Every day (in fact every minute of every day and night) the value of the Aussie dollar jumps around, seemingly at random.

Shortly after the Aussie dollar was floated in December 1983, there was a famous TV interview where the head of foreign exchange trading at Westpac Bank (which had the largest FX trading floor in Australia) was asked why the Aussie dollar went up that day.

He looked around the huge trading floor full of traders and computer screens, scratched his head for what seemed like ages, and then finally said, “The dollar went up because there were more buyers than sellers!”. Duh!

He had no idea why there were more buyers than sellers. Commentators and even FX traders are no wiser today!

In news bulletins every night, the finance reporter will rattle off what is up and down that day, then shrug their shoulders and say: “. . and that’s finance!”

Why exchange rates are important

Long-term investors like us need to take a little more interest in understanding what drives the value of the AUD. Exchange rates are important for investors, not just when planning overseas travel. For example, when:

- Calculating/estimating and past/future returns on international assets

- Setting the mix of Australian and global shares and other assets in portfolios

- Planning timing of buying/selling decisions on international assets (eg shares, share funds)

- Currency hedging decisions (eg the mix between hedged and un-hedged share funds)

- Planning the timing of repatriation of foreign income and proceeds of sale of international investments

- Planning dividends - not just from foreign companies, but several major ASX-listed companies report earnings and dividends in US dollars because their revenues are priced mainly in US dollars.

This series of articles looks at the four main drivers of the Aussie dollar:

- Fundamental ‘fair value’ (long-term effect)

- Interest rate differentials (short/medium-term effect)

- Commodities prices (short/medium-term effect)

- Share market (short/medium-term effect)

(NB there are dozens of other factors that I have researched, studied, and tested at length, but these four factors have demonstrated consistently strong statistical and fundamental relationships that have persisted for several decades covering many different types of conditions, and I have used them in asset allocations processes in portfolios for the past two decades).

In this story today we look at one of the short/medium-term drivers – ‘Interest rate differentials’.

Interest Rate Differentials

Since the float of the AUD in 1983, there has been a strong positive correlation between the USD/AUD exchange rate and the difference between short-term interest rates in Australia and the US (the interest rate 'differential').

Why focus on the US Dollar?

Although there are other broad measures for the AUD, including the ‘Trade-Weighted Index’ (TWI), and exchange rates with other major global currencies like the Yen, RMB and Euro, our main interest is in the exchange rate with US dollars because the US dollar is still the dominant currency for global share markets, global trade, and almost all commodities prices. US interest rates dominate and drive monetary policies and interest rates everywhere else.

Why interest rate differentials affect exchange rates

When short-term interest rates are higher in Australia than the US, global investors sell their US dollars and buy Aussie dollars to earn the higher interest rates here. This is known as the ‘carry trade’. This net selling of USD to buy AUD raises the AUD relative to the USD.

Conversely, when short-term interest rates are higher in the US than in Australia, investors sell their AUD and buy USD to earn the higher interest rates there. This sounds too simple to be true, but it is a trillion dollar trade that continues around the clock regardless of time zones.

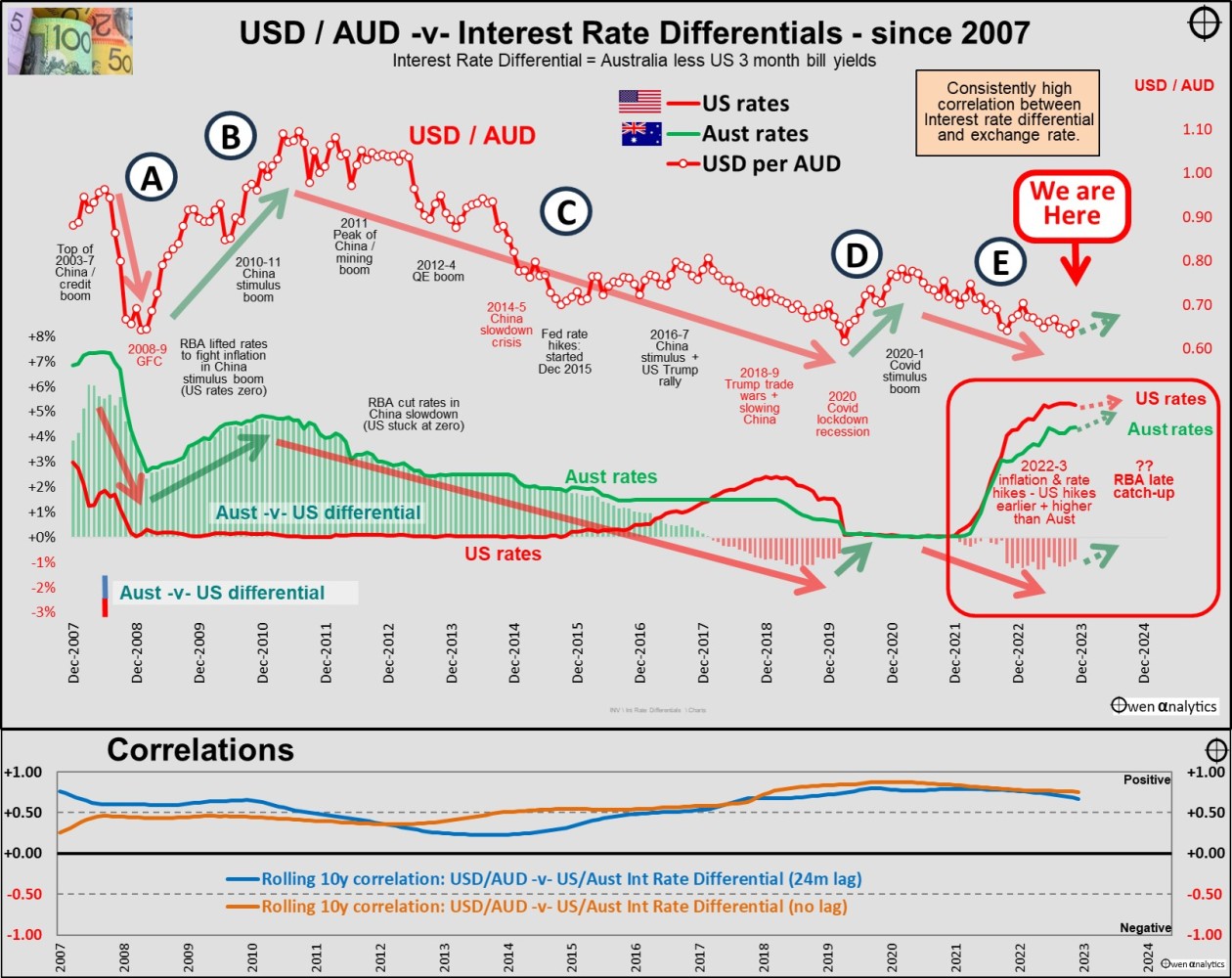

The following chart shows the relationship since 2007 (the top of the boom pre-GFC). On the chart we have:

- the USD/AUD exchange rate (red line/dots) in the upper section

- the yield on three-month bills in Australia (green line)

- the yield on three-month bills in the US (red line)

- the AUD-USD interest rate differential (Australian less US bill yields) - Positive green bars when Australian rates are higher, negative red bars when US rates are higher.

Australian dollar exchange rate - interest rate differentials since 2007

The lower section of the chart shows the consistently positive correlation between the Aust-US interest rate differential and the exchange rate. More on this later.

Parallel paths

The large red/green arrows in the upper section show how the exchange rate essentially travels in parallel with the interest rate differential through different phases.

There have been five main phases of this relationship since 2007. Starting from the left of the chart –

- A – Both the USD/AUD exchange rate and the interest rate differential fell heavily in the 2008-9 GFC, because the RBA cut rates further than the US Fed.

- B – Both rose strongly during the 2010-11 China stimulus boom. The RBA raised rates but US retained zero rates.

- C - Both then fell from 2012 through the 2012-14 QE boom, the 2014-5 China slowdown scare, the 2018 US rate hike recession scare, and 2018 China slowdown, through to the 2020 Covid scare.

- D – in the Covid rebound, the AUD rose while the interest rate differential rose from negative back to zero (rates were zero in both countries).

