August Reporting Season for Australian Listed Companies

August is the main full-year reporting season for Australian listed companies, as most companies have June reporting years.

For ASX100 companies that reported their June full-year results in August, total profits fell by one third from $116b to $76b.

This is recession-era stuff. The -34% fall in aggregate reported profits is similar to profit declines in deep recessions in the past, like the GFC, early 1990s recession, and early 1980s recession, but the dollar amounts are of course much larger now (largely due to inflation).

A 34% fall in total profits, and we’re not even in recession yet!

This rather alarmist headline is somewhat misleading. In fact, 53% of companies posted higher profits, and 61% of companies increased their dividends.

The big decline in aggregate profits was caused by a small number of one-off factors. The largest contributors were:

- BHP’s profit (converted to A$) dropped by more than half - from US$45b to US$19b, reversing the windfall iron ore profits from last year. Even after the fall, the 2023 result was still more than $4b higher than the 2021 profit.

- Woolworth’s profit decline of $6.3b was because last year’s profit included the one-off $6.4b gain on the spin-off of Endeavour. Operating profits were more or less flat.

- Property valuation write-downs in the property trusts (Dexus, Goodman, Mirvac, Stockland, Vicinity, Charter Hall).

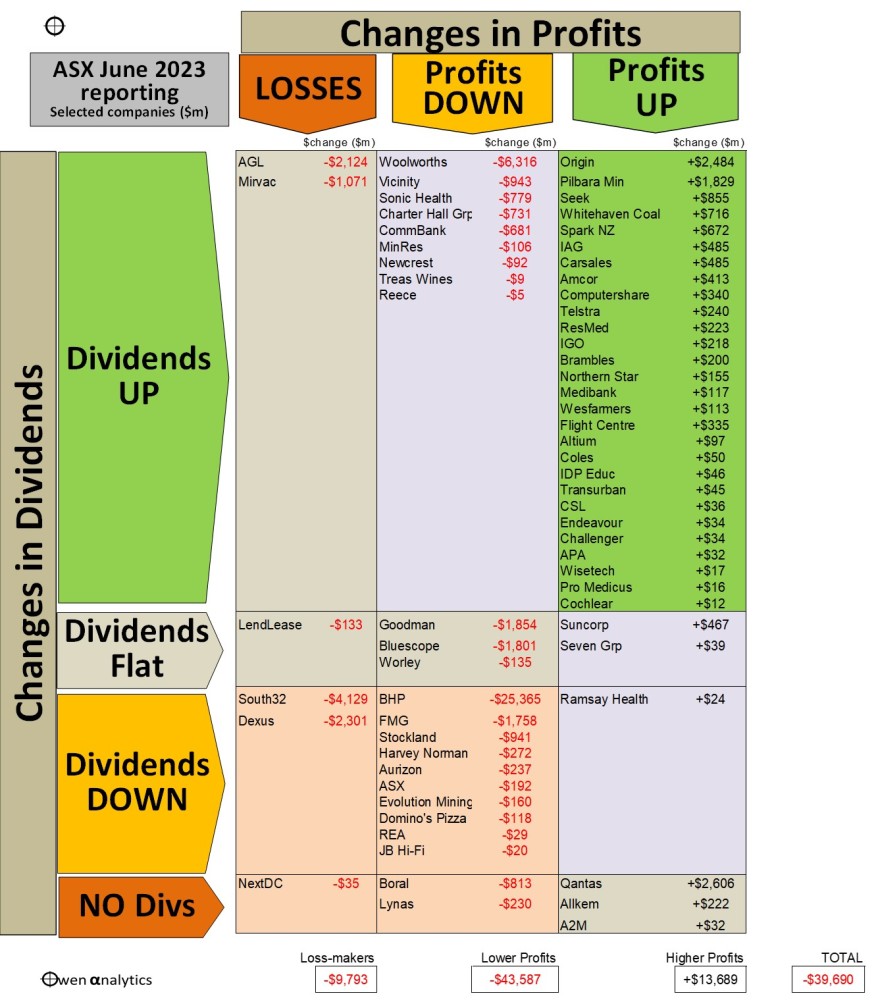

Chart 1 – Changes in Profits and Dividends

The first chart shows changes in $profits for the main companies – and sorts them into categories – based on changes in profits - with losses (left column), lower profits (middle column), or higher profits (right column), and also their changes in dividends - higher dividends (top section), flat, lower, or no dividends (bottom section).

Table showing ASX100 companies - by changes in profits and changes in dividends

NB. Although the vast majority of ASX-listed companies have June financial years, several large companies have different financial years, which are not included here – September (Westpac, ANZ, NAB, Aristocrat, Orica, Incitec Pivot), December (Woodside, Santos, RIO, QBE, Scentre, TPG, GPT, Ampol, Medibank, IIuka, Alumina), and March (Macquarie, James Hardie, Xero).

