Yes, it’s half way through the 2020s decade already! Time flies!

The decade started out with governments everywhere locking citizens in their homes and out of their businesses and schools for months on end, then they cut interest rates to zero and racked up war-time like debts spraying free money around everywhere, fuelling speculative bubbles in everything from housing to meme stocks, crypto’s and ‘NFTs’, then we get a massive inflation spike (Duh!), followed by savage rate hikes – and before you know it the decade is half over!

Meanwhile, Trump started out in the White House, then out, then sort of in, then really out, and now nearly back in again.

Time to take a look at half-time scores for investment markets. First up - the Australian share market.

The picture is not good:

-

- Aussie shares are having a below-average decade so far (and below other markets including the US).

- It has remained below average all decade – after a poor start with the 2020 Covid lockdowns.

- But all is not lost – some past decades also started out slow but ended up with good full decade returns.

- There is plenty of time left this decade for the next big speculative boom to lift the share market – history is on our side!

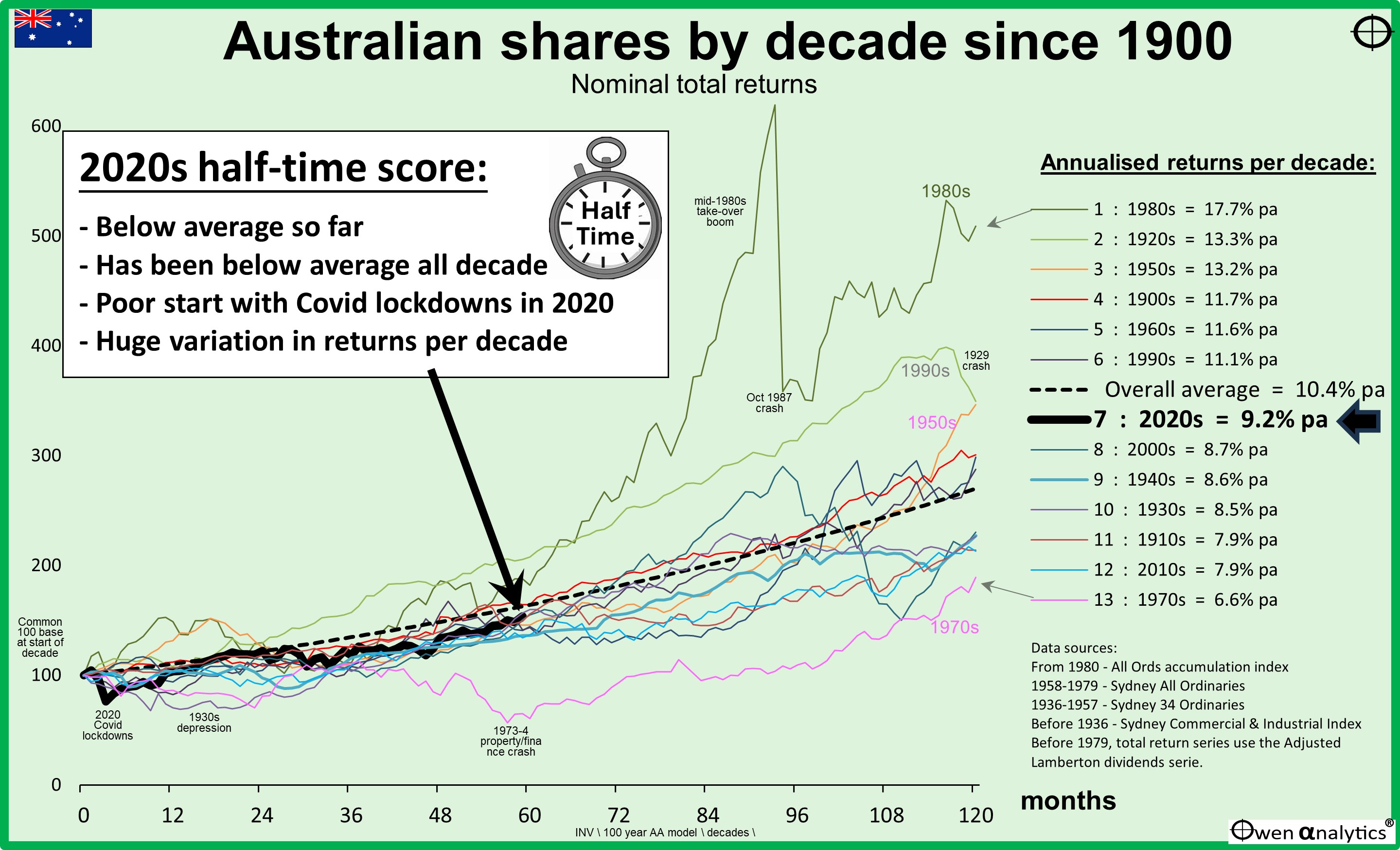

Today’s chart shows nominal total returns from the broad Australian share market per decade since 1900. (‘Nominal’ means not adjusted for inflation. ‘Total returns’ means price gains/losses plus dividends reinvested)

