Here we tackle these difficult questions, and similar questions like:

- 'When can I afford to retire?'

- 'Will my money last as long as I do?

Here are the two key Numbers to tackle these questions. Plus two quick tests to help measure progress toward your goal.

'Retiring'? or just want the Freedom to choose?

If you are looking forward to retiring one day, or if you don’t want to actually ‘retire’ but want the freedom to be able to scale back work or take an indefinite break – how much capital will you need?

Is it $1m, or $2m, or more? How do you know what to aim for? How far along are you on the journey?

Obviously, the amount of capital you need will depend on your level of spending in future years. That is hard enough to estimate, but it is probably the least difficult variable in the whole process.

It also depends on a whole host of other factors as well. Everyone is different, so everyone has a different number.

That may be true, but it is a glib, and not very practical or useful answer!

This article provides more detail to help readers better understand their own individual journeys.

The two most common (financial) questions about retirement

The common way of expressing retirement goals (or at least the financial aspects of retirement goals) is to ask one of two questions (which are essentially the same question expressed in two different ways):

‘How much capital do I need per dollar of living expenses?’

This is mainly for people planning retirement, who want to estimate how much capital they will need to be able to finance their required or desired spending budget (rising with inflation), with a good degree of confidence that they will not run out of money, ie that their money will last as long as they do, and with enough left over to satisfy their bequest goals (eg leave a financial legacy for their family and/or other causes).

For people who are still working, they may have the option of working longer, increasing their contributions, and/or topping up their savings from other sources, and want to set a target amount of capital that will be enough to achieve their financial goals for the rest of their lives, and beyond. It gives them a capital goal to aim for.

Or the second main question:

‘How much can I afford to spend given the amount of capital I have?’

This approach is mainly for people who have already retired, or those who are not willing or able to work longer or otherwise top up their savings from other sources.

Given the amount of capital they have (or are aiming for at retirement), they want to know how much they can safely afford to spend each year with a good degree of confidence that they will not run out of money, and that their money will last as long as they do, with enough left over to satisfy their bequest goals.

Other key questions like - ‘How long will by retirement savings last?’, and ‘When can I afford to retire?’ are driven by the same numbers.

The two key Numbers

To estimate the answers to these questions, there are two key numbers:

- The maximum ‘safe spending rate’ (also known as the ‘safe withdrawal rate’), and

- the required ‘multiple’ of the spending budget. The multiple is merely the ‘reciprocal’ of the spending rate. For example, if the maximum safe spending rate is 5%, the minimum required multiple is 1/5% = 20.

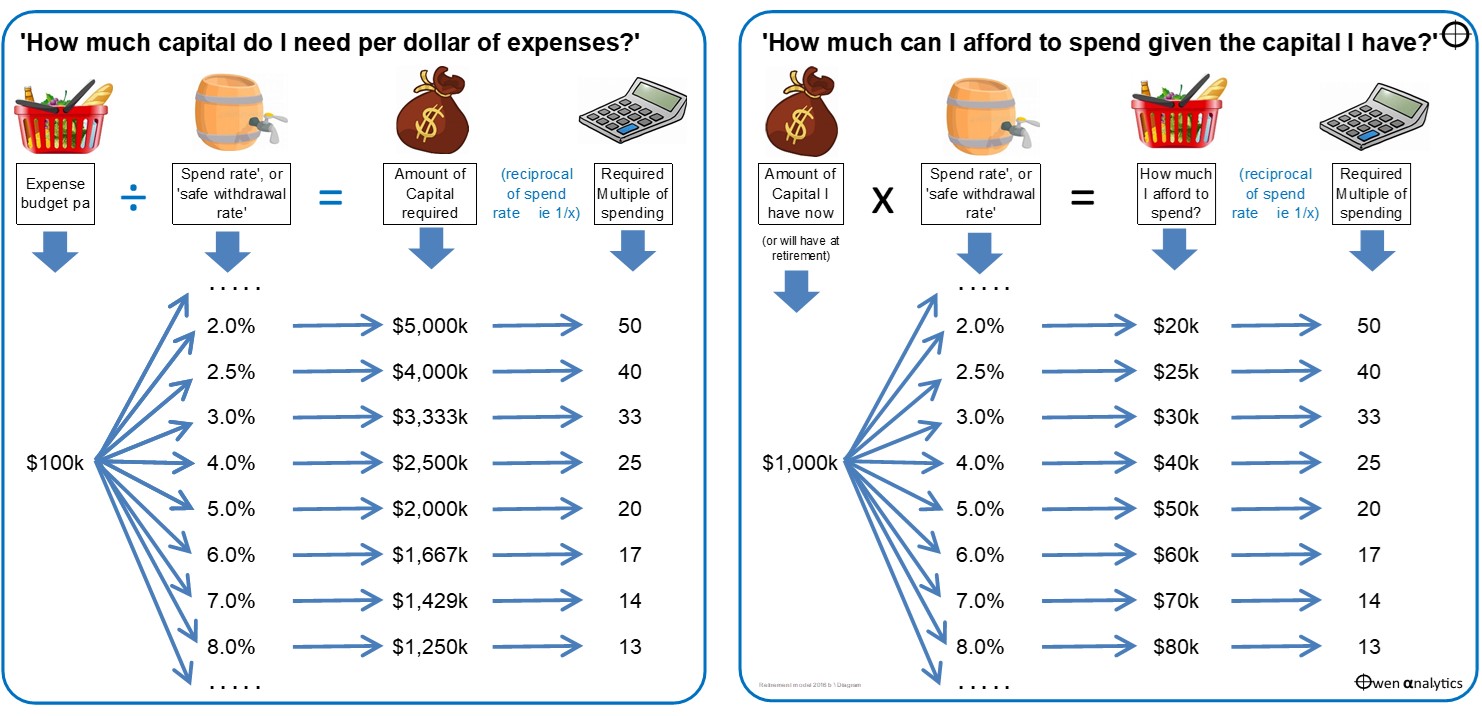

The following tables illustrate the two key questions. The table on the left starts with a given level of expenses, using the example of $100k pa spending budget for simplicity. The table on the right starts with a given amount of capital, using an example of $1m for simplicity:

For example, using the left table, for an expense budget of say $100k in retirement, if the maximum safe spending rate (or safe withdrawal rate) for your circumstances is 4%, then you will need at least $2.5m in capital to support that expense budget (rising for inflation in retirement).

Alternatively, using the right table, if you have (or plan to have) $1m in capital, and your individual safe spending rate is 4%, then you can afford to spend up to $40k pa as your initial spending budget (rising for inflation).

Different for everyone

Some web sites and studies say you need just 10 times your spending budget (ie a safe spending rate of 10% of starting capital), while others say you need 25 times your spending budget (a safe spending rate of 4%), or even more.

Which is correct? Each calculation is based on very different assumptions, which may or may not apply to you.

While the maths is easy, the difficult task is in estimating what is the appropriate safe spending rate (maximum withdrawal rate) and required multiple for your individual circumstances. This is difficult to estimate with a sufficient degree of confidence because there are so many variables involving future conditions and personal circumstances.

(We outline the main factors and how to apply them in Part 2 of this story, next week)

Not only are the safe spending rate and required multiple different for everyone, they can also change over time with changes in personal circumstances (eg health, family circumstances, inheritances), and changes in external conditions (eg investment markets, inflation, tax changes, regulatory changes, etc).

Because of the vagueness and variability of these assumptions about the future, it pays to be conservative (err on the side of lower spend rate or a higher multiple), because most retirees can’t simply ‘go back to work’ or ‘top up your savings’, and they may not like the idea of having to dramatically cut their spending in the future.

Retirement planning is about providing people with confidence so they can sleep at night without worrying about running out of money.

At one extreme – zero capital required!

If you are happy to rely on the government age pension for all of your income (the age pension is currently around $28k per year for singles, and $22k each for couples), and if are sure that all of your other capital needs are going to be paid for by others, and/or by selling the family home, then your required capital base and multiple is Zero.

Believe it or not, this is the most popular option.

After more than 30 years of compulsory employer super in Australia, the median superannuation balance of Australians aged between 60-64 is just $181k for males, and $139k for females. Up to half of all retirees use their super to pay off debts when they retire, and so two thirds of Aussie retirees just go on the government age pension!

Depressing but true.

(Some people see this as a sign of a civilized society, where people don’t need to worry about providing for themselves in the future. They can spend everything they earn while they are working, and then be looked after by the Nanny State for the rest of their lives).

Online calculators

There are dozens of web sites - run by government departments, super funds, banks, fund managers, and product issuers - that have ‘retirement calculators’. They are easy to use, therefore simplistic and create a false sense of security (or insecurity).

For example, according to the Association of Superannuation Funds of Australia (ASFA), a typical retired Australian couple aged 65-84 can enjoy a ‘comfortable’ retirement on an expense budget of $70k per year (December 2023 numbers), and they say this requires just $690k in capital.

That is a spending rate of 10% (ie required capital is a multiple of 10 times spending budget).

You will see that my tables of sample safe spending rates do not even go up to 10% (ie Multiples don’t go down to 10) because the ASFA calculator (and most other online retirement calculators) assumes you will be relying on the government age pension, and it assumes the government pension will remain in place in its current form and eligibility, and indexed, forever.

That would seem to place a lot of faith in the goodwill and financial resources of future governments and future taxpayers. While it is good to know the government age pension will probably always be there in the future as a last resort, our approach is for people who wish to be more self-reliant and self-sufficient.

‘Comfortable’ looks pretty grim to me

It’s worth taking a look at what sort of spending ASFA considers a ‘comfortable’ lifestyle. It’s fairly depressing!

It may be fine for most people (remember that two thirds of Aussie retirees are on government age pensions), but my readers are probably not ‘average’.

We have only one shot on this planet, and we are going to want to make the best of it – not just get by on government welfare!

On the other hand - high Multiples, low Safe Spending Rates

At the other end of the scale – depending on your circumstances, your maximum spending rate may be just 3% of capital, ie required capital base of 33 times spending.

This would be the case if some or all of the following apply to you:

- if you don’t want to rely on the goodwill of future taxpayers to determine how much you can spend for the rest of your life,

- if you don’t want to ‘eat into capital’ (ie you want to withdraw only the income, and not sell down any assets),

- if you have a low tolerance for risk and volatility, and prefer more ‘conservative’ investments for your peace of mind,

- if you have dependents that are relying on you for financial support (during your life and beyond),

- if you believe you have a good chance of living longer than the median life tables suggest,

- if you want a fixed level of withdrawals each year (rising for inflation) rather than have your income go up and down each year with ‘the market’,

- if you are starting out in retirement at the top of a boom when financial assets are over-priced - eg now!

If some or all of these statements apply to you, then you are probably going to have a higher required level of Capital (higher Multiple of spending), ie a lower Safe Spending Rate on the capital you have.