The full year result is likely to be lower by a couple of billion dollars (including profit declines of perhaps -$3b for Woodside, -$1b for Santos, -$1b for RIO, but partially offset by possible profit increases of perhaps +$1b each for Westpac, ANZ, and NAB).

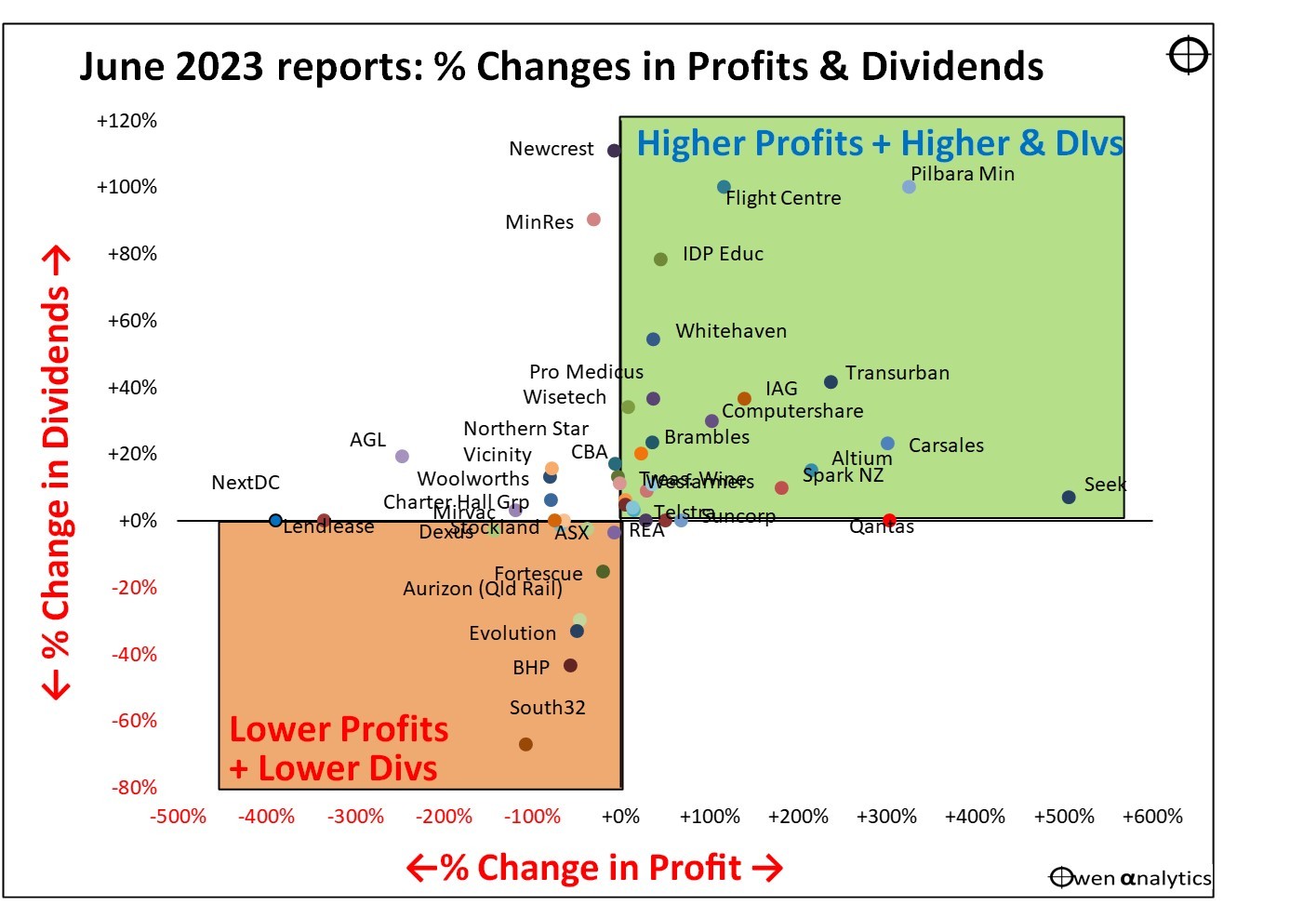

Chart 2 – Changes to Profits and Dividends Mapped

Our second chart plots companies by % change in profits versus % change in dividends.

More than half of companies posted higher profits (right hand sections), and most also posted higher dividends (upper sections).

In the upper right section (higher profits and dividends), we see some stand-outs – Pilbara Minerals (lithium), Flight Centre, IDP education, Seek, Transurban, etc.

At the other extreme, the lower left section has the companies with lower profits (or losses) and lower dividends. These are mainly the miners – coming off windfall profits and dividends last year.