To the right of the chart are the average annualised returns per decade sorted from best decade (1980s) to worst (1970s). The average decade return has been 10.4% pa (dotted black line), and the current decade is running below that at 9.2% pa at half-time (solid black line).

Best decades

By far the best decade for the Aussie share market was the 1980s, with returns averaging 17.1% pa or a total gain of 409% for the decade. It started out strongly with the early 1980s property construction and mining booms, but those booms quickly collapsed in the 1981-3 recession after cash rates were hiked to 20% to attack inflation running at 12%.

Our early 1980s recession was milder than the US inflation-busting Volcker recessions because the government and RBA opted not to attack inflation with interest rates, but use the Accord process instead.

In the mid-1980s we had an extraordinary speculative boom driven by Labor’s raft of economic reforms, including floating the dollar, deregulating capital markets, interest rates, and banks. This fuelled a wild speculative lending and take-over boom that collapsed sharply in the October 1987 crash, but even after the overall market dropped by -50% in the crash, it was still much higher than when the boom started. Essentially the market doubled, then halved again in a little over a year in 1986-7.

At the end of the 1980s decade following the 1987 crash, the deregulated banks survived but switched from mad lending on crazy take-over deals in the mid-1980s, to mad lending on crazy property construction deals in the late 1980s. This boom would also collapse of course, but that was in a new decade – the 1990s.

The 1990s was also a very good decade for the local share market, with returns averaging 11.1% pa, or 188% in total. It started out poorly with the 1990-1 recession and 1992-3 bank crisis caused by the orgy of bad lending in the 1980s coming home to roost. However, despite this poor start, the 1990s turned out to be a very good decade, thanks to the late 1990s ‘dot-com’ boom. That boom also collapsed, of course, but the ‘2001-2’ tech wreck was in a new decade.

Worst decades

The worst decade for Australian shares since Federation was the 1970s, with total returns averaging just 6.6% pa, or 89% in total. (Actually the 1890s was even worse, but that's another story for another day!)

The 1970s started out badly with the early 1970s collapse of the wild late-1960s speculative mining boom. Then things went from bad to worse with spiralling inflation and the Whitlam government’s chaos and spending sprees. The share market collapsed in the 1973-4 credit crunch and it recovered only weakly by the end of the ‘stagflation’ decade.

After the 1970s, the next worst decade for Australian share market was the 2010s. Unlike the 1970s, there were no major crashes during the 2010s decade, just a succession of minor crises – ‘Greece 1’ in 2010, ‘Greece 2’ and the US debt downgrade crisis in 2011, the China slowdown and commodities collapse in 2014-5, and the US rate hike/recession scare in 2018. Overall a very poor decade with returns of just 7.9% pa, or 113% in total.

2020s at half time?

At the half-way point in the current decade, the overall Aussie share market has returned and average of 9.2% per year. This is below the overall average return of 10.4% pa since 1900.

If the last decade (the 2010s) was a poor decade, and the current one is poor so far, can we have two poor decades in a row? Sure. The 1930s and 1940s were both poor decades with below-average returns. The 2000s and 2010s were also both poor decades with below average returns. Unfortunately there is no magic rule that says that one poor decade will be followed by above-average returns next decade.

All is not lost

The fact that we have had a poor first half does not necessarily mean that it will end up being a poor decade overall. There were several times in the past when a poor first half decade turned into an above-average full decade. For example:

- The 1900s decade was at a similar below-average level at half-time, thanks to severe drought in the early years, but still ended up returning an above-average 11.7% pa for the full decade. The drought ended and we had a strong revival of wool and wheat in the latter years.

- The 1950s decade had a worse first half than we are now in the 2020s, with the Korean War inflation spike and recession in the early years, but ended up returning a very strong 13.2% pa for the full decade. The inflation spike was resolved, and a consumer finance boom boosted the market in the late 1950s (but collapsed in the early 1960s).

- The 1960s decade also had a worse first half than the 2020s, but ended up returning 11.6% pa for the full decade, thanks to the wild late-1960s speculative mining boom.

