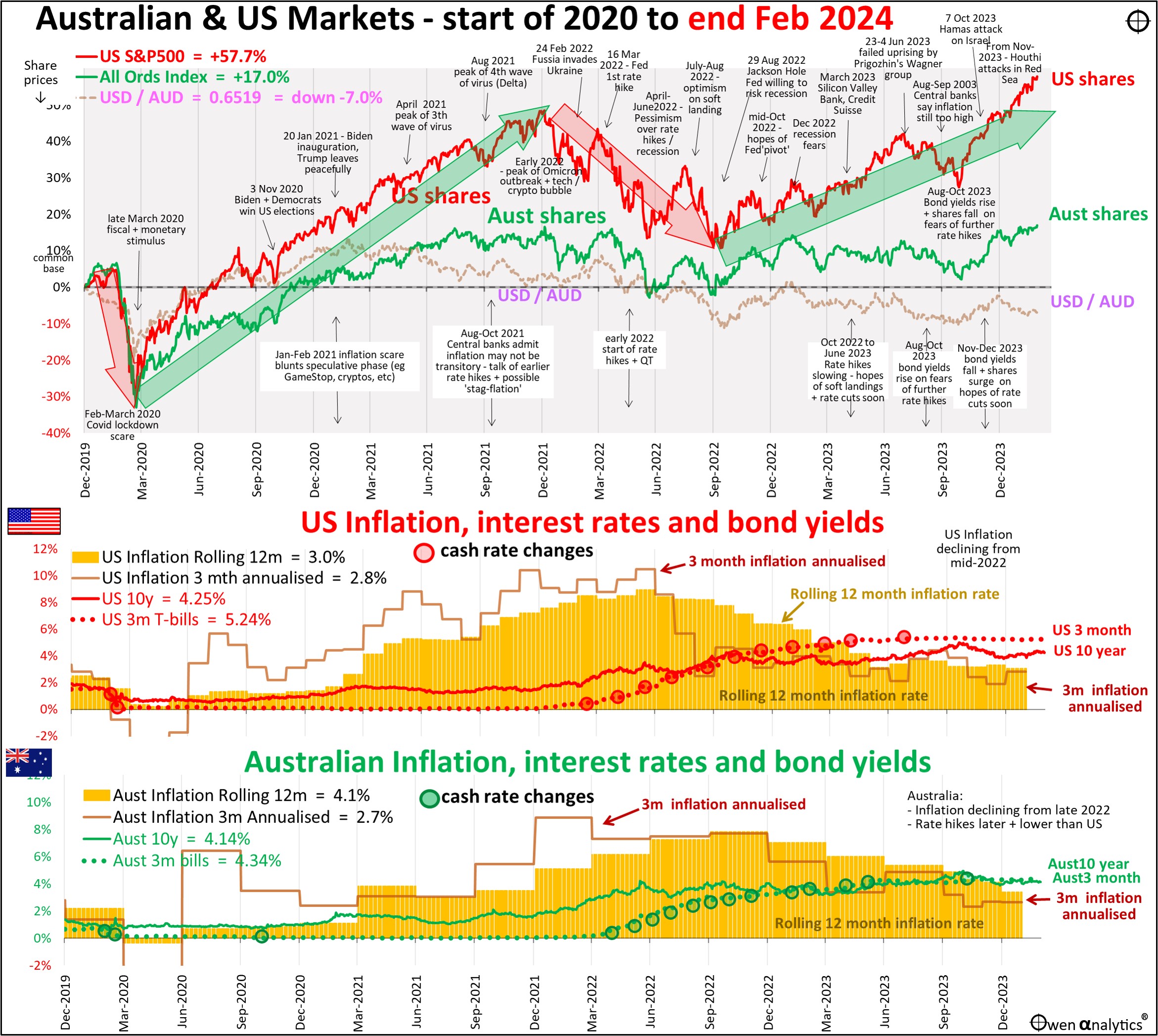

Here is my quick snapshot for Aussie investors – covering Australian and US share markets, short- and long-term interest rates, inflation, and the USD/AUD exchange rate - since the start of 2020.

There are two versions – first is the traditional version on a single chart:

Also a second version requested by several advisers - showing inflation (rolling 12 month annual rate, and annualised rolling 3-months) in Australia and US -

Here is a quick wrap-up of some key developments in February 2024.

Global share markets

Global markets were up by an average of 4% in February, after January’s slow start to the year. The big movers were once again the US tech giants.

A.I. chip maker Nvidia was up another +28% on strong growth in revenues and profits. Nvidia leap-frogged Amazon, Meta/Facebook, Alphabet/Google, and Telsla to become the third most valuable company in the world, behind only Microsoft and Apple.

Meta/Facebook jumped +26% after reporting a surge in profits, a $50b share buyback, and declared its first dividend. Apple, Microsoft, and Alphabet/Google were more or less flat on weaker results.

It wasn’t just tech that did well in February. Every global sector was up in February except real estate and utilities, which were both down just a faction.

All major share markets up for the month (except UK was flat, dragged down by Rio Tinto).

Even Chinese share markets were up, posting their first positive month in six months, but they are still down some 50% from their peak in January 2021. Some brave investors (or rather, speculators) are jumping into Chinese shares, hoping to catch a rebound.

New Highs almost everywhere

Media commentators carry on about the ‘Magnificent Seven’ US giants being responsible for all or almost all of the gains in world share indexes – but that is completely wrong.

The fact is that share markets all over the world are hitting new highs in the current rally.

February saw new highs in dozens of countries, not just the US, but also in Australia, France, Germany, Italy, Netherlands, India, Brazil, Chile, Czech Republic, Hungary, Indonesia, Mexico, Pakistan, Peru, Poland, Taiwan, and many others.

Each of these hit new highs in February, exceeding their previous highs, which in most cases was in early January 2022, right before the sharp 2022 rate hike sell-off.

Japan

The stand-out was Japan, when the Nikkei225 finally regained the high that it posted on the last day of 1989. Thirty four years is a long time to wait for shares to ‘come good’!.

In the case of Japan, a lot of it is smoke and mirrors. Sure, the Japanese share market has been strong on the surface, but it has mostly been the result of two unsustainable factors supporting the market artificially.

First, Japanese revenues, profits and share prices have been greatly assisted by the Bank of Japan trashing the Yen since the start of ‘Abenomics’ (the Yen is down 43% against the USD since December 2012).

The yen is being kept weak by the Bank of Japan, the only central bank left still running negative interest rates and ‘QE’ money-printing, to deliberately trash the currency to assist exporters.

(Officially its motive is to revive inflation, but Japanese inflation has been running above target for the past two years, so it is nothing more than a blatant currency war).

Second, the Bank of Japan has being buying so many Japanese shares - because it has run out of Japanese government bonds to buy - it is now the largest owner of Japanese shares.

US corporate profit season

The big driver of global markets in February was the US corporate profit season, which was better than most analysts expected. (Recall also that an overwhelming majority of ‘professional’ economists predicted US/global recessions for 2023 - Economists are a waste of space - why do they bother?).

For S&P 500 companies, December quarter 2023 aggregate earnings per share were up a healthy +14.7% over December quarter 2022. Calendar year 2023 earnings per share were up +10% on calendar year 2022.

True, most of that was in the ‘Magnificent 7’ but the strong earnings ‘Beats’ were across other sectors as well, especially in Energy, Staples, and Healthcare sectors.

More over-priced

The problem is that the good rise in profits is not enough to explain the big surge in share prices over the past year.

The S&P500 index is up 28% over the past 12 months, but aggregate earnings per share were up only 10%. Therefore, two thirds of the price rises over the past year were simply because people were paying more per dollar of earnings.

Therein lies the problem. The US share market was expensive a year ago, and it is even more expensive now. Share prices have run even further ahead of profits.

This is why I say that share markets everywhere are surging on confidence from US profits, not just US profits. It is more about confidence (or over-confidence) than just the Magnificent Seven, or US profits per se.

See:

Australian shares

The local share market posted a slight gain in February – up +0.6% after a modest +1.1% in January. The local reporting season was not nearly as dramatic as in the US, and we will report on that in a later story.

February’s rise was enough to take the All Ordinaries Index to a new all-time high, finally exceeding the previous high on 4th Jan 2022 (before the 2022 rate hike sell-off which took the index down -16.6% in the first half of 2022).

Three of the fout big banks were strong again in February as mortgage arrears remained low – the dreaded ‘mortgage cliff’ never arrived, or hasn't.

The exception was CBA, which gave back some of January’s share price gains. CBA is by far the most expensive retail bank in the world, for no apparent reason, and investors are finally realising this.

CSL fell back after another setback in US FDA approvals. CSL is still stuck below the highs reached four years ago in the middle of the Covid crisis in 2020 when it briefly became the largest stock on the ASX.

Following the US theme, local tech stocks were the stars in February, as local investors frantically try jump on US tech / A.I. bandwagon.

Appen was up +74%, but is still down 98% from its 2020 high. Square/AfterPay also bounced +18%, but is still down 50% from its pre-take-over high. Wisetech, REA, Xero, CarSales were also up strongly.

