Australia has the fastest rising residential property prices and rents, mading it residential 'Landlord Heaven, Tenant Hell'.

The tide will turn one day, but when?

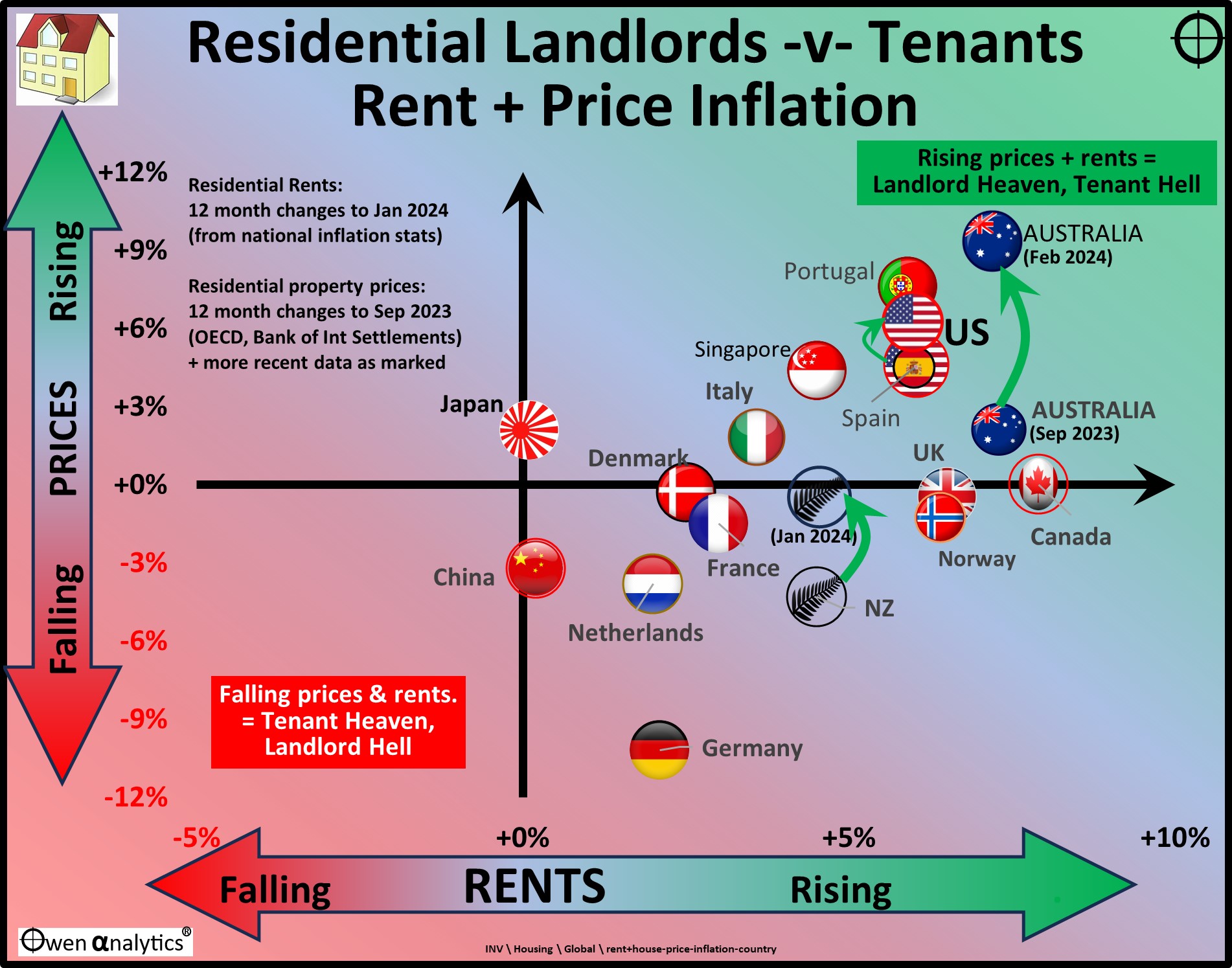

Today’s chart plots 12-month changes in resident rents on the horizontal axis, and 12-month changes in residential property prices on the vertical scale – for several countries. (Notes on sources and timing below).

‘Landlord Heaven, Tenant Hell’

The top right section of the chart is ‘Landlord Heaven and Tenant Hell’ – with rising residential property values and rents.

It is hell for tenants, not only because rents are rising rapidly, but also because rising property prices put buying their own home further out of reach, and keeps them in the rental pool, increasing demand and rents.

Australia stands out in the upper right corner - with the largest 12-month increase in property values, and also strongly rising rents.

Canada and the UK also have strongly rising rents, but residential property prices were virtually flat in those markets.

Behind Australia’s gold medal, Portugal takes silver. USA and Spain tie for bronze.

Household debts and rate hikes

It is true that Australians have the highest levels of household debt per capita in the world, but rising property values/prices magnifies gains in net wealth and returns.

