Here is my 1-page snapshot for Aussie investors – covering Australian and US share markets, short- and long-term interest rates, inflation, and the USD/AUD exchange rate - since the start of 2020.

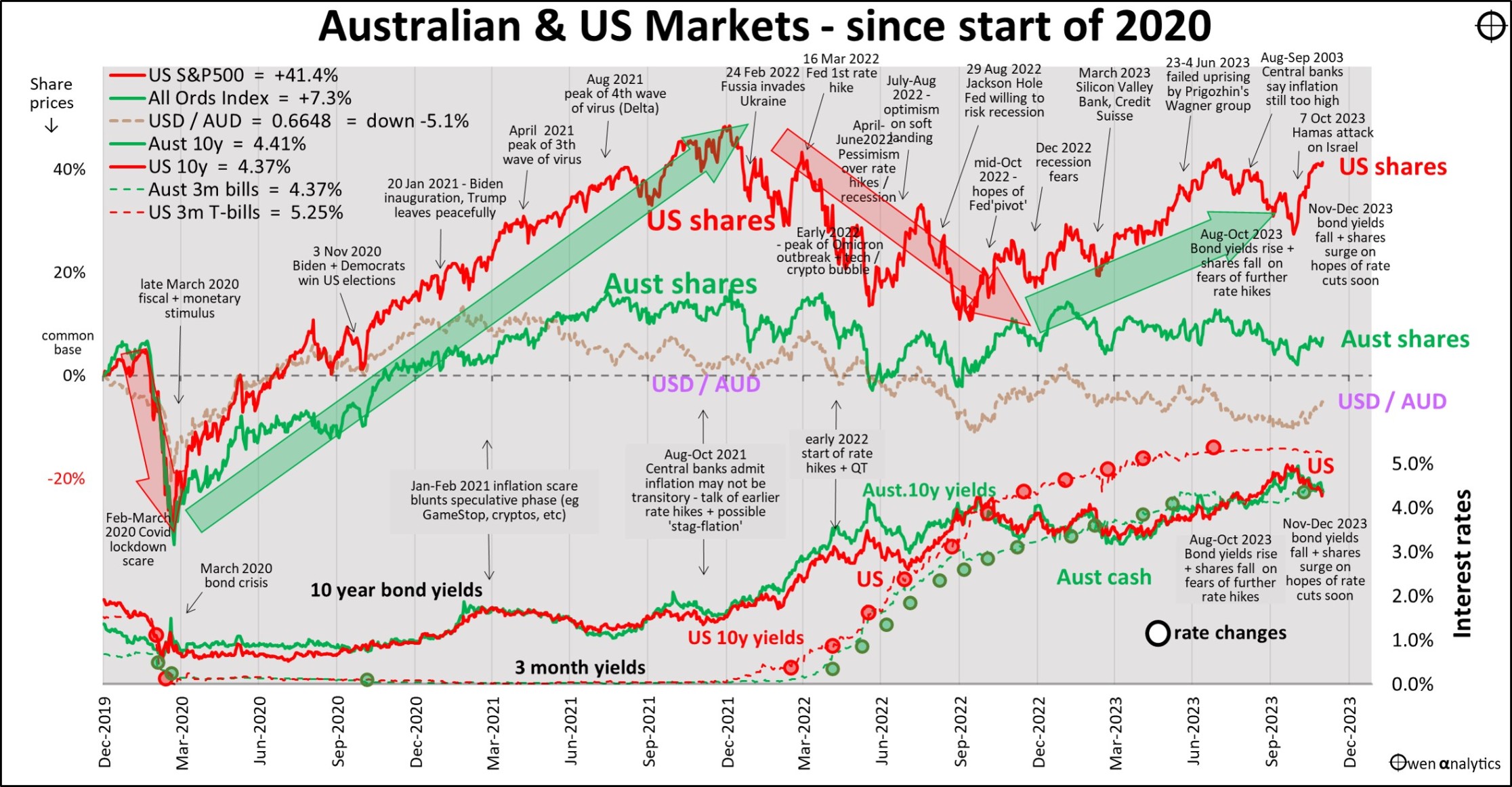

There are two versions – first is the traditional version on a single chart:

Australia + US - Share markets, bond yields, interest rates, interest rate hikes/cuts

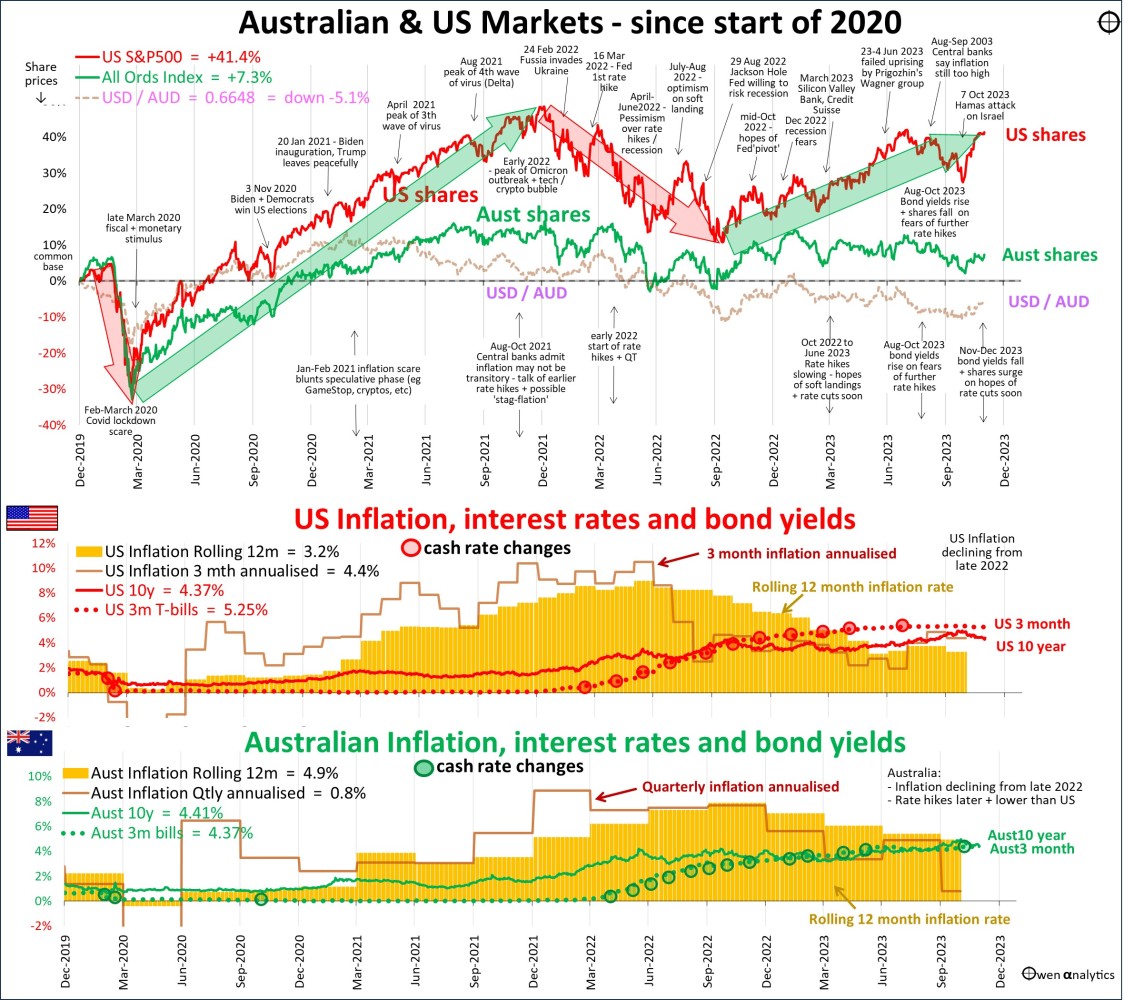

Also, a second version requested by several advisers - showing inflation (rolling 12-month annual rate, and annualised rolling 3-months) in Australia and US -

Australia + US - Share markets, bond yields, interest rates, interest rate hikes/cuts, inflation

Main developments affecting investment markets in November

Shares, bonds, and the Aussie dollar all turned upward to post gains in November, as weakening inflation triggered a switch in sentiment away from ‘higher for longer inflation and cash rates’ to hopes of rate cuts soon, despite repeated warnings from central bankers that further rate hikes may be needed.

- Share markets posted positive returns in November (all sectors up except fossil fuels), after three months of declines. All major share markets posted gains for the month. Aside from China (down again for fourth straight month), weakest was the UK (heavy fossil fuel exposure), but still ahead for the month.

- The local share market followed global markets up in November, but not by as much as the rest of the world. The big iron ore producers were stronger, with iron ore prices continuing to rise on China’s stimulus plans. What held the local market back in November were fossil fuels/utilities, on lower oil, gas, and coal prices.

- Bond markets finally posted positive returns in November as yields fell back, after six months of rising yields.

- Australian Housing – prices and rents have risen this year, but buyer confidence appears to be slowing with expectation the RBA is not done yet with rate hikes. The much heralded ‘mortgage cliff’ thus far avoiding a major outbreak of widespread foreclosures, but the stores of spare cash from the Covid stimulus handouts are being run down.

- Commercial property – more cuts to prices & valuations, more funds defaulting, freezing redemptions. REIT prices finally rose in November with the lower bond yields reflecting hopes of rate cuts soon.

- China – further relatively minor support measures from Beijing to address the widening property/construction/finance collapse, but no massive stimulus boost yet like 2009-10 or 2016-7.

- Commodities – iron ore higher on further stimulus measures from the Chinese government, lower prices for fossil fuels (oil, gas, coal), and the bubble in battery metals continued to deflate. Gold edged above $2,000 once again – hardly an inflation hedge, as inflation is receding everywhere.

The Israel-Palestine war continued but has not yet spilled over into wider conflict in the region.

- US-China tensions also gathered pace over Taiwan, although more on the ‘chip war’ front rather than militarily. Joe Biden met Xi Jinping at the APEC meeting in San Diego – there were some vague platitudes, but nothing specific, which I guess is positive.

- Other developments include: - in the Netherlands, election of Geert Wilders from the right-wing, anti-immigration, anti-Muslim, anti-EU, Pro-Putin ‘Freedom Party’ – which will probably reduce Europe’s support of Ukraine.

- In Taiwan, China secretly brokered a coalition between the pro-China Nationalists and pro-China Taiwan People’s Party, which could be enough to topple the ruling anti-China Democratic Progressive Party in the January elections. A Nationalist/TPP victory, plus a Trump win in the US, may pave the way for Xi’s stated plans to 'incorporate' (invade and subsume) Taiwan. Meanwhile, the US is hastily building chip factories in the US, and TSMC (which makes more than half of all semiconductors used globally) is accelerating a shift to manufacture chips in Japan. Getting very interesting up there! Military build-ups are great for Aussie miners!

- Economic growth has remained relatively strong, but starting to soften a little in the US, Europe, and Australia – thus far defying economists' widespread predictions of recessions.

On a sombre note, Warren Buffett’s deputy/side-kick Charlie Munger died on 28 November, one month short of turning 100. As a long-term Berkshire Hathaway shareholder and avid observer/reader of Buffet and Munger, I do regret never attending their ‘Woodstock for capitalists’ AGMs in Ohama. See my recent story on Berkshire Hathaway – Warren Buffett – World’s greatest investor – but even he lost it 20 years ago.