- E - Both fell in 2022-3 as the US hiked rates earlier and further than the RBA, sending the interest rate differential negative once again, and sending the AUD down.

Where are we now?

Phase E (falling interest rate differentials and falling AUD) is over for now, reducing the downward pressure on the AUD.

The RBA was later and slower in hiking cash rates to attack inflation, and is now left with higher inflation than the US.

In the US, the Fed’s last rate hike was in July, (to 5.25-5.5% target range), and short-term rates have been flat since then, in expectation of no more rate hikes for a while. (Talk/hopes of US rate cuts soon is a little premature!)

In Australia, the RBA hiked rates in November - to just 4.35%, even though inflation is running 3% above US inflation.

Australian short-term rates have edged a little higher, in expectation of further rate hikes by the RBA - or that the Fed will cut sooner than the RBA. Thus, over the past three months, the Aust-US interest rate differential has narrowed, removing some of the downward pressure on the AUD that was present over the past year.

However, this has not turned yet into significant upward pressure on the AUD (on this measure) because US rates are still around 1.1% higher than here – which is still a decent incentive to lure AUD investors into US dollars.

Serious upward pressure on the AUD (on this measures) would not return until Australian short-term rates are back above US rates – which is probably many months or more away.

- Note that this is only one of the four main factors driving the dollar. We cover the other factors in separate articles over the next week or so.