In the upper left section, some companies reported lower profits, but still raised dividends to appease shareholders (eg CommBank, Woolworths).

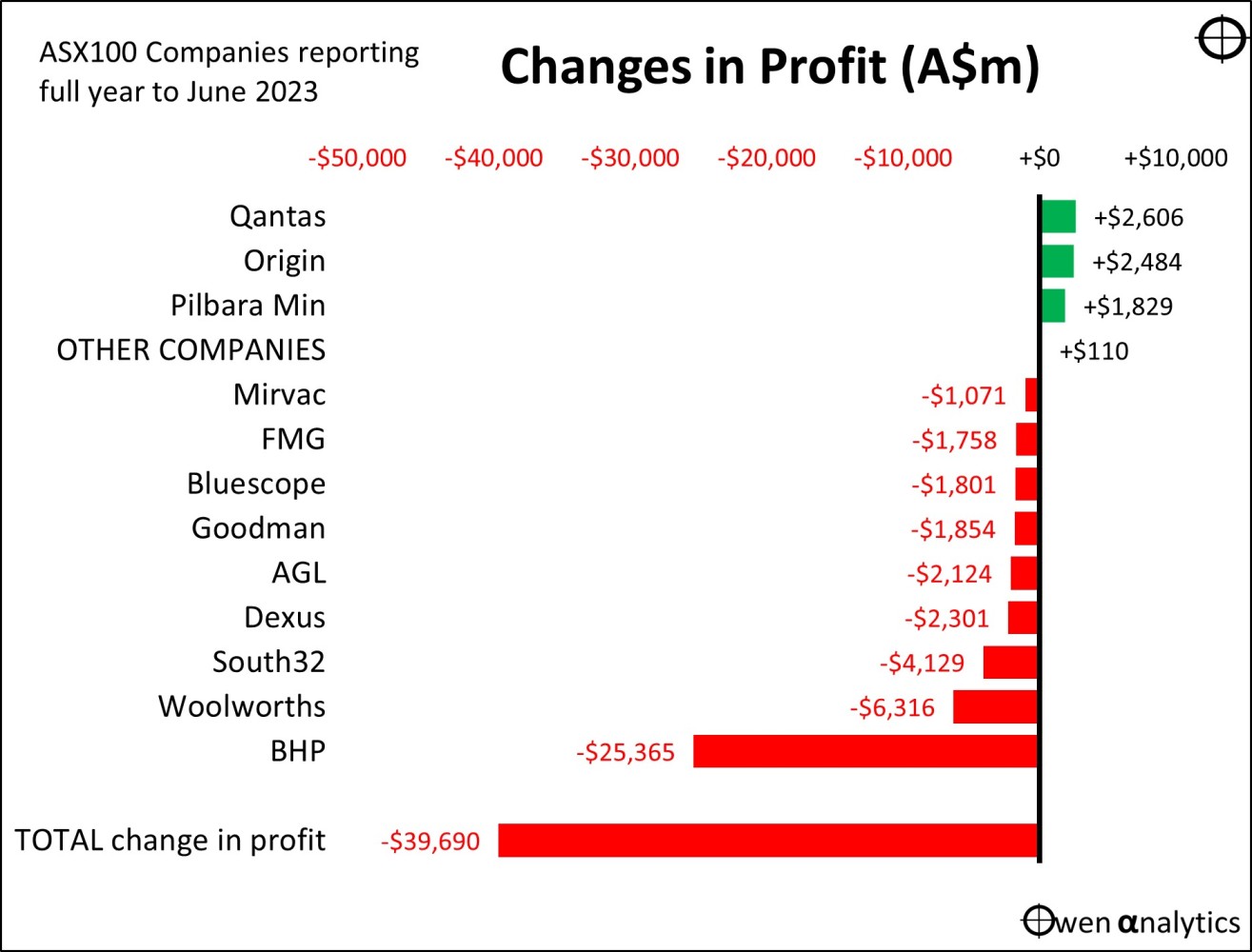

Chart 3 – Main Contributors to the -$40 Fall in Total Profits

This chart shows the main contributors to the overall aggregate -$40 reduction in profits.

The single largest profit increase was from Qantas, going from a -$800m loss last year to a $1,744 profit this year. (The fact that this $2.6b profit gain matched almost exactly the $2.7b in tax-payer handouts Qantas took during Covid, made for great media headlines).

Iron Ore Republic!

This chart highlights the fact that total profits and dividends from the whole ASX-listed market are extremely sensitive to iron ore prices and Chinese iron ore demand.

In 2022, more than half of the total combined profits and dividends from the entire 2,200+ ASX-listed companies came from just three companies - iron ore miners BHP, RIO, and FMG. The iron ore price fell -8% for the year to June, and that wiped off $30b from aggregate profits. From a distance, it makes us look very much like a 'banana (or iron ore) republic'! Surely we can do better!

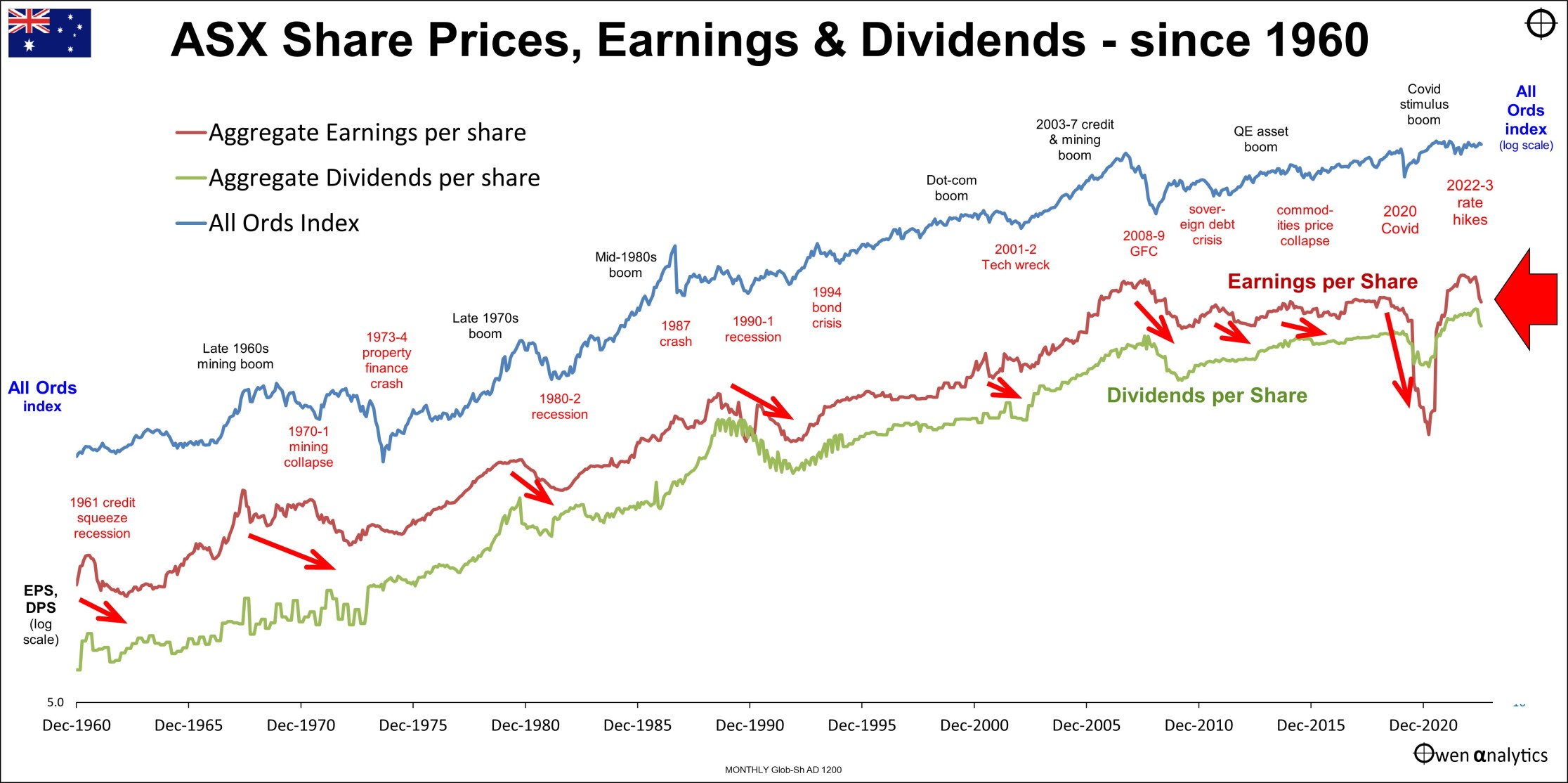

Chart 4 – The BIG Picture – Where Are We Now?

To put this reporting season in context, here is a chart of Australian share prices, aggregate earnings per share, and aggregate dividends per share since 1960.

Profits and dividends were cut savagely in the 2020 Covid recession, then surged in the Covid stimulus rally, well above their pre-Covid levels.

The latest cut in profits and dividends is really only giving back the windfall profits and dividends from the Covid rally.

Note that aggregate earnings and dividends per share in Australia are barely higher now than they were 15 years ago (unlike in the US, where profits and dividends have soared over the same period).

That’s another story for another day!