Today (25 October 2023) the latest inflation figures for Australia were released (for the September quarter).

The news was mixed – quarterly inflation rose from 0.8% to 1.2%, but the annual rate (rolling 12 months) fell from 6.1% to 5.4%.

Meanwhile, the cash rate has been sitting at 4.1% since June, after twelve rate hikes.

What does all of this mean? Is the RBA doing enough? Are more rate hikes required to control inflation?

How does Australia rate against other countries? Are we ahead of the game on fighting inflation, or behind?

Here is the full story in seven quick charts:

-

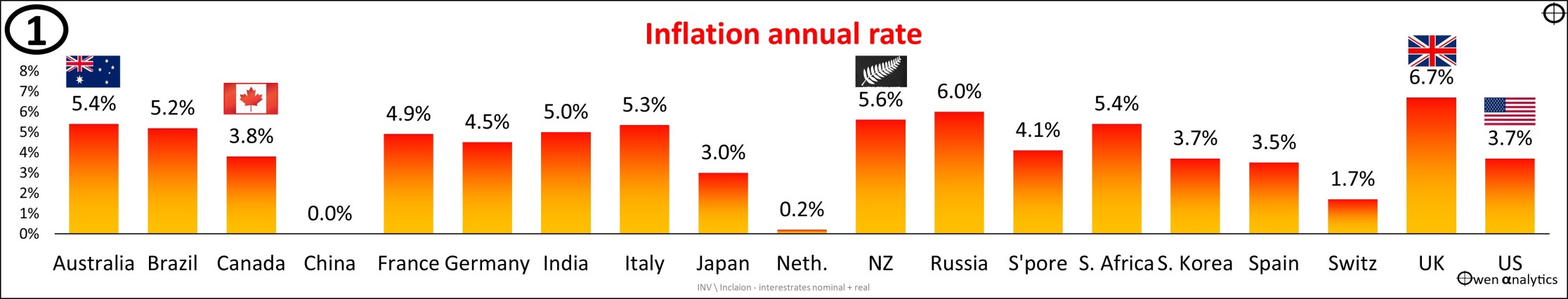

1. Annual inflation rates – Australia in the back half of the pack

- Australia’s annual rate is around the middle of the global pack. With a few notable exceptions, inflation is running well above target in the global inflation spike:

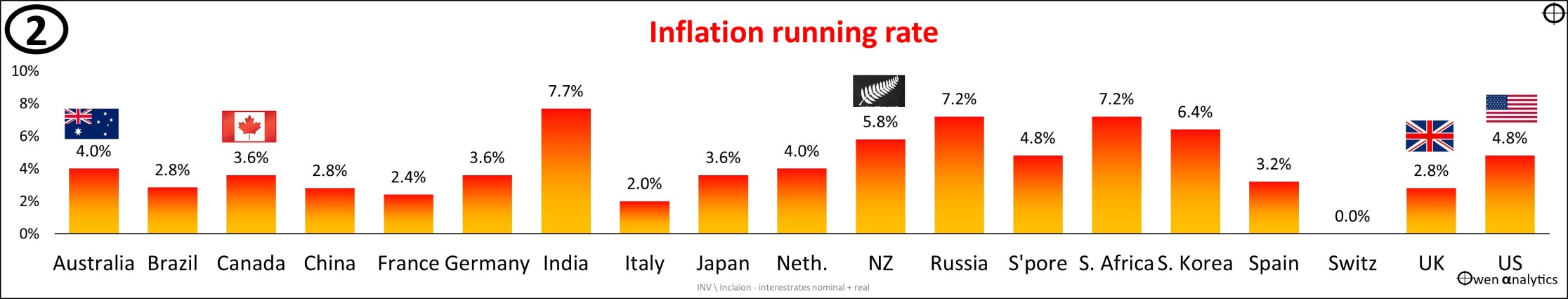

2. Inflation ‘running rates’ – Australia in the middle of the pack

Annual inflation numbers can be misleading because they relate current (or recent) prices to prices a year ago, and much has changed over the past year.

A much better measure is the current ‘running rate’ of inflation. Most countries report inflation monthly, and for these, I annualize the last three months' inflation rate to get the current ‘running rate’. Only two countries report only quarterly (Australia and New Zealand), so I annualize the past two quarters to get the current ‘running rate’:

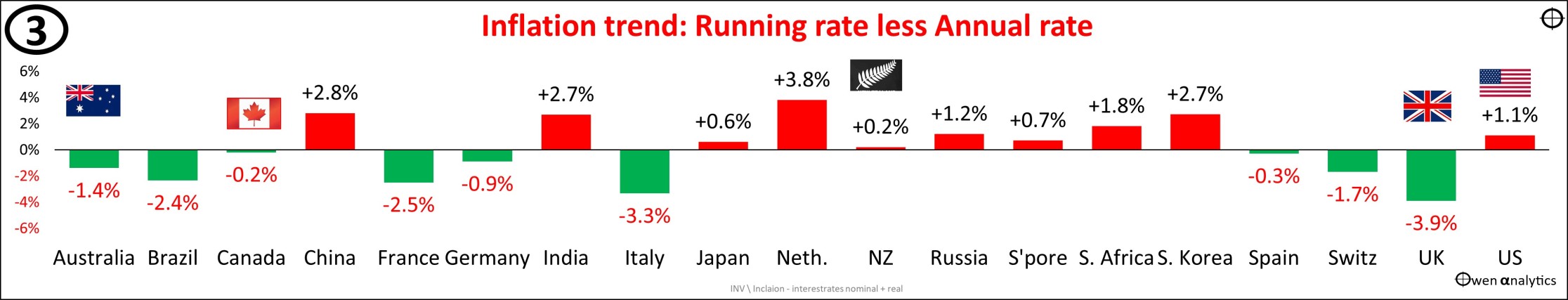

3. Inflation trend – Australia doing well in slowing inflation

The current inflation trend is shown in Chart 3, which is the difference between chart 2 and 1.

The good news is that Australia (plus Brazil, France, Italy, and UK) are slowing inflation – with the current running rate below the annual rate (negative change on the chart).

Below the line is good (declining inflation). Above the line is bad (rising inflation).

Several countries' inflation is going the wrong way - back on the rise again (notably in the US, India, Netherlands, and South Korea). Inflation in China is finally rising again after price deflation in the first half of 2023.

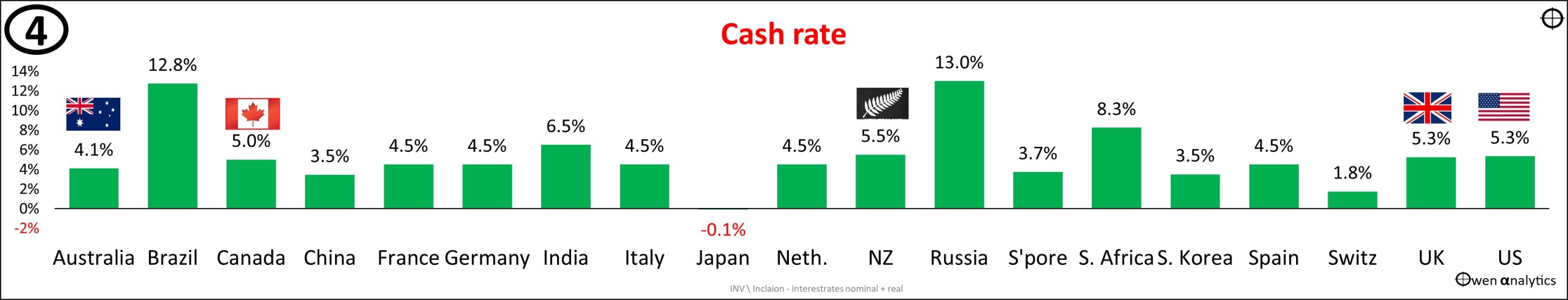

4. Cash rates – Australia still lower than most countries

How are central banks going with cash rate hikes to kill off inflation?

Despite a dozen rate hikes here, cash rates in Australia are still lower than in most other countries – in particular, our main ‘peers’ – Canada, NZ, US, and UK:

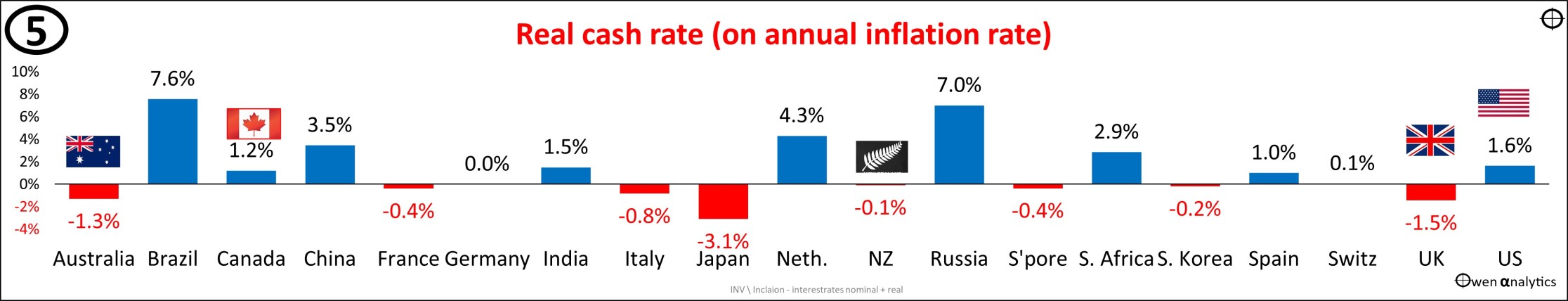

5. 'Real' cash rates (based on annual inflation) – Australia lagging

Cash rates have risen, but have they risen by enough? How high should cash rates be to contain inflation?

The key is ‘real’ interest rates (cash rate less inflation).

