Key points:

- War is scary, so it is tempting for investors to panic and race for the exits

- It's important to look beyond the media headlines - knee-jerk, herd-following reactions are usually wrong

- Usually positive for commodities demand, prices, mining shares

Nothing scares investors like news of ‘war’ or ‘recession’. These can be devastating in terms of impacts on human lives and livelihoods, and it is tempting for investors to race for the exits and wait on the sidelines for things to ‘calm down’ before getting back in the market.

One of the most difficult aspects of investing is learning to ignore kneejerk emotional reactions, ignore what the crowd is saying and doing, and focus instead on the facts.

In this two-part story I look at what happened to share prices in Australia and the US during the ‘big one’ – World War Two – which engulfed almost the entire world in the worst man-made catastrophe in human history. My purpose here is not to make light of war or downplay the devastating human toll, but to provide a fact-based assessment of what happened and why.

Australia follows US lead

Throughout our history, Australian share prices have almost always closely followed the lead from Wall Street. Whenever there is a significant event that affects markets, Australian investors have always tended to follow Wall Street’s reaction to the event, rather than respond to the event itself. So, when WW2 broke out and Wall Street was closed, Australian investors had to decide for themselves how to react to the declarations of war – without any lead from Wall Street.

1939 lead-up to war

Share prices had been volatile during 1939 with German advances in Europe, and also with Japan’s invasion of China.

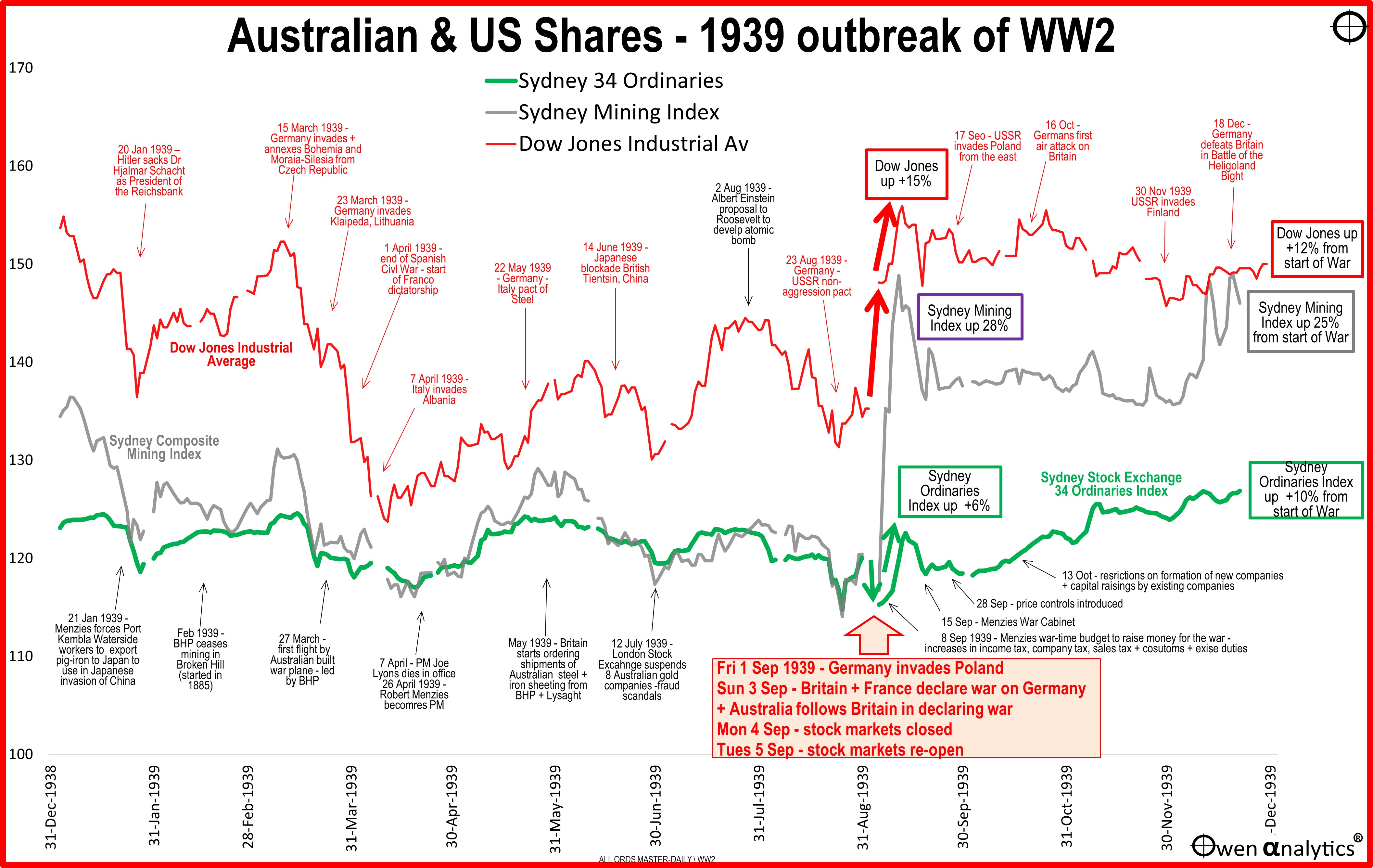

The chart shows share indexes in Australia (green for the overall market, grey for the Sydney Mining index), and in the US (Dow Jones, in red).

Germany had spent most of the late 1930s re-building its military and industrial capacity in preparation for war. In 1939 Hitler started by invading the Czech Republic and Lithuania, making threatening demands on Poland and numerous other targets, and building military alliances with the Soviet Union and Italy. The key events are highlighted on the chart.

Declarations of war

Here is what happened as the declarations of war unfolded:

Friday 1st September 1939– Hitler invaded Poland. The London and Sydney stock exchanges were closed as Britain made preparations for war, mobilising the Navy, and evacuating London.

Saturday 2nd – stock exchanges in Australia remained closed for Saturday trading on the news from Europe (stock exchanges in Melbourne, Sydney other cities traded six days per week up until the start of 1947).

Sunday 3rd - Britain and France declared war on Germany. Australian PM Bob Menzies announced via national radio broadcast that as Britain was at war with German, so too was Australia.

Monday 4th – stock exchanges remained closed in Australia, London, and New York.

Tuesday 5th – stock exchanges re-opened in Australia, London, and New York.

Reaction on the Tuesday 5 September when markets re-opened:

The problem was that when Australian markets re-opened for trading on Tuesday 5th, Wall Street was still closed as New York is 15 hours behind Sydney/Melbourne time. So Australian investors had to decide from themselves whether to be bullish or bearish about the start of War in Europe – without the usual lead from Wall Street. (History has shown that it is usually not good when Aussies are left to think for themselves, another prime example was Trump's 2016 election win.)

Australian stock exchanges re-opened on Tuesday in response to Bob Menzies’ plea to the nation that Australia should remain ‘business as usual’. But Australian shares fell heavily on Tuesday in the absence of any lead from Wall Street. The broad Sydney Ordinaries index closed down 4% for the day, with pastoral companies, industrials and miners hit hardest.

It was the worst day on the local market since the end of September 1938 when British PM Neville Chamberlain’s ‘Munich Agreement’ allowed Hitler to take Sudetenland (the German speaking part of Czechoslovakia) in return for Hitler’s promise not to take any more (which he subsequently broke, of course).

Pessimism was a natural enough reaction for Australians on that Tuesday. The newly declared World War 2 was essentially a continuation of World War 1 with Germany resuming where it left off at the end of WW1, only this time it was probably going to be worse. This time Germany had more armed forces, more deadly weapons (built with the help of imports of base metals from Australia), and also appeared to have Italy and USSR as allies.

On top of all that, Japan was also on the rampage through China and setting its sights on South-East Asia. The First World War was so devastating in terms of loss of human life and destruction of property it was called the ‘Great War’, but this new war was probably going to be even more destructive, so it was natural to be pessimistic and get out of shares.

Australian reaction to Wall Street’s reaction

But when Wall Street re-opened on Tuesday 5th New York time after Australian markets had closed for the day, American shares rocketed upward and enjoyed one of their best days ever. The Dow Jones Industrial index ended up an incredible 9.5% for the day, its third best day ever up to that point.

When Australian brokers and their clients woke up the next day – Wednesday 6th September - and saw the cables from New York, they certainly had egg on their faces. So they quickly abandoned their pessimism and raced back into the market to re-purchase the shares they had dumped the day before.

Over the next week Americans kept bidding up share prices on Wall Street and Australians followed their lead. The Dow Jones rose 15% in the week following the outbreak of war, the Sydney Ordinaries index rose 6%, and the Sydney Mining index was up by an incredible 28%, with the sudden surge in likely demand and prices for metals.

It was an amazing turnaround for mining shares in particular, as they were sold down most during the pre-war build-up and also down heavily on Tuesday 5th.

Overall, September 1939 was a great month for shares – the mining index ended up 14% for the month and the pastoral index up 12%. Wall Street ended up 12% for September.

Share prices by the end of 1939

The start of the War turned out to be very positive for Australian and US share markets. From the start of the war to the end of 1939, the Dow Jones ended up 12%, the Sydney Ordinaries was up 10%, and the Sydney Mining Index was up 25%.

To find out what happened over the course of the War itself see Part 2 of this story:

‘World War 2 & share markets - Part 2 of 2: the full story’ – I will post in a few days

See also:

‘Till next time – stay safe!