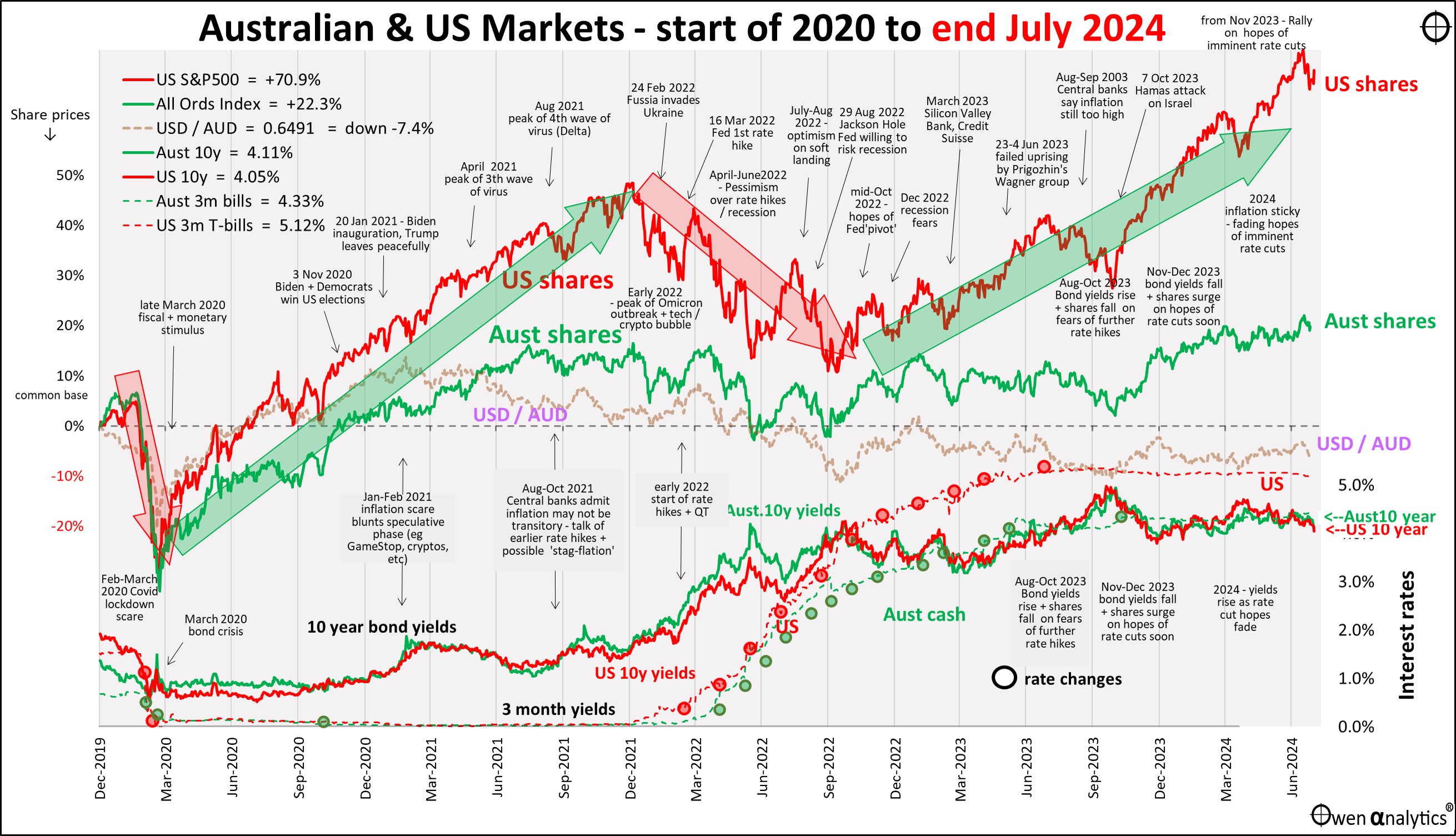

Here is my essential 1-page snapshot chart for Aussie investors – covering Australian and US share markets, short- and long-term interest rates, inflation, and the AUD/USD exchange rate.

There are two versions – first is the traditional version on a single chart:

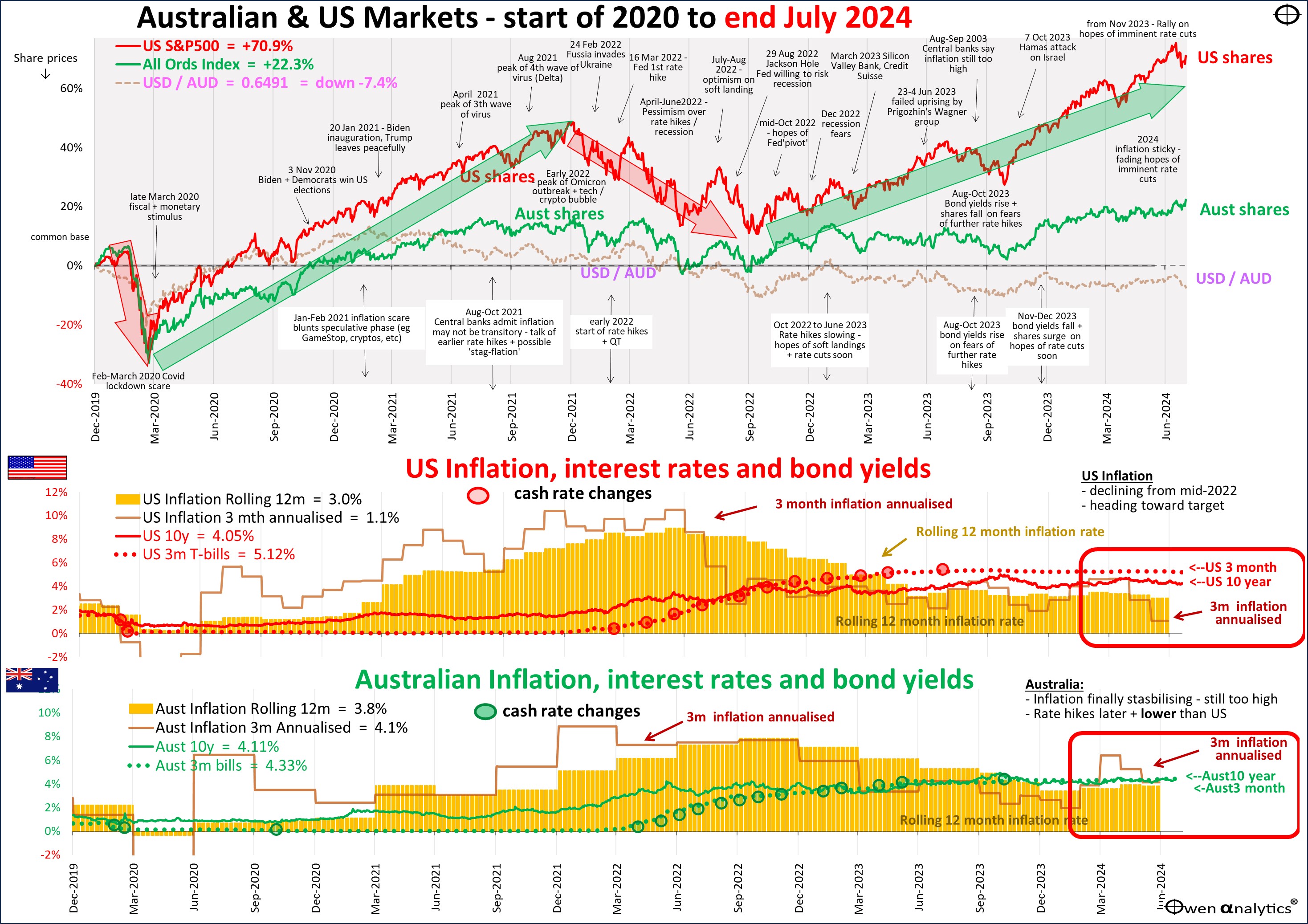

Also the alternate version below, requested by several advisers - showing inflation (rolling 12-month annual rate, and annualised rolling 3-month rate) in Australia and the US in the lower sections.

Inflation – finally stabilising

This second chart highlights the elephant in the room – inflation – the yellow lumps in the lower two sections. The orange bars are the rolling 12-month inflation rates, and the orange lines are the annualised 3-month rates.

In the US, inflation peaked in mid-2022, declined for the next 12 months to mid-2023 and is now near target zone at last. The rolling 12-month rate is still 3% but the annualised rolling 3-month rate is now down to 1%.

The Australian picture is not as good, and different in some important ways. Australian inflation peaked later (end of 2022), has been declining more slowly since then, but rose again in early 2024 (orange bars above the annual rate, dragging it higher). Adding to the fire we have strong jobs and wages growth, driven by government sectors.

RBA rate hikes in Australia (green dots) have been later, slower, and lower than the Fed rate hikes in the US (red dots). Cash rates in the US and other peer countries have been above 5% for more than a year now. In contrast, cash rates in Australia are a full per-cent lower, but our inflation is higher.

Australian governments threw much more money at propping up businesses and incomes during the Covid lockdowns than US governments, and Australian wages systems are much more centralised. As a result, high ‘services inflation’ is keeping inflation figures elevated despite declines in ‘goods inflation’.

Rate cuts have started elsewhere in the world, including Canada (twice), Europe (once), and China (several times, to try to stimulate a stalled economy). Japan is the main exception – belatedly raising rates and scaling back QE(!).

While (most of) the rest of the world is cutting or preparing to cut rates, Australia is at least not likely to raise rates further. Either way, the sentiment is bullish for share markets.

Share market trends

The broad green and red arrows marking the US S&P500 index in the upper section of the above charts are just my simple estimations of the big swings in the US share market. They are not predictions, just my sense of where sentiment is taking the market at the time.

This current upward trend (current green arrow) is being sustained by hopes of imminent rate cuts, declining inflation, and avoidance of sharp recessions.

Regular readers will know that I have not changed the direction or slope of the current green bull market arrow over the past year. The US market has just kept on the same broad upward trend driven by positive sentiment since late 2022.

Sometimes the market gets ahead of itself and surges ahead of the green arrow – eg in mid-2023 and again in 2024 – but it inevitably falls back to a more sustainable trend. We saw another mini-mini-correction in the middle of July.

Currently the US market is well above the green arrow once again, so it is vulnerable to fall back sooner or later. It is probably not going to be a big ‘crash’ just yet, just a healthy correction, unless sentiment changes dramatically to the downside.

(I tend to focus firstly on the US as it drives all global markets, including Australia, regardless of local pricing and conditions).

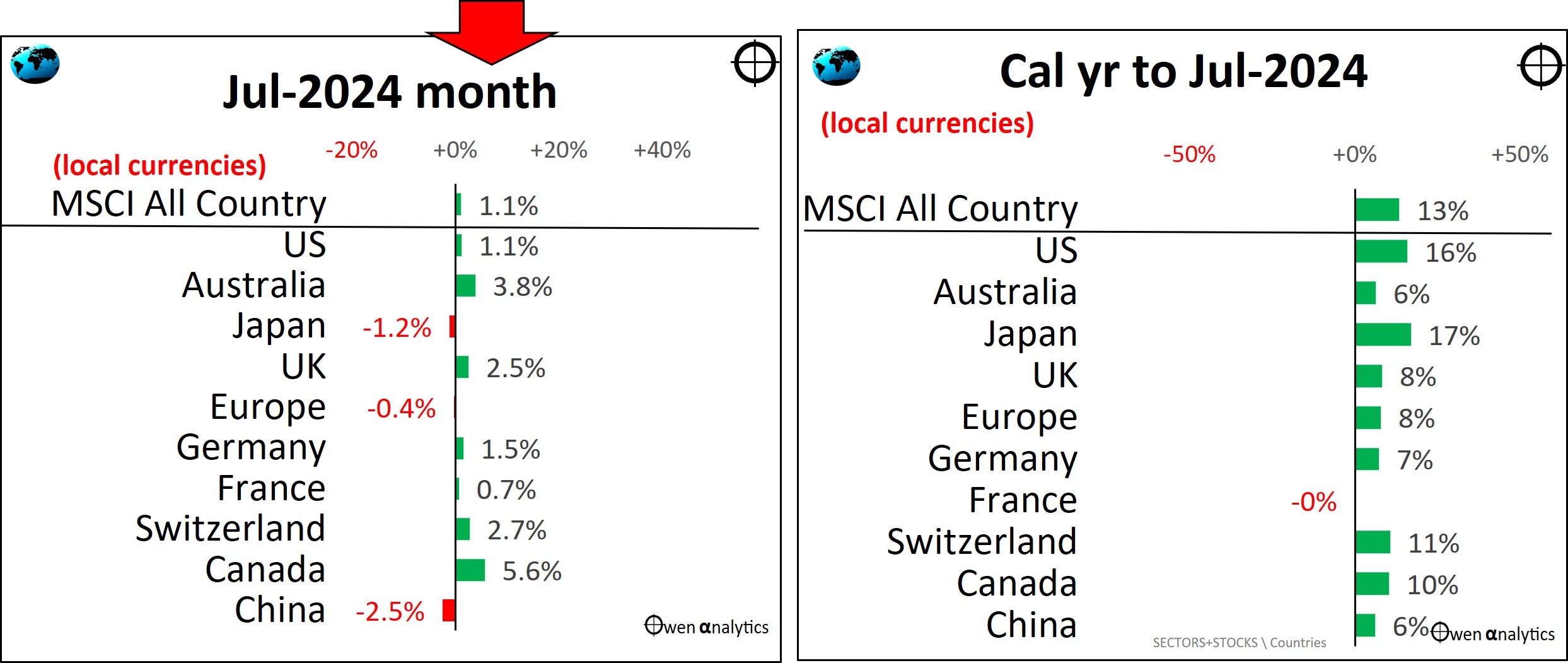

Global shares – up – but all in last day

Global share markets gained 1% in July, but all of that came on the last day of the month, after US Fed Chair Powell more or less confirmed a Fed rate cut in September.

The gainers for the month were sectors and stocks most likely to benefit from lower interest rates – industrials, real estate, banks. Healthcare stocks were also stronger virtually across the board.

On the other hand, the fancied US tech/ai stocks were a net drag on the overall market (Nvidia, Microsoft, Meta/Facebook, Alphabet/Google, Amazon, Netflix were all down, but Tesla and Apple gained).

Year to date it is still a strong story for global share markets, with most countries (even China) on the way to good gains.

The main exception is France, where luxury goods brands (LVMH, Kering, L'Oreal) have been hit hard by the spending slowdown in China.

Australia’s relatively poor performance this year is covered below.

Aussie Dollar down further

The AUD fell in July against all major currencies, especially the rebounding Yen, as the RBA is unlikely to raise interest rates further. For calendar 2024 to date, the AUD is down -5% against the USD, and down against most other currencies except the Yen.

