In January 2024, Australia’s population reached 27 million. This came 18 years sooner than the government planned and predicted just 22 years ago! That sounds like an extraordinary case of poor government planning and/or poor predicting!

Australia has the highest population growth rate outside of Africa, but it is still the sparsest/least densely populated country on earth.

In this issue we discuss why this is critical for investors and how it shapes our investment markets and outcomes.

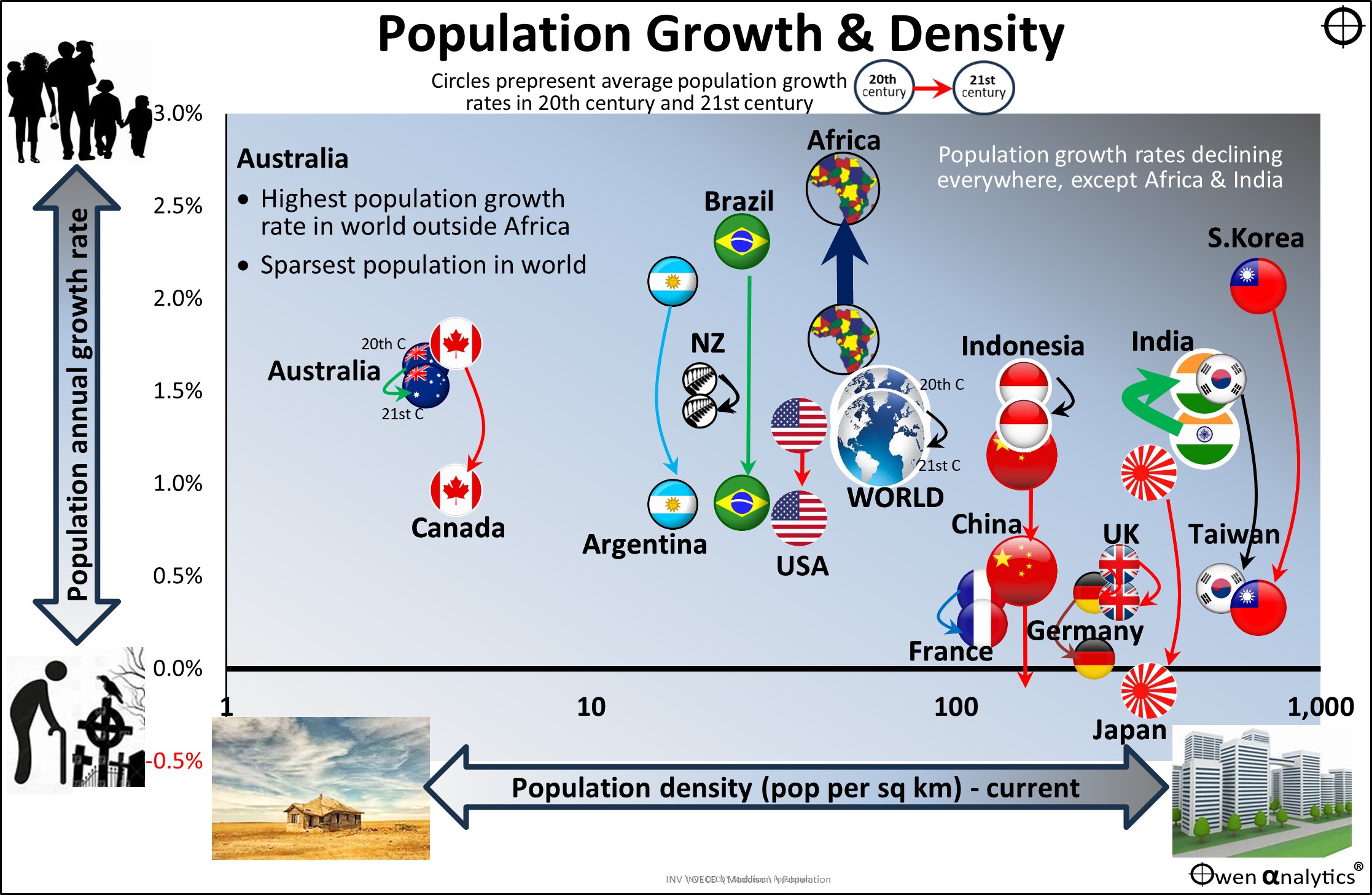

Today’s chart shows population growth rates and population density for selected countries.

Each country is represented by two circles, indicating their average annual population growth rate in the 20th century, and also for the 21st century so far, plotted along the vertical scale. The higher up the chart, the higher the population growth rate.

In almost all cases, population growth rates have declined from the 20th century to the 21st (ie downward arrows between the circles). More on this later.

Population density (people per square kilometre) in each country is shown on the horizontal scale – from sparsest at far left (Australia and Canada), through to highest density to the far right (South Korea, Taiwan).

Why population growth matters for investors

Population growth is a fascinating subject, as it involves controversial policy debates like immigration, refugees, fertility, childcare, housing, inter-generational equity, etc. But why is it important for investors, and for Australian investors in particular?

Because, unlike other ‘developed markets’, our population growth has been the largest single contributor to overall economic growth, far greater than productivity growth or participation rates.

Who needs productivity growth when we can just dig more holes in the ground and export more rocks, dirt, or gas?

On various measures, the Australian share market has been the best or near-best performing share market in the world over the past century or so, and Australians’ overall living standards (eg median incomes and wealth per person) are also the highest in the world.

