124 reasons NOT to invest! ‘This time is different’ – or is it?

Every year there are ‘End of the world’, or ‘End of life as we know it’ crises and threats that scare investors into waiting and watching from the sidelines, but share markets have always seemed to power through them. This includes wars (including ‘world wars’), political crises, recessions/depressions, inflation spikes, natural disasters, and a host of other ‘crises’.

Are the current batch of threats and fears different this time?

2023

2023 turned out to be an above-average year for share markets here and around the world, despite a host of fears dominating headlines throughout the year, including fears of:

- persistent high inflation,

- more aggressive rate hikes,

- US/global recessions,

- an emerging markets debt crises caused by the rising US dollar and interest rates.

None of these fears eventuated, but they sure did make nice, scary headlines for the scare-mongers and doomsayers. Despite the fears and the negative headlines, share markets powered on regardless.

Fear and scare-mongering make better headlines!

There is always a seemingly good reason NOT to invest. Just turn on the news (or internet).

Somewhere in the world there is always a war, inflation, deflation, economic crisis, major bankruptcy, banking crisis, famine, drought, flood, civil war, cold war, military coup, revolution, bomb attack, interest rate hike, tax hike, rogue trading loss, terrorist attack, assassination, sovereign default, hyperinflation, trade war, current account crisis, commodity collapse, debt crisis, oil price spike, nuclear scare, foreign invasion, earth quake, tsunami, political scandal, election, currency collapse, virus pandemic, and the list goes on.

When one of these crises hits the news (which is every day), many people lose their nerve and say, “Maybe I’ll just wait a while until things settle down”.

By the time it does, of course, there is another good reason not to invest, and so they wait on the sidelines for the next crisis to blow over, and the next, and the next.

Years pass, and they look back and inevitably wish they had ignored the media headlines and scaremongering and just stayed in the market the whole time.

Worse still, because they are now several years behind, it is easy to succumb to the temptation to ‘get it back’, or ‘catch up’ by taking extra risk, gearing up, or falling for fraudulent get-rich-quick schemes.

‘FOMO’ and ‘FOLE’

‘FOMO’ (‘fear of missing out’) is a very common way to lose money (or under-perform a passive index fund) by chasing high returns, usually at the tops of speculative booms, when everyone else is also rushing in.

However, I have met just as many people over the years who have been left behind in their wealth-building journey because of ‘FOLE’ (‘fear of losing everything’).

Last year I met a couple who had been sitting in bank term deposits since panicking and selling out at the bottom of the GFC sell-off in early 2009. Term deposits had been paying at least some interest in the early years, but they paid virtually no interest in several recent years.

Their bank TDs are government guaranteed, so there is no risk of loss, but the interest is fully taxable, and they offer no potential growth, not even for inflation. Meanwhile the Australian share market is up three-fold, the US market is up five-fold since then, and shares have tax benefits, growth prospects, and a relatively good inflation hedge.

The couple realised that their over-caution had resulted in them having a much lower standard of living for the rest of their lives. Their question to me was: ‘How can we get back to where I would have been?’ The answer of course is that they can’t.

‘The future is Uncertain!’

Probably the most common word used by media commentators to scare investors is ‘uncertain’.

Of course the future is ‘uncertain’! When scary-sounding events occur, people tend to think that that the future is now suddenly ‘more uncertain’ than normal, but that is ridiculous.

The future is always completely and utterly uncertain and unknowable. It always has been and always will be.

Sudden events like the September 2001 terrorist attacks on New York and Washington, the Coronavirus pandemic, the Japanese bombing of Pearl Harbour, Russia’s invasion of Ukraine, etc, came out of the blue. There will never be a day when the future is somehow magically more ‘certain’.

Share markets march on

Throughout this constant stream of ‘crises’, share markets have kept marching right along on their long, upward path, with temporary ups and downs along the way.