The falling AUD has boosted returns to local investors from unhedged global shares by around +2% in July, and by around +5% so far in 2024. (In my model portfolios I remain biased toward un-hedged on global shares.)

Current positive sentiment on a roll

I have written extensively that the US share market (and therefore the overall global share market) is significantly over-priced on a number of different measures - see for example:

But that does not mean they are about to collapse immediately. In my stories on the over-pricing, I emphasise the fact that share markets can run into very expensive territory for many years before they eventually crash – for example the US market rose strong for whole of the 1990s decade before the almighty 2001-2 ‘tech-wreck’.

There will be a major collapse in time (there always is), but not until we have a major trigger.

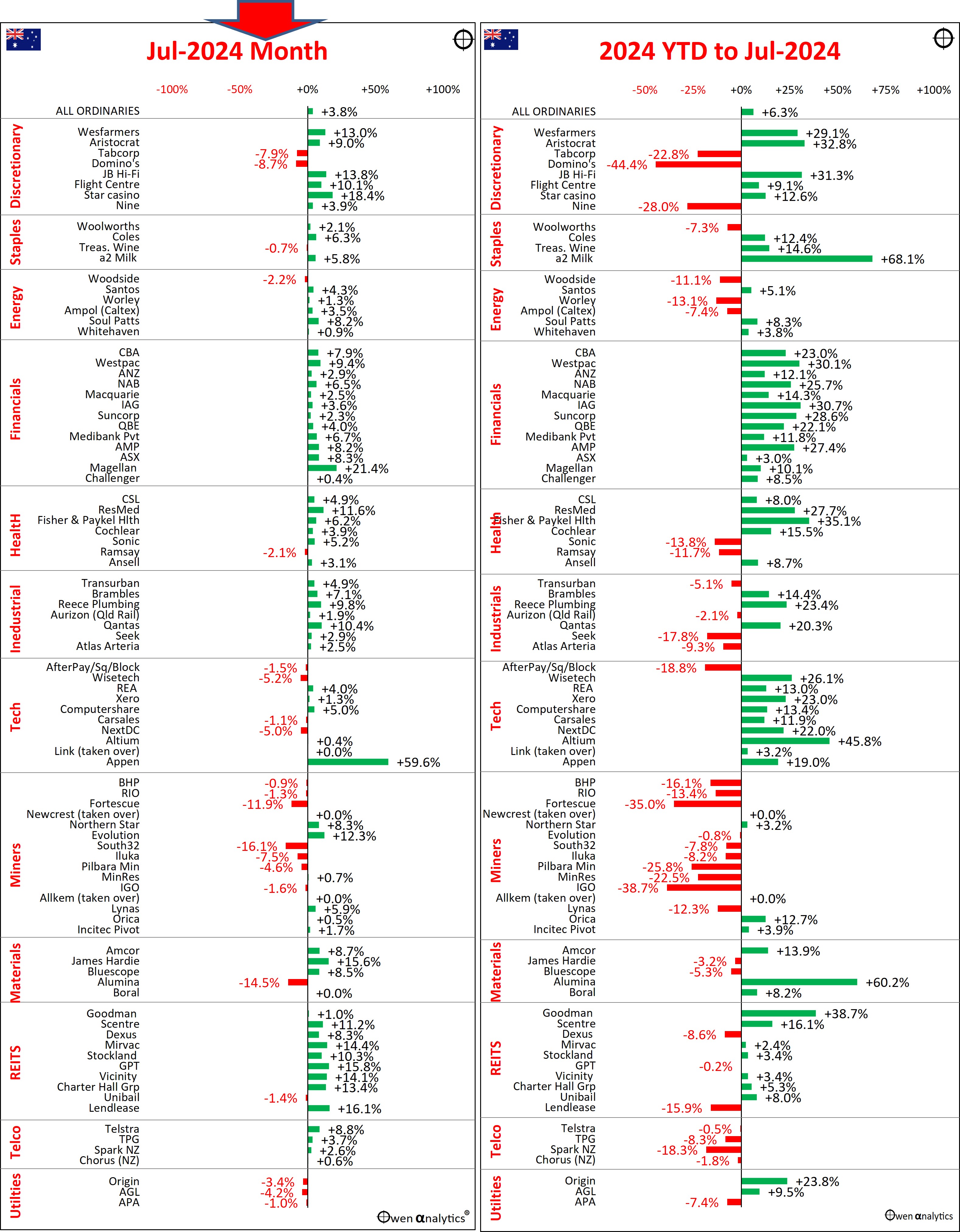

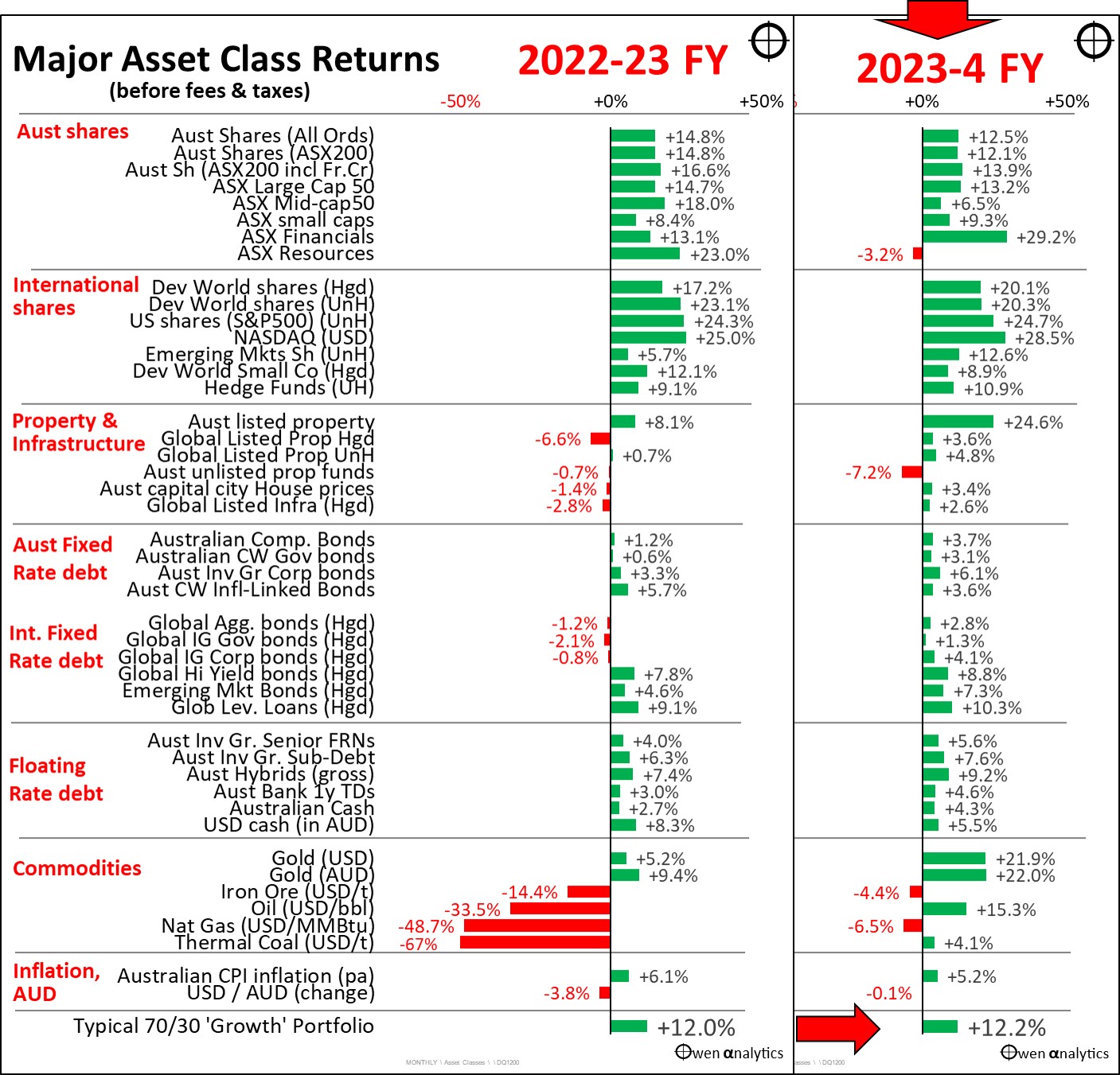

Australian shares – strong July, but still lagging

The local share market had a good month in July, as flat inflation numbers probably ended fears of more RBA rate hikes, for the time being anyway.

However, the local market is still lagging global markets by a sizable margin in 2024, due mainly to the big iron ore miners being dragged back by lower iron ore prices and lack of big stimulus from China.

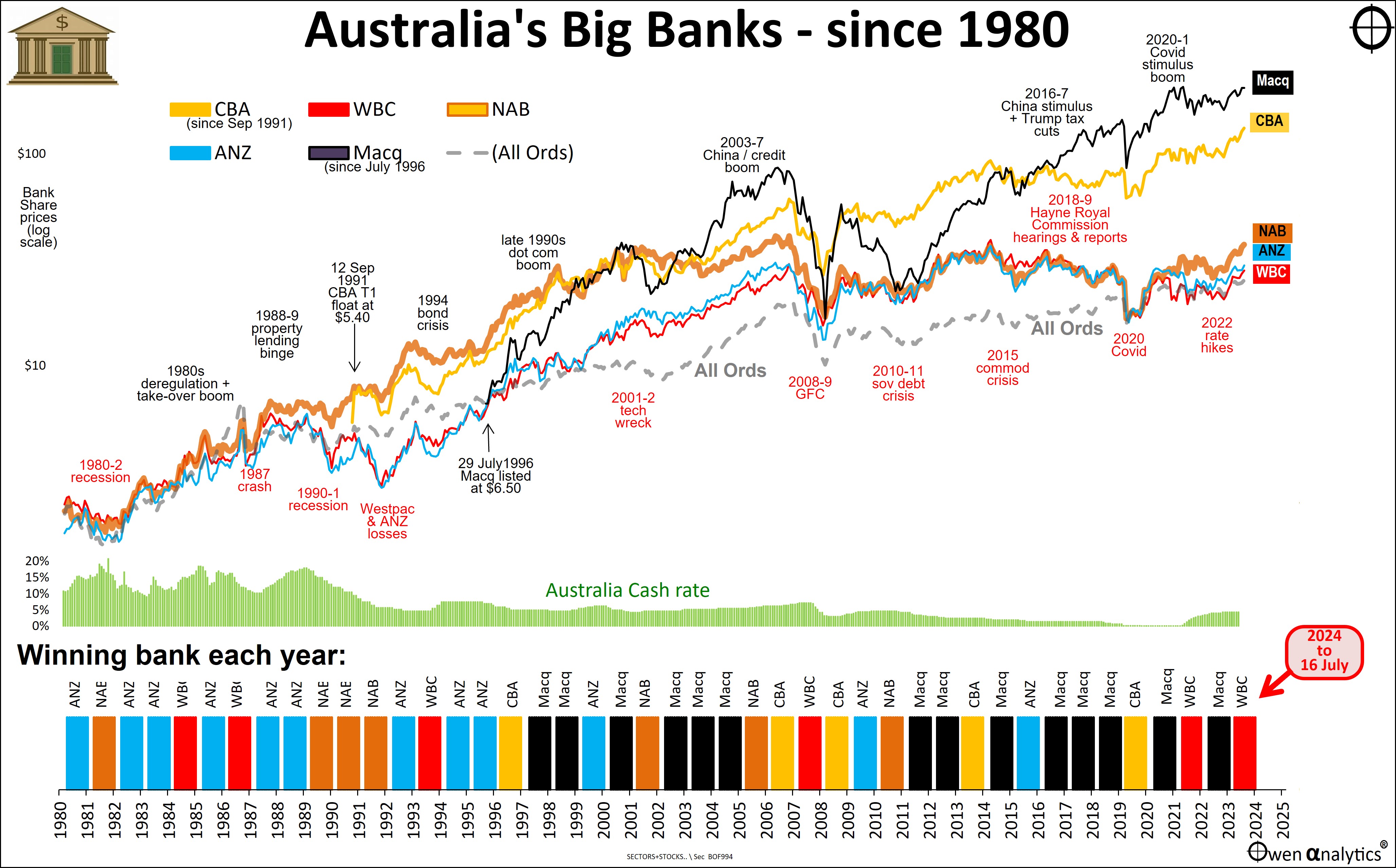

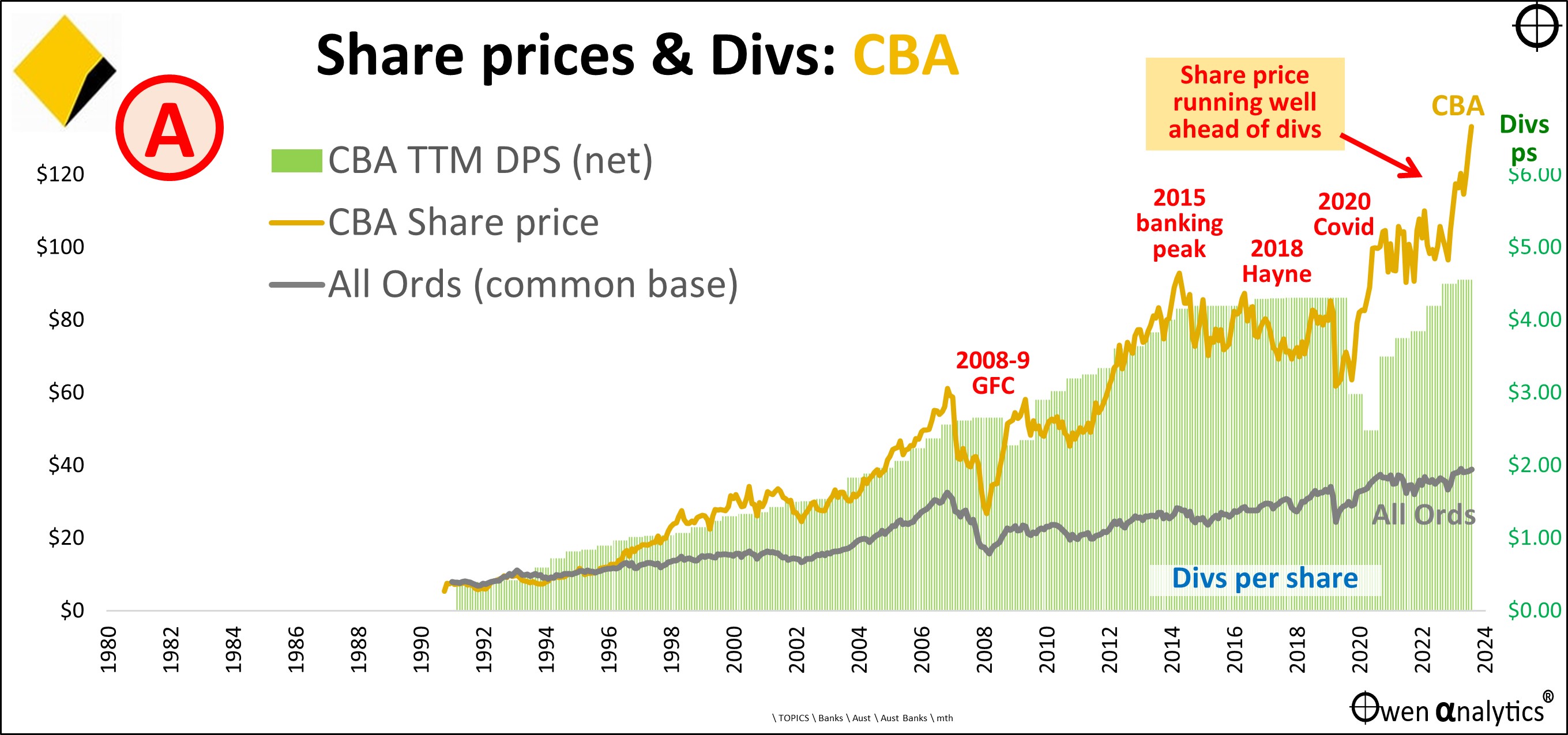

The main stars this year (and also in July) were the big banks – extending their extraordinary run into even more expensive territory.

On the puzzling boom in Aussie bank shares, see also:

· Which Bank? . . is winning the Battle of the Banks? (17 July 2024)

· CBA in 7 charts – the ‘Steven Bradbury’ of Australian banking – now suddenly a ‘growth stock’? (29 July 2024)

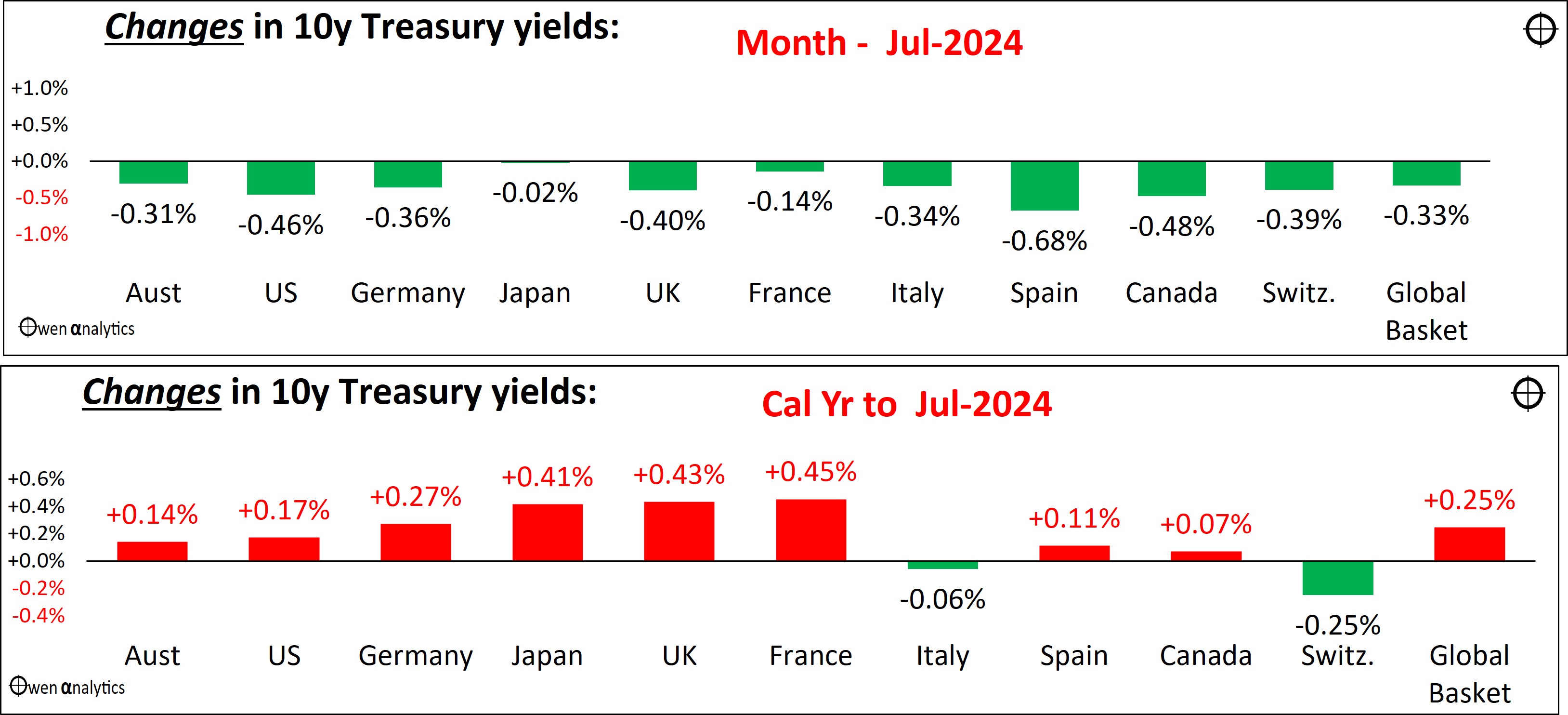

Bonds – positive returns in July, ahead for the year at last

With inflation numbers clearing the hurdle for likely rate cuts in the US, and ending fears of further rate hikes in Australia, bond yields fell back in the US, Australia, and other markets (but flat in Japan).