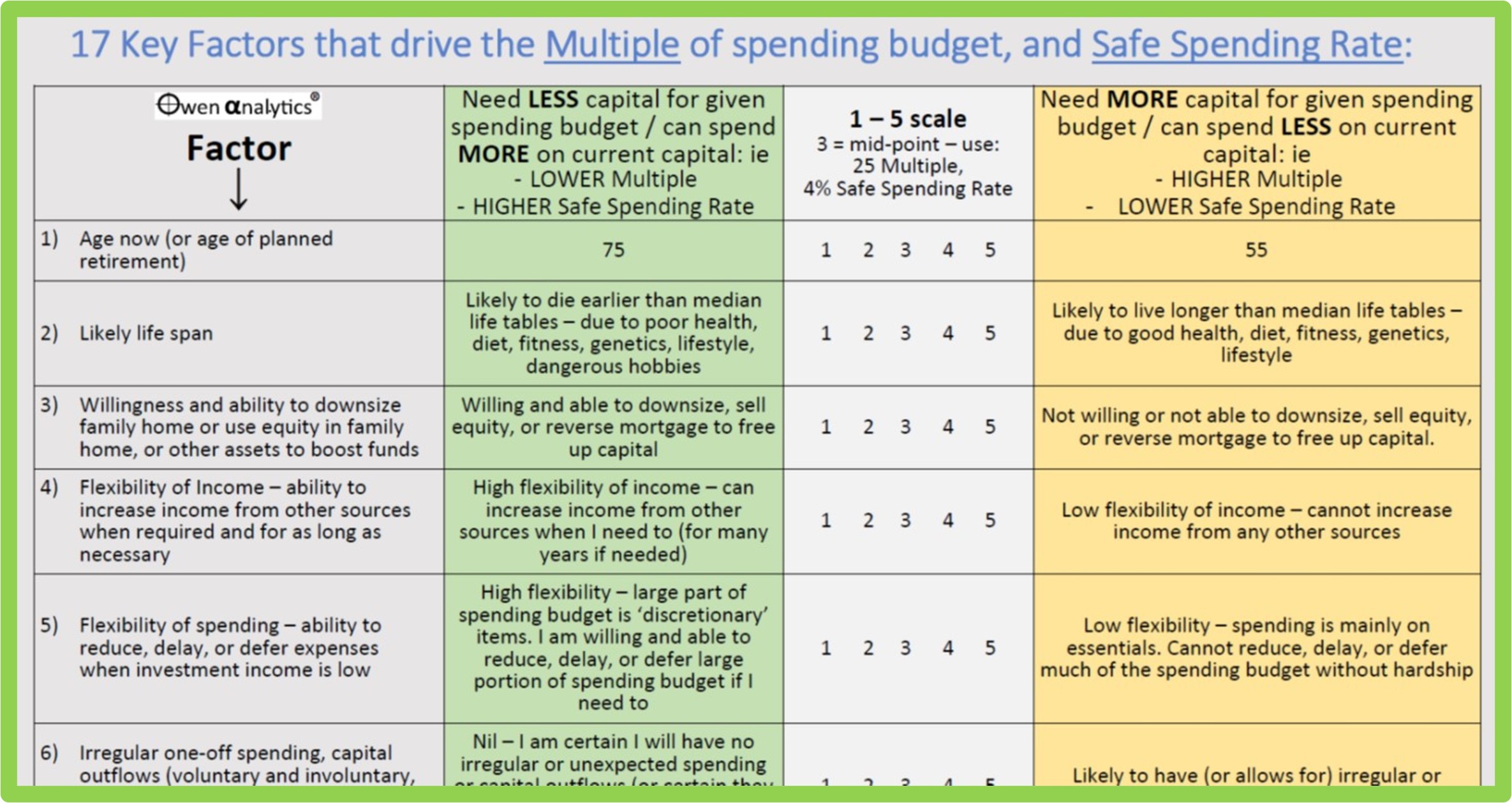

Part 2 of this story will outline the main factors that impact the amount of capital you need per dollar of your spending budget (the required Multiple), or how much you can safely afford to spend given your current level of capital (Safe Spending Rate).

Two quick back-of-the-envelope tests

There is a reason that I put a 4% Safe Spending Rate (ie minimum required multiple of 25) in the middle of the two tables above. It is because I have found it to be the most useful starting point in discussions with people when they are planning to retire, or already semi-retired or retired.

Everyone has different needs, goals, and circumstances that will affect their individual safe spending rates and multiples, but I have found it a good starting point as it is usually around the area where most people end up after taking into account all of the different variables.

Do these two quick tests:

TEST 1 - How much Capital do you need? - Where am I now on the journey?

|

step

|

question

|

example

|

|

a)

|

Take your current spending budget (or if you don’t have one, use your current annual after-tax income from working).

|

$100k

|

|

b)

|

Multiply it by 25. That is the roughly amount of investment capital you will need to stop working tomorrow and continue your current lifestyle indefinitely. That’s your Number – your capital goal.

|

$2.5m

|

|

c)

|

What is your current level of investment capital (super fund balance, plus other investment assets excluding the family home, and deduct ALL debts, including mortgage on the family home).

|

$1.0m

|

|

d)

|

How far along are you toward your Capital goal?

|

40% there

|

In this case, if you are relatively young with plenty of working years left, you might be well on your way to your goal, given your age.

On the other hand, if you are wanting to retire or scale back soon (in some occupations you often don't have a choice), it looks like you may need to think about scaling back your spending budget, or rethinking some of the other assumptions (see Part 2 next week).

TEST 2 - How much can I safely withdraw/spend from my capital to cover my living expenses?

|

step

|

question

|

example

|

|

a)

|

Take your current investment capital base (super fund, other investment assets excluding the family home, and deduct ALL debts, including mortgage on the family home).

|

$1.0m

|

|

b)

|

Multiply it by 4%. That is the roughly the annual spending budget you can withdraw from your fund (rising for inflation each year) – indefinitely, with a reasonably high degree of confidence that you won’t run out of money.

|

$40k

|

|

c)

|

What is your annual spending budget (or your current after-tax income from working)?

|

$100k

|

|

d)

|

What percentage of your current living expenses (or income from working) will your current Capital base generate safely?

|

40%

|

These are very simplistic tests that gloss over a whole lot of important and critical details, but this exercise is a good starting point to get a quick picture of roughly where you are now on the journey.

Are you nearly there, or still a long way to go? Are your expectations of spending budget realistic?

Is it time to review your future lifestyle and spending budget? Do you have a spending budget?

In this story, the examples used a minimum required multiple of 25 times spending budget and a 4% safe spending rate. This is not a bad starting point for the purposes of illustration. But the numbers will be different for everyone because each of us has different cicrumstances, goals and priorities.

Now we can move to the next stage - Part2:

· 'What's your Number? Part 2: 17 key factors driving 'How much do I need' & 'How much can I spend?'

Part 2 sets out the key factors that determine the Mutliple and Safe Spending Rate - and allows readers to estimate their own numbers given their own individual circumstances, goals and priorities.

(Note to Millennials and Gen-Zers: An ‘envelope’ is a paper sleeve used to encase a ‘letter’ that is to be physically transported to a distant destination via a ‘postal service’.

A ‘letter’ is . . . . don’t even ask - Google it!)

‘Till next time – happy investing!

Thank you for your time – please send me feedback and/or ideas for future editions!