- The 1990s decade also had a worse first half than the 2020s, with the first half marred by the 1990-1 recession and 1992-3 bank crisis. But the 1990s decade ended up returning 11.1% pa for the full decade, thanks to the late 1990s ‘dot-com’ boom (which collapsed in early 2000s).

We need another speculative boom!

Do you see a common pattern here? It is a strange phenomenon that speculative booms have tended to occur in the latter part of decades. For example -

Housing, suburbanisation, and motor cars in the late 1920s, gold in the late 1930s, consumer finance in the late 1950s, mining in the late 1960s, construction and mining in the late 1970s, take-overs, housing, and construction in the late 1980s, ‘dot-com’ stocks in the late 1990s, mining in the mid-late 2000s.

Each of these booms collapsed of course – mostly at the end of the decade or early in the new decade.

Where are we now?

So far in the 2020s decade, Australia has largely missed out on the current US-led social media / a.i. boom (hence the relatively poor returns here) – but we have another half a decade to find the next boom!

The good news is that humans have a never-ending ability to come up with new ideas to fuel the next speculative boom. They always eventually collapse of course, but there is still a good chance the next boom will power the local share market to good returns by the end of the current decade.

There is ALWAYS another speculative boom - I just don’t know what it will be yet!

Pricing expensive

Although the first half of this decade has been below average, the local share market is actually at very expensive levels at present. Share prices have risen by below average levels so far this decade, but aggregate profits and dividends have been even weaker. Consequently the current market is very expensive relative to aggregate profits, dividends, book values, and returns on equity.

The current poor share price performance this decade is masking an even weaker performance of the local economy, profits, and dividends.

The problem is that expensive pricing on fundamentals usually means below average returns ahead. Therefore, if the market is going to surge ahead and end up with an average (or better than average) decade from the current halfway point, it will need to be an almighty speculative boom in the next few years to do the job!

Fortunately our market has a history of wild speculative booms that have run well ahead of fundamentals, so there is no reason that this regular pattern will end now. We just need another one soon!

Huge variation in returns in different decades

This chart highlights the huge variations in returns in different decades. Finance textbooks say that 10 years is ‘long-term’, and share funds always warn potential investors that the minimum holding period for shares is 7-10 years.

The implication is that if you should be prepared to hold for a minimum of 7-10 years because the share market is volatile - ie result in very different outcomes over shorter holding periods. The problem is that the outcomes are very different even over 10 year holding periods, like the different decades on the chart.

Timing is everything! ‘Time in the market’ only works if you pick the right decade/s

The chart shows that even 10 years is a not nearly long enough to reduce the variability of returns and provide investors with any degree of confidence that a 10 year holding period will result in returns mor or less around the long term average. Unfortunately, in the real world, the share market can generate returns well below average (or well above average) even for 20 year holding periods or more sometimes.

If you are relying on ‘time in the market’, then much of it comes down to pure luck – when you happen to have been born – which more or less determines when you start working and investing, and when you retire.

For example – if you happened to retire at the start of the 1930s or at the start of the 2000s with a pot of money to fund your lifestyle, you would have immediately faced two decades of very poor returns (lower lifestyles and/or run out of money sooner) in both cases.

But if you happened to retire at the start of the 1950s or at the start of the 1980s, then would have faced 20 years of significantly above average returns (better lifestyles and/or larger legacy) in each case.

That’s the great lottery of birth! But that’s too much reliance on luck for my liking!

Look out for future editions where I look at the decade half-time score for US shares and other asset classes.

‘Till next time, safe investing!

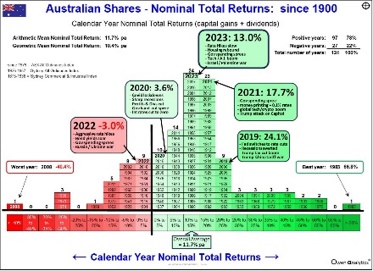

For annual returns on Australian shares since 1900 - see -

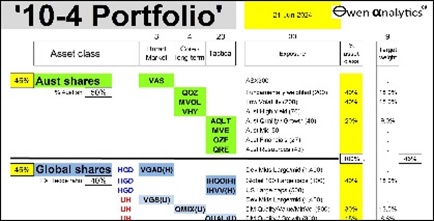

For current holdings in my long term ETF portfolio - see:

A note on data sources for Australian shares:

- From 1980 - All Ords Accumulation index

- 1958-1979 - Sydney All Ordinaries

- 1936-1957 - Sydney Ordinaries

- Before 1936 - Sydney Commercial & Industrial Index (excludes miners)

- Before 1979, total return series use the Adjusted Lamberton dividends series