As a result, bond markets posted positive returns of around 1.5% to 2% in July, and are finally into positive territory this year.

The lower section of the above chart shows that bond yields are still higher for the year, suppressing returns.

I remain bearish on bond returns in the medium term. Returns from government bonds would soar (briefly) in the event of a sharp recession, but any gains would be reversed quickly during recession. Timing is critical, and extremely difficult to get right, so I have stayed out of fixed rates over the past three years, and instead favoured high grade floating rate notes.

See also:

For the impacts of inflation on investment market returns see:

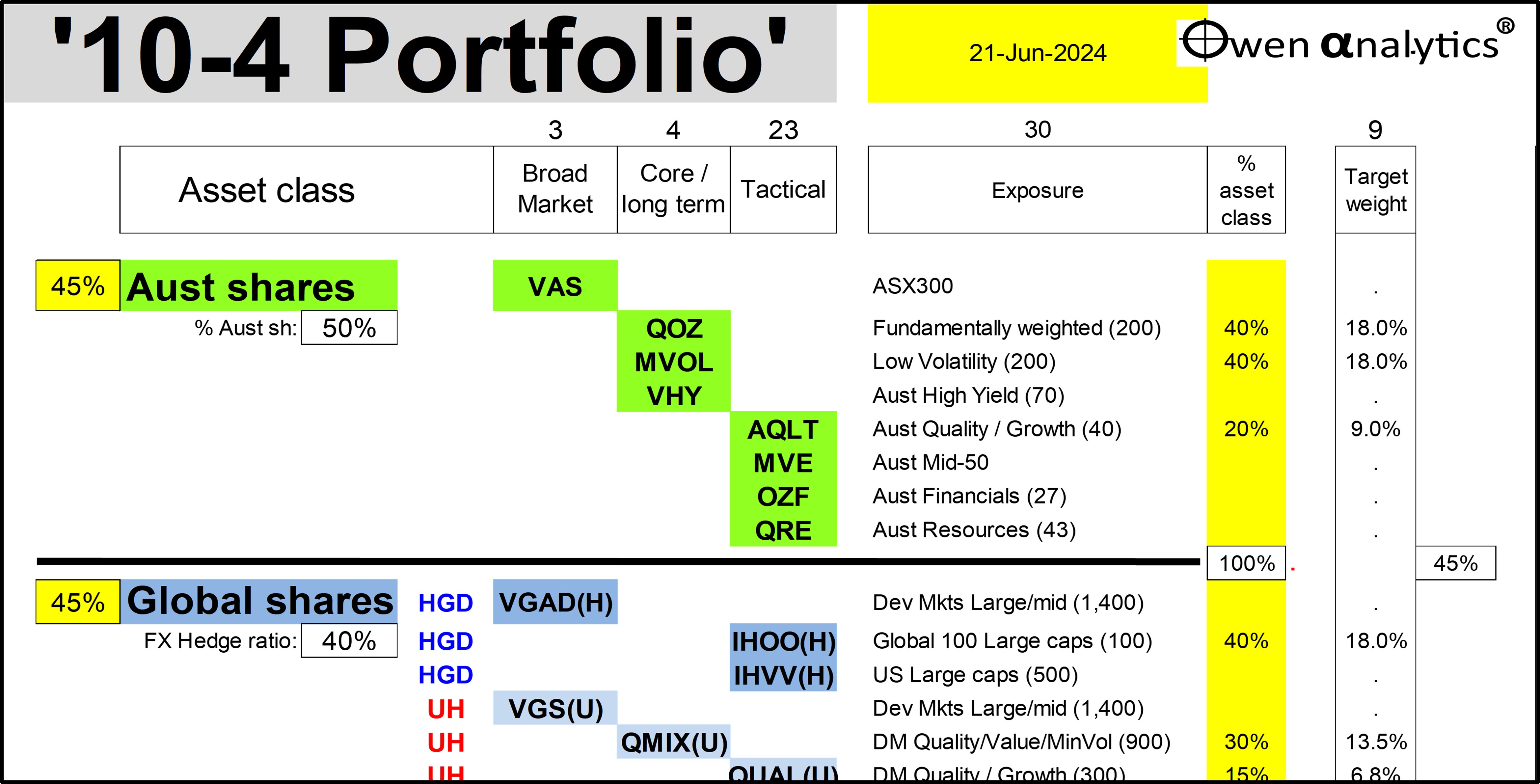

For my current views on asset classes reflected in my own long-term portfolio- see:

· My ‘10-4 all-weather ETF portfolio’ – Part 2: What’s in it? (7 July 2024)

‘Till next time – happy investing!

Thank you for your time – please send me feedback and/or ideas for future editions!