(It is the opposite when values are falling, of course, but we cover the risk of recessions and housing corrections below).

It is also true that Australia has the greatest mortgage sensitivity to interest rate hikes because of our unique predominance of floating rate mortgages, but rents are rising strongly to help cover interest payments.

‘Tenant Heaven, Landlord Hell’

Conversely the lower left section of the chart is ‘Tenant Heaven and Landlord Hell’ – with falling residential property values and rents. No country shown here is in this position.

China is closest – but we warn of the usual qualifications about the reliability of any data out of China. The current deep residential construction/finance collapse in China is probably having a significant negative impact on both prices and rents, but getting reliable data is difficult.

Australia and other ‘rich world’ markets had falling housing prices in 2021, but they were accompanied by rising rents, which helped geared-up landlords cope with rising interest costs.

‘Landlord Hell’ occurs when rents and property values are both plummeting. These are in broad property crashes, with widespread bankruptcies, usually triggering banking crises. Every country has experienced this at one time or another – we cover these crashes below.

Residential rents

Data on rental inflation comes from national inflation statistics for each country, and in most cases these are to January 2024.

Rental inflation in most countries peaked in early 2022 along with overall CPI inflation rates.

Rental inflation higher than CPI inflation

Although overall CPI inflation rates have fallen back in 2023 and 2024, residential rents are still rising more quickly than CPI inflation because CPI inflation is being brought down mainly by lower goods inflation after the supply shocks of 2020 and 2021 have eased.

In most countries, including Australia, rental inflation is still running at between one and a half and double the rate of CPI inflation.

Landlords are jacking up rents to cover higher interest costs on borrowings, and also because they can, because rental supply remains tight. Construction has slowed, as developers and builders are being squeezed by higher costs of interest, construction materials, and wages.

Rental supply is probably going to remain tight for some time – especially in Australia, meaning rental inflation will remain strong for some time.

Residential property prices/values

Data on residential property prices comes from the OECD and Bank of International Settlements, and is to the September quarter 2023, which is the most recently available data across a wide spread of countries.

Property prices in most countries fell during 2022 while interest rates were being raised aggressively by central banks to fight inflation. However, housing prices started to rise again during 2023 when central banks slowed and paused their rate hikes.

In the case of Australia, NZ and the US, I have also added a second symbol for each country for more recent data on house price growth.

In all three of these countries, residential property price increases are accelerating (upward movement on the chart).

In the case of Australia, median prices rose by +2% for the 12 months to September 2023, but the CoreLogic national price series has national capital city average prices rising by +10% in the 12 months to the end of February 2024.

Residential property prices are also accelerating in the US and NZ (upward arrows on the chart, like Australia).

Other countries, including in Europe, are also probably on an upward path, but still probably a long way behind Australia.

The outlook?

In Australia, residential rents are likely to continue to rise as long as demand growth exceeds supply growth, especially now that wages are on the rise.

For renters, their wage rises can go straight into landlords’ pockets because rental supply is tight, and landlords can raise rents. Tenants have little choice as they have nowhere to go.

Rental demand is likely to remain strong due to high immigration rates, strong jobs markets, rising wages, high property prices, and interest rates remaining more or less where they are.

High prices and interest rates put buying a property out of reach of most renters, so they remain renters for longer, pushing rents up even further.

On the rental property supply side, the federal government has announced grand plans to dramatically increase the residential stock over the coming years, but most people in the industry can’t see how this can be done in practice.

Instead, property developers and builders are slowing construction activity due to higher interest rates, materials costs, and wages.

Property/economic correction or recession?

What would bring rents and property values down substantially is a deep property/economic correction/recession. Australia had one in 1974-5, and again in 1990-3.

For the US it was in the 1980s ('S&L' crisis), and in 2006-8 ('subprime' crisis). Ireland, Spain, Portugal, Iceland, and Dubai had crises in the aftermath of the GFC, and China has been in a deep property construction/finance crisis/contraction since 2021.

Each of those property/construction/finance crashes was caused by high interest rates (and/or other lending restrictions or collapses) bursting an over-supply boom, resulting in banking/finance crises.

In Australia we do not have an over-supply boom at present (in fact we have chronic under-supply), and we are unlikely to see interest rates rise much above current levels.

We may, of course, suffer a ‘normal’ economic recession (when, not if), but the next economic slowdown will probably not cause a deep contraction in residential property prices and rents, nor a banking crisis, as was the case in the other cycles mentioned above.

Personally, I would not want to be a tenant in the current environment!

But the tide will turn one day – as it always does.

(A note on terminology - I use the common term ‘landlord’ to cover rental property owners of all genders. Apologies for any offence caused.)

See also:

Disclosure:

My personal wealth has come from roughly a 50/50 split between shares and property. In the case of property, it has been a combination of owner-occupied and rental properties in Sydney, Melbourne, and S/E Queensland, over a period of 40 years since the mid-1980s. I have been a tenant during two periods: in the early 1980s before buying first house, and for a year in the mid-2010s awaiting divorce settlement.