See also:

Miners – no memory or shame

The big Aussie miners were down on lower iron ore prices again in February with the continued lack of big stimulus measures from China. Battery metal stocks had a minor bounce after big falls due to collapsing global battery metals prices.

The main story in February was miners’ shameless grovelling for tax-payer handouts. Miners have no memory or shame.

In the good years they over-pay for acquisitions and new mine developments to try to cash in on the booms while they last. They complain about government interference, and they minimise taxes by shuffling profits into offshore tax havens (‘Singapore Marketing Hubs’).

But when commodity prices collapse as a result of production gluts they helped create, the miners suddenly cry poor, write off billions on their over-priced top-of-the-market new mines and acquisitions, then beg for hand-outs from the very same taxpayers they tried to rip off in the first place!

All commodities cycles follow the same pattern. Mining CEO IQ's are lower they their shoe sizes! Here’s a recent example:

· Case Study: 2003-7 Uranium-Paladin bubble & bust. Lessons from the last bubble-bust

Commodities

Fossil fuels prices were mixed in February: Oil +3%, LNG gas down another -12%, Coal recovered a little after big decline last year. Gold ended flat for the month.

Iron ore was down another -12% in February. The spot price is now down -20% below $144 at the start of the year. There is a big iron ore glut on the horizon when Simandeau Ginea production comes on stream. BHP/Rio execs will act surprised, as usual: 'I didn't see that coming!'

Duh! How dumb can you be - seriously!

Nickel and lithium posted small recoveries (on signs of tax-payer bailouts) after big falls over the past year due to production gluts and weak EV demand.

Inflation

During February, more signs emerged that inflation may not be solved as quickly as hoped. Goods inflation is receding as supply constraints are resolved, but services inflation remains problematic, due to rising wages.

In Australia, inflation (to January) is running at 2.6% pa (annualised most recent three months), and 3.4% pa (rolling 12 months). The three-month running rate has not fallen since November last year.

In the US, inflation (to January) is running at 2.8% pa (annualised most recent three months), and 3.0% pa (rolling 12 months). This was higher than expected, and it dashed hopes of early rate cuts.

Bond markets

Confronted by news of stickier than expected inflation, investors here and around the world backtracked on their overly-ambitious expectations of aggressive rate cuts this year. They sold off bonds, sending bond yields higher again.

Yields on benchmark 10-year government bonds rose +0.26% in the US, +0.12% in Australia, +0.33% in UK, +0.24% in Germany, +0.22% in France, +0.27% in Canada, but were flat in QE time-warp Japan.

Credit spreads/risk: no risk of recession priced in

Credit spreads on corporate bonds remained very low and they tightened even further in February, especially in high yield and emerging markets bonds, reflecting very low priced in risk of a recession cycle.

Credit spreads are currently assuming an on-going economic boom, not a hard landing or even a soft landing.

Bond returns mostly negative again

As a result of rising bond yields, government and inflation linked bonds posted negative returns once again.

In corporate bond markets, high grade bonds were also negative. However, in high yield and emerging markets, rising yields were more or less offset by tightening credit spreads, so returns were up a fraction in Feb.

Jobs

Jobs markets also remained very strong in Australia and the US, flowing through to wage rises, which are keeping services inflation high and preventing central banks from cutting rates.

Military conflicts

Escalating military conflicts failed to rattle share markets. Russia’s war on Ukraine enters its third year without any end in sight, and there have been further signs of waning support for Ukraine from the US and Europe.

The Israel-Gaza conflict is also showing no sign of ending or even pausing. Iran’s support of Hamas in Gaza, Hezbollah in Lebanon, and Houthi in Yemen is still strong, and flush with cash from Iran’s oil export revenues from China.

Regardless of western sanctions on Russia and Iran, China continues to finance Russia’s war on Ukraine and Iran’s backing of Hamas, Hezbollah, and Houthi, as China is the biggest buyer of oil from both Russia and Iran.

Thus far, the main impact of the middle east conflicts on global markets has been the Iran/Houthi attacks on commercial shipping in the Red Sea, adding to shipping costs and supply constraints, and keeping upward pressure on inflation.

Repeat of the 1970s oil shocks?

A lot of people I talk to are worried about a repeat of the 1970s oil shocks, but today's world is very different now.

In the 1970s, the US was heavily dependent on the middle-east for its energy needs, and the two oil supply shocks in 1973 and 1979 had severe impacts on US inflation and economic growth.

Today, the US is the world's largest oil producer and largest LNG exporter (yes, larger than Australia and Qatar), so it is much more resilent and self-reliant.

Stay tuned for further developments as they unfold.

Thank you for your time – please send me feedback and/or ideas for future editions!