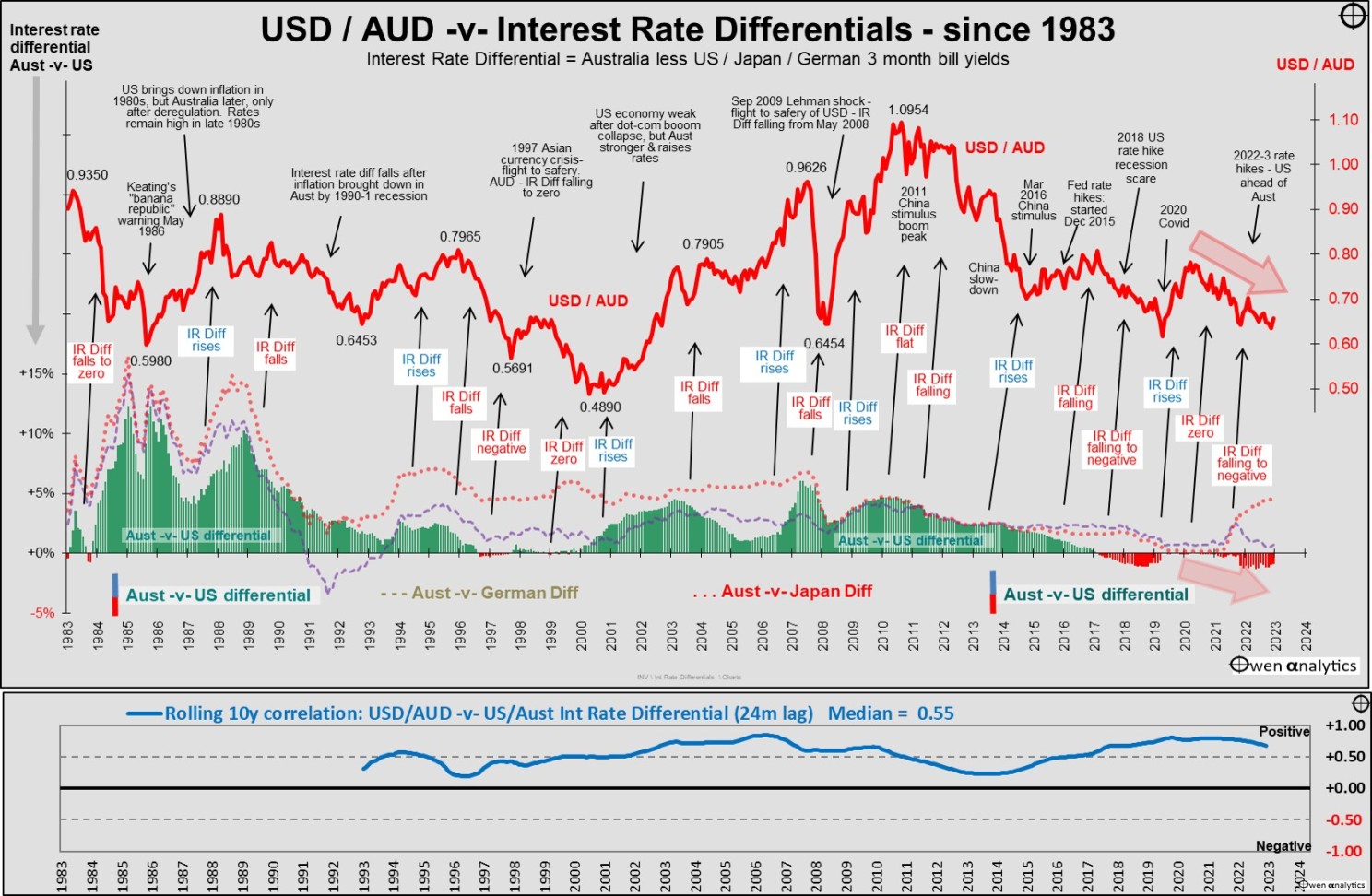

Full history since AUD float in 1983

or completeness, to illustrate how the relationship between interest rate differentials and the Aussie dollar is not a recent phenomenon, here is the full picture since the float of the AUD in 1983.

The red line is the USD/AUD exchange rate, and the green/red bars show the interest rate differential between short term interest rates in Australia versus the US.

Green positive bars are when short term (thee month) interest rates are higher in Australia; red negative bars are when short term rates are higher in the US.

Australian dollar exchange rate - interest rate differentials since 1983

The main section of the above chart highlights the key relationship –

- Rising interest rate differentials (Australia less US) are almost always followed by a rising USD/AUD exchange rate.

- Falling or negative differentials are almost always followed by a falling exchange rate.

The lower section of the chart shows the consistently positive correlation between the Aust-US interest rate differential and the exchange rate after a 24 month lag.

I call this a ‘short/medium-term effect’ because the relationship has the highest correlations after a lag of up to 24 months – ie interest rate differential at a point in time and the exchange rate 24 months later.

Australia’s higher interest rates

There is a predominance of green positive bars, and hardly any red negative bars. Since the 1983 AUD float, interest rates have been higher in Australia than in the US 85% of the time.

On average over the 40 year period, short-term interest rates have been 2.3% higher in Australia than in the US.

Interest rates and inflation

Interest rates have been higher in Australia than in the US because inflation in Australia has been higher.

CPI inflation since December 1983 has averaged 3.4% pa in Australia, compared to 2.8% pa in the US, and Australian inflation is still 3% higher today.

The very few times when interest rates were lower in Australia than in the US (negative red bars) were followed by significant falls in the AUD:

- Late 1984, which was followed by the AUD falling from USD93c to 65c.

- 1998 to 2000 (the ‘dot-com’ boom when commodities countries like Australia were very much out of fashion) – the AUD fell to all-time lows below USD50c.

- Late 2018 to 2019 (the US Fed hiked rates but the RBA did not) – the AUD fell from 81c to 67c

- Then during 2022-3 when the US Fed raised interest rates earlier and faster than the RBA – the AUD fell from 78c to 63c

Carry trade = capital flows = investment, not just speculation

Higher interest rates in Australia than the US have meant an almost constant incentive for inflow of US dollars seeking higher returns here. This has been a good thing, because post-settlement Australia was built with foreign capital.

Australia has always been a net importer of capital until only the past couple of years.

The above chart also shows interest rate differences between Australia and Germany and also Japan, because these differentials do drive an AUD carry trade into Australia from Europe and Japan, but the most important differential is with US interest rates.

For a recent more detailed picture on inflation and interest rates, see:

· Australia -v- Rest of the World on inflation and interest rates

Plus stay tuned for upcoming articles on the other major drivers of the AUD:

- Fundamental ‘fair value’ (long-term effect)

- Commodities prices (short/medium-term effect)

- Share market (short/medium-term effect)

‘Till next time – happy investing!

Thank you for your time – please send me feedback and/or ideas for future editions!