This growth has been underpinned by our relatively high rate of economic growth, and most of that has come from population growth.

Two main sources of economic growth

Growth in the overall economic pie comes from two main sources -

(a) population growth (more people producing the same output per person); and

(b) productivity growth (more output per person).

Of these two components, productivity growth is more important, because that contributes to higher incomes and living standards per person. (a third, but much smaller source of growth is increases in participation rates).

On the other hand, population growth without productivity growth just increases over-crowding, but does not increase living standards per person. The problem is that most of Australia’s overall economic growth has come from population growth, rather than productivity growth.

Australia -v- USA on productivity

In Australia, two thirds of our overall economic growth has come from population growth, and only one third from productivity growth. In the US it is the other way around. We cover this in a separate story.

While there are many theories about why Australia has not been able to generate much productivity growth, there is no doubt that we have been blessed the curse of resource abundance.

Unless we believe that a sudden jump in productivity growth will appear like magic, then we must continue to pursue high population growth (which means high immigration) as the main source of our economic growth.

Greenies will recoil in horror, but that’s how they (and all of us) got rich, relative to the rest of the world!

Shape of our share market

A second main reason for the importance of population growth (which is the main driver of economic growth here) for investors is that it has had a big influence on the shape of our share market.

The Australian share market is made up largely of century-plus-year-old companies that are domestic in nature, confined by, and heavily reliant upon, growth in the local domestic economy.

Domestic dominance, international failures

Every one of the big banks, retailers, insurers, telcos, construction firms, etc, have tried to expand into international markets over the years, but almost all of their grand overseas adventures have ended in failure, huge write-offs, and humiliating retreats.

For every CSL that has made it internationally, there have been hundreds of failures.

Fortunately, the high rate of growth of the domestic economy (mostly via high immigration-led population growth) has been enough to sustain high levels of overall share market returns relative to other countries.

Commodities are just commodities

It is true that more than half of all our listed companies are resources companies (actually, 95% of them are revenue-less, profit-less explorers with little more than a map, a compass, and a bucket of hope and hype).

Non-value-adding commodities, by definition, can be overtaken by alternative suppliers and substitutes, and they are entirely reliant on commodities demand and prices that are set by foreigners, and are highly volatile and cyclical.

They are also reliant on finding useful stuff to dig up! This is hardly a sustainable business case, as it relies purely on luck, but we have been lucky so far!

Virtually no real ‘industrial’ companies

Our reliance on population growth rather than productivity has shaped our industry mix.

For example, in most countries, ‘industrial’ companies make things, but we don’t actually make much here. It is much easier to just dig up the raw materials and ship them to other countries who make them into useful stuff that we import back at thousands of times the price we got for the raw materials.

Australia’s ‘industrial’ sector is mainly transport companies that just move imported stuff around - Transurban (roads), Brambles (pallets), Aurizon (rail), Qantas (aircraft), Cleanaway (rubbish), Qube (ports), etc.

The largest sector of the ASX is still the cartel of dinosaur banks, which just shuffle money around, taking a clip everywhere they can, and they also act as a conduit for importing foreign capital to fund local domestic businesses.

Construction

Our national emphasis on population growth for economic growth has also resulted in real estate construction being a more important sector here than in other ‘developed’ countries.

As a result, Australia is the only country where ‘real estate’ is considered a separate asset class in its own right. In the US and other markets, ‘real estate’ is found in the back of finance textbooks under ‘Alternative’ assets, along with hedge funds, venture capital, and other ‘exotics’.

Old World -v- New World

Among the high-growth ‘New World’ countries, Australia is ahead of New Zealand, Canada, and the US. These four countries have translated high population growth into prosperity and high living standards (incomes and wealth per person).

However, Argentina and Brazil (as well as Africa and Indonesia) have also had relatively high population growth rates, but they have not had the political stability required to replicate the success of Australia, US, Canada, and NZ.

Growth alone does not guarantee prosperity.

Declining rates of population growth

The chart shows that population growth rates are declining everywhere except in India and Africa – the only two pairs of circles with upward arrows. Population has actually started to shrink (ie negative growth) in Japan, Russia, parts of western/northern Europe, and in China.

The overall world population will probably peak at around 9 billion people around the middle of this century, and then start to decline.

Importantly, in this world of declining population growth rates (and soon declining overall population), Australia not only has had the highest population growth rate (outside of Africa), it also has the smallest decline in population growth rates from the 20th century to the 21st. (Australia’s pair of circles are closest together).

Sparsest country on earth

Although high population growth means more over-crowding and pollution, fortunately there is plenty of room left!

Australia is still the sparsest country on earth (apart from Greenland and Western Sahara) with 3.5 people per square kilometre. This is less than one tenth of the density of the US.

We are not spread out evenly of course. We are one of the most urbanised nations on earth, with 86% of us huddled together in the coastal cities.

True, only 4% of our land is arable (similar to Canada, Russia, Norway, and many other countries), but this huge rock in the middle of the ocean seems to be packed full of useful minerals the rest of the world wants, probably much of which we don’t even know about yet.

18 times our ‘fair share’ of land

We have 0.3% of the world’s population, but we claim to ‘own’ 6% of the world’s total land area. That is 18 times our ‘fair share’ of land per person.

It is the sparsest country on the planet, but it is also the richest in resources, and the hardest to defend against aggressors.

The bottom line is that high population growth (primarily via immigration) is still the key to our continued prosperity, self-determination, and investment returns.

The data:

See also: