Key points:

- Good case study representing the vast majority of ASX listed companies – as a volatile speculative hopeful with no revenues or assets to underpin value.

- Eventually defied the odds and the elements by actually finding something of enormous value.

- But it required extreme patience and perseverance – it holds the record for longest wait for first revenue, first profit, and first dividend of any ASX listed company.

For most of its seventy year life, Woodside was hailed as a great success story – a champion of the underdog, battling against the odds, the elements, and extreme remoteness, through sheer determination and perseverance to eventually strike it rich, discovering and developing one of Australia’s greatest resource finds, securing Australia’s energy self-reliance, and even becoming one of Australia’s largest export revenue earners.

Great fortunes were made and lost by Woodside shareholders as it grew from a struggling explorer that regularly ran out of money, to survive and eventually grow into a global giant and an occasional member of the top 10 list of largest ASX listed companies. What’s not to like?

But the world has changed

Over the past decade, however, Woodside has become a fossil fuel pariah, caught somewhere between two competing views - ‘gas is an evil fossil fuel that is burning the planet’ versus ‘gas is an essential part of the transition to renewables.’

(Some ‘ESG’/‘ethical’ funds and ETFs filter out Woodside for the first reason, but others allow it in for the second reason – all very confusing! Rules and definitions of what is ‘good’ and ‘evil’ are very vague, and change constantly. My advice is to look at the facts for yourself and form your own views.)

I am not expressing a view either way on this, and I have never been a shareholder.

But as I study companies and Australian listed companies in particular, and have invested in speculative mining stocks over the years, Woodside is a good case study as it has many features in common with more than half of the 2,200 companies listed on the ASX, and more than half of the 30,000 or so companies that have every been listed on Australian stock exchange in the past - as a speculative and volatile commodities play in which great fortunes are made and lost.

Two Parts

I have divided the Woodside story into two periods. This first story covers the first half of its life – from formation in 1954 up until 1980, when it moved from ‘explorer’ to ‘developer’ when it started construction of its first commercial domestic gas operations at Burrup and North Rankin A.

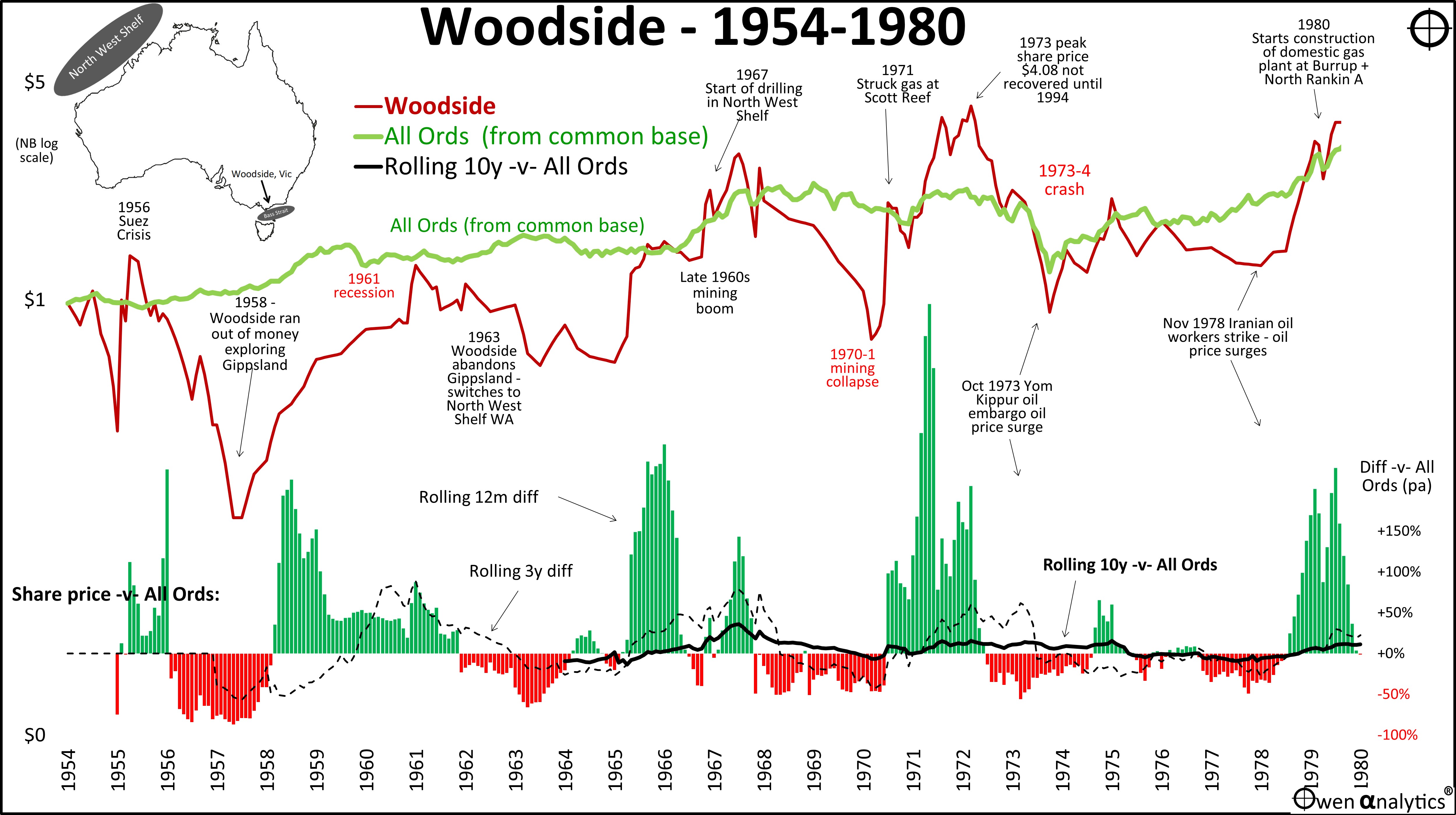

Today’s chart shows Woodside’s share price (maroon) from its 1954 float to 1980 compared to the market index (green).

The lower section shows the share price performance relative to the market index over three periods – rolling 12 month (green/red bars), rolling 3 years (black dashes), and rolling 10-years (black line). The rolling 12 month line in particular highlights the extreme volatility of Woodside shares relative to the overall market.

During the early years, Woodside was a struggling explorer, constantly running low on cash, but somehow surviving on the ‘smell of an oily rag’ - literally. This is the state of play for more than half of all companies that have ever been listed on stock exchanges in Australia, including more than half of the 2,000+ companies on the ASX today.

Rare survivor – and triple record holder!

Unlike the vast majority of listed speculative explorers on the ASX past and present, Woodside somehow managed to survive. After three decades, it actually did end up finding something worth digging up or drilling for, and it eventually became profitable and even paid dividends.

However, it was a very long wait – 30 years for its first revenue, 33 years for its first profit, and 37 years for its first dividend. But we cover that era in Part 2. As far as I know, Woodside holds the record for the longest wait for the first revenue, first profit, and first dividend for any Australian listed company.

In the first half of Woodside’s life it was just another speculative explorer with no revenues or profits or even any tangible assets to underpin the share price, or to base an assessment of value, so its share prices was extremely volatile, forever lurching from mad speculative frenzies in the booms, to gut-wrenching price collapses in the busts.

On par with the Market, but much more volatile

Even though it ended up discovering and developing one of Australia’s greatest ever resources finds, the chart from 1954 to 1980 shows that the share price (adjusted for changes in capital structure) only just managed to keep up with broad market index over the period, but it was an extremely volatile ride along the way. For speculative explorers, returns to shareholders depended purely on when they bought and sold. As with all investing - timing is everything.

Like all speculative shares in all boom-bust cycles, most of the public shareholders bought in the speculative boom frenzies when prices are high and still rising, and most end up dumping their shares in the busts when all hope is lost. You only make money if you buy cheap, but when prices are cheap there are no buyers anywhere to be found.

The beginning

Although Woodside eventually became Australia’s largest oil/gas exporter from the rich gas fields off the north-west coast of Western Australia, it actually got its name from a tiny town in the opposite corner of Australia, 4,000 kilometres away on the south-east coast of Victoria.

Woodside (Lakes Entrance) Oil Co NL was formed in 1954 by a Melbourne stockbroker Rees Withers, with the aim of looking for oil in Bass Strait, off Victoria’s Gippsland coast (near the tiny seaside town of Woodside).

They started the search there because it was where oil was first discovered in Australia back in 1924. The float raised £375,000 (after handing back £200,000 in over-subscriptions, which it would soon regret) and the search was on!

‘Missed it by THAT much!’

After a decade of fruitless and expensive searching, the company ran out of money and gave up in Bass Straight. The directors scratched together some more cash from their hardy supporters in Melbourne, and shifted the search to the opposite corner of Australia, some 4,000 km away - the North West Shelf off the coast of Western Australia.

In a cruel twist of fate, shortly after Woodside abandoned the Bass Strait after running out of money, the ‘Big Australian’ BHP, in a joint venture with US giant Esso, discovered rich Bass Strait oil/gas fields in 1965. BHP-Shell expanded and ran it profitably for the next 50 years. It was these Bass Strait oil/gas fields that BHP eventually sold to Woodside in 2022 in exchange of half of Woodside’s shares, doubling the size of Woodside (covered in Part 2).

North West Shelf

Meanwhile, back in the 1960s, after giving up in Bass Strait, Woodside headed for WA’s North West Shelf because oil was discovered there in 1953 by West Australian Petroleum (‘WAPET’), which was a joint venture between Caltex (US) and Ampol (Australian).

WAPET’s initial oil find on Rough Range WA sparked the famous ‘Rough Range’ speculative frenzy. Unfortunately, it proved uncommercial and was abandoned. WAPET eventually discovered WA’s first commercial natural gas field on-shore at Dongara (south of Geraldton) in 1964, sparking another speculative frenzy. The profitable Dongara oil field became Austin Oil, then Arc Energy, then Australian Worldwide Exploration, then AWE, which was eventually acquired by Mitsui (Japan), in 2018.

WAPET-Shell also discovered oil on Barrow Island (North Carnarvon Basin, off the Pilbara coast) in 1964 (famous for being the site of Britain’s atomic bomb tests in the 1950s), and production started in 1967. Further exploration led to the enormous Gorgon gas project, which Chevron/Exxon-Mobil/Shell completed 2017.

Back in 1963, to get into the action, Woodside paid £100 for the rights to explore an enormous area of 367,000 square kilometres (the size of Norway or Japan) of uncharted ocean, stretching from Onslow almost to Darwin.

With no cash for this huge project, Woodside brought in global oil/gas partners – Burmah Oil (British, bought by BP in 2000), BP, Shell, and Chevron.

Woodside still uses this strategy today, getting half a dozen global giants to put in most of the cash, with Woodside as a minority one-sixth share (financed mainly with debt), managing the operations.

Success at last

Woodside began exploratory drilling in 1967, and discovered a huge gas field on the North West Shelf in 1968, but it took another 16 years to develop, because of the extreme remoteness, weather and ocean conditions. The first domestic gas production was shipped to Perth in 1984, and the first LNG export was shipped to Japan in 1989, some 35 years after the float. Patience and perseverance finally paid off.

Wild ride for share prices

The chart shows Woodside’s share price from the 1954 float up until 1980. During this period the company had no production or revenues, and so the share price was essentially a wild roller-coaster ride driven not just by news of each new discovery or development, but also other related and unrelated global events.

The share price soared during the 1956 Suez crisis, and again in 1958 on rare positive exploration reports in Bass Strait, but collapsed just as quickly.

The share price recovered in 1960-2, but fell back in first half of 1960s. It soared again from the mid-1960s in the general euphoria of BHP’s discoveries of oil in Bass Strait, and in the broader minerals boom in the late 1960s, but then fell heavily in the 1970-1 collapse of the mining boom.

It soared once again in 1971 when Woodside struck gas at Scott Reef. The peak share price of $4.08 in early 1973 was not recovered until more than 20 years later in 1994. The price then fell heavily with the rest of the market in the 1973-4 market crash despite global oil prices surging in the Yom-Kippur Arab oil embargo crisis.

Threat of nationalisation

In the early-mid 1970s the Whitlam government even tried to nationalise WA’s oil and gas operations (including Woodside’s assets) by mandatorily taking all the oil/gas at an unspecified price in order to control distribution. Whitlam’s Minister of Minerals and Energy, Rex Connor also tried to raise US$4b from shady Arab sources to finance a proposed government nationalisation of all of Australia’s natural resources! Whitlam sacked Connor, but he kept negotiating the deal anyway.

These heavy handed attempts at government intervention scared off domestic and foreign investment in oil/gas in Australia (shades of this again under Albanese) until the entire Whitlam government was dismissed in November 1975.

Speculative volatility + risk of total loss

Part 1 of the Woodside story is a good illustration of how a speculative venture without any revenues or profits or assets to underpin a sensible valuation, is much more volatile than the overall market, and is highly sensitive to company-specific news and to changes in overall sentiment that could be triggered by any number of random events.

The risk of total loss is very high (the vast majority of explorers simply run out of money and disappear worthless), but big money can be made (and lost) trying to ride the up-swings, and avoid the dramatic price falls. It is a game for insiders. Retail punters almost always fall into the trap of following the herd, buying high and selling low.

Even though Woodside turned out to be very profitable, investors in this speculative revenue-less and profit-less period from birth to 1980 did no better than the overall market index, and the ride was much more volatile (noting also that it paid no dividends at all during this period).

Speculative warning

It is hard for investors to ignore the lure of volatile speculative stocks. I have bought numerous speculative hopefuls over the years. It is a high risk game, but the math is compelling: the downside is limited to minus -100%, but the upside is unlimited, so one big lucky winner can more than pay for the losses on the others. Compelling but dangerous!

I have been lucky to have found one ‘thousand-bagger’ in my life, and I therefore fully accept that I probably won’t find another one – but it sure is tempting!

Look out for ‘Woodside Part 2 – Producer to global giant to pariah’.

In Part 2, we see that even after Woodside moved from speculative explorer to a successful producer with revenues, profits, and dividends, it was still a wildly volatile ride, and it still did no better than the overall market!

See also:

‘Till next time – happy investing!

Disclosure: I do not hold shares in Woodside and have not in the past (aside from possible indirect holdings via passive/active funds/ETFs). This is certainly NOT a recommendation to buy, sell, or hold shares in this or any other company.

As always, my analysis is fact-based and intended to be as dispassionate as possible, regardless of whether or not I am a buyer, a seller, or holder. This quick, initial snapshot is no substitute for more detailed research.