Chart 5 shows cash rates less annual inflation rates:

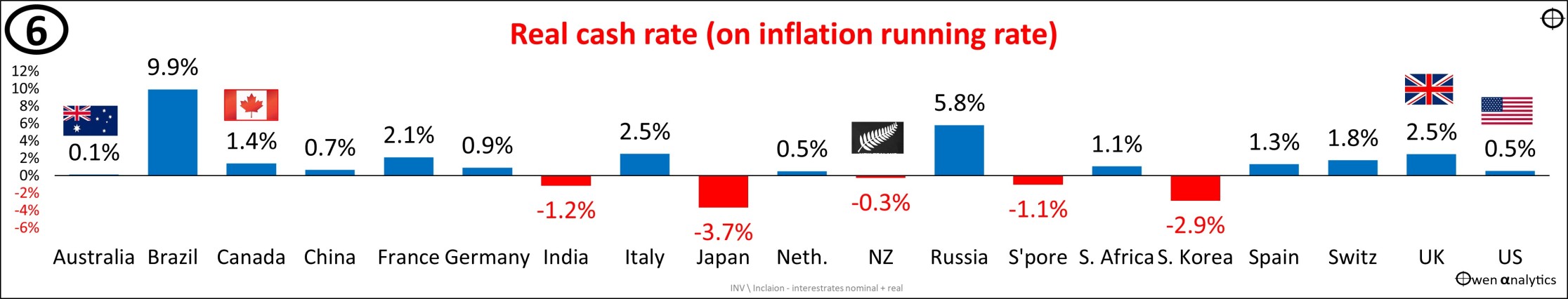

6. Real cash rates (on inflation running rate) – Australia well below what is required

The better measure of real interest rates is the cash rate less the current running rate for inflation:

Australia currently has a real cash rate of around zero. Most other countries have positive real interest rates.

Real interest rates are the crux of the problem, and they are the prime long-term policy measure for central banks.

Real interest rates need to be around 2% to 3%

Throughout history, real interest rates have averaged around 2% to 3%. This is consistent with economic theory, which says that the average real interest rate over time should be around the average real growth rate of the economy – which is also 2% to 3%, to prevent inflation from rising.

This will vary up and down through economic cycles, but the real interest rate will need to be around 2% to 3% over a cycle.

Even after the aggressive rate hikes over the past year and a half, real interest rates are still around zero to 1%, and inflation is still running well above target everywhere.

Although the full impacts of recent rate hikes have yet to be passed on in full to borrowers, it is clear that the rate hikes to date have not done enough to bring inflation back to target, let alone keep them there.

Even when inflation is brought down to target ranges, real cash rates will need to be around 2% to contain inflation. Therefore, if inflation is say 2% or 3%, and real economic growth is say 2% (most of which is just population growth in the case of Australia), this would require a real interest rate of 2%, and that would mean cash rates of around 4.5% to 5%.

Ordinarily, the current inflation running rates, plus the slowing trend of inflation, would point to central bankers' work almost being done.

Except for two wee problems -

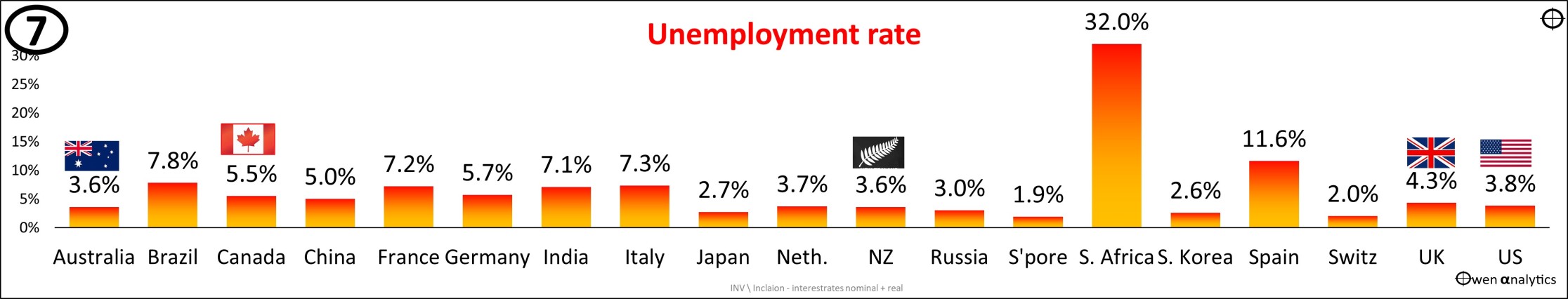

7. Unemployment – Australia lower than most – makes containing inflation a lot harder

The first problem is unemployment. Jobs markets are still very tight here and around the world:

Tight jobs markets mean wages are rising everywhere. Even the RBA’s own staff recently rejected an 11% pay rise!

Rising wages without an equivalent rise in output just pushes prices higher and feeds an inflationary spiral.

Government spending sprees

The other missing link is government spending. Central banks are trying to put their foot on the brakes, but their governments are doing everything they can to keep their foot on the accelerator.

We will cover this in future editions.

Stay tuned for another rate hike or so (or 'higher for longer inflation', which is an even worse outcome for investment markets).

‘Till next time – happy investing!

Thank you for your time – please send me feedback and/or ideas for future editions!