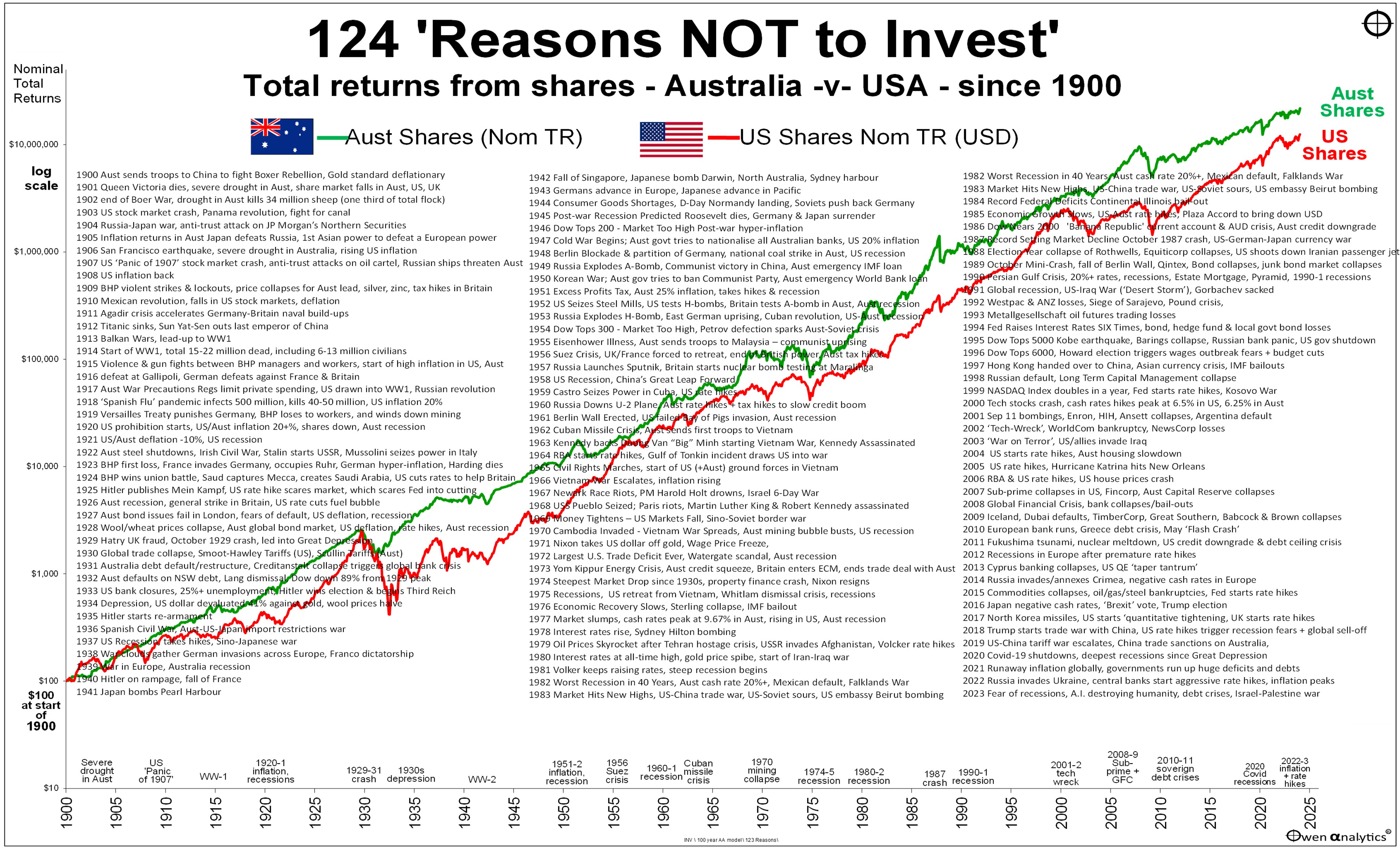

This chart shows the broad stock market index of total returns (ie share price growth plus dividends re-invested) for the Australia (green, in AUD) and the US (red, in USD) since 1900.

For very long term charts like this, we use a logarithmic (‘log’) scale on the vertical axis, which highlights the fact that the compound growth rates delivered by the share markets have been fairly consistent for more than a century (ie. fairly straight lines sloping upward over time), with temporary ups and downs along the way.

These reasonably consistent share market returns have been driven by reasonably consistent compound growth rates in population, economic growth, and aggregate corporate profits, which underpin the long term growth in share prices and dividends.

On the chart we also list one or more major events each year that were probably enough to scare off many investors at the time. All of the big events are there - including the World Wars, depressions, crashes, etc.

Even when the whole world was caught up in catastrophic, destructive, global events like the World Wars, they turned out to be little more than temporary hiccups in the long upward march of share markets.

‘Where’s Wally?’

You can use this chart to play ‘Spot the War’, or ‘Spot the Depression’, or ‘Spot the crash’, etc.

They are all there, but often the impact on share markets was so minor, they are hard to spot on the chart without a magnifying glass.

For example, Australia’s sharpest and deepest stock market crash was in October 1987, when the market index fell by 50% in just 19 trading days (and didn’t recover until the 1990-1 recession).

Can you find it on the chart? It will probably take you longer to find than you might have expected.

Find these global ‘crises’

Can you find the September 2001 terrorist attacks (in which the financial heart of the US was literally blown up),

or the bombing of Pearl Harbour,

or the fall of the Berlin Wall,

or the 1973 oil shock,

or Nixon abandoning the USD/gold standard?

Those sudden events triggered deep and fundamental changes to the world order, but good luck spotting their impact on share prices!

Find these Aussie ‘crises’

In the case of Australia, can you find when the Australian government defaulted on its entire stock of domestic debt in a Greek-style default and restructure?

or the constitutional crisis with the sacking of Prime Minister Whitlam?

or the Japanese bombing of Australia (including bombing Sydney Harbour)?

These were tremendously traumatic and disruptive events for economic and political life in Australia, but good luck finding their impacts on the share prices!

We are not intending to make light of massive human tragedies like World Wars that killed tens of millions of people, and other catastrophic events. Our point is that the engine of corporate profitability is remarkably robust through all sorts of major crises, even when whole nations, economic systems, and pollical regimes are destroyed or dramatically re-shaped.

Individual companies come and go of course, but if you own widely diversified portfolios of companies, or even own whole markets by using index funds, then even the most devastating crises and catastrophes have turned out to be little more than temporary set-backs for long term investors, at least for Australian and US share markets so far.

Is this time different?

In 2020 the big scare was the global pandemic and governments locking entire populations of citizens in their homes and closing businesses, causing the sharpest and deepest economic contractions since the Great Depression.

In 2021 it was runaway inflation, and governments running up massive wartime-like deficits and debts.

In 2022 it was Russia’s invasion of Ukraine, soaring commodities and energy prices, and aggressive interest rate hikes everywhere

In 2023 it was the fear of persistent high inflation, more aggressive rate hikes, fears of US/global recessions (ho-hum – we’ve seen dozens of them before!), and fears of emerging market debt crises caused by the rising US dollar and interest rates.

None of these fears eventuated, but they made nice, scary headlines for the scare-mongers and doomsayers. Despite the fears and the negative headlines, share markets powered on regardless.

(The main positive force predicted by countless ‘experts’ at the start of 2023 was a rebound from China re-opening after its extended lockdowns. That rebound did not occur either! Instead, China ground to a halt with its deepening property/construction/finance collapse.)

Fears for 2024?

In 2024, economists, with egg on their faces (again!), are still warning of recessions, escalation of wars in the Middle East, Europe letting Russia take Ukraine, and China invading Taiwan.

In addition we have two longer term existential threats. The first is the warning from the creators of generative artificial intelligence (‘A.I.’) that A.I. could wipe out humanity (for example by hijacking weapons systems and then bombing whatever ‘they’ wanted to bomb).

The second is the warning by the Inter-governmental Panel on Climate Change that a global temperature rise of more than 2 degrees by 2100 would cause unavoidable, irreversible, abrupt changes to human habitation, ecosystems, and food production on earth. (These two threats are self-eliminating of course – if A.I. bots killed all humans, or even most humans in rich countries, that would stop human activity from warming the planet).

These threats all sound credible, as they come from highly qualified and experienced scientists and experts who have spent many years studying their respective fields.

So, is it NOW time to sell up and stay out of the market until things ‘settle down ‘and become ‘certain’?

You decide!

Thank you for your time – please send me feedback and/or ideas for future editions!

See also: