Paris just wrapped up another amazing Olympic Games and my overwhelming reaction is …’Wow!’ It certainly was specular and action-packed from start to finish. (The Paralympics is yet to come of course!). Congrats to all winners, participants, coaches, families, support teams, organisers, volunteers, paramedics, security, etc, and the whole of Paris.

Australia’s best ever

Australia posted its best ever medal haul, placing fourth on the table behind giants US, China, and Japan.

But a regular medal table just based on the number of medals won per country glosses over the fact that individual countries vary vastly in population and wealth.

Today’s story reveals the real winners once we adjust the medal tally for population and wealth. How did Australia and our rivals and peers rate?

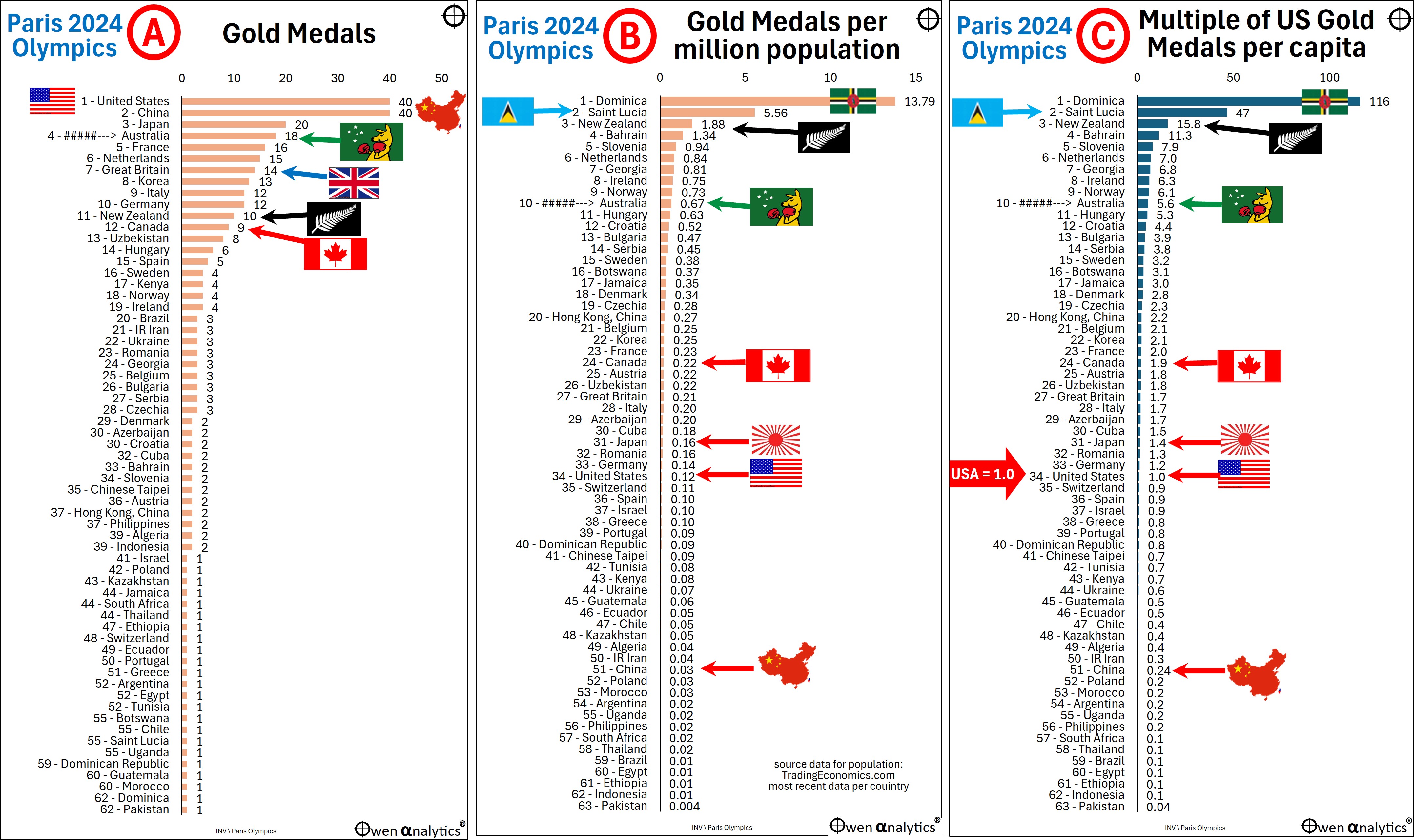

In the first set of charts, chart A is the regular table you have all seen – ranking the 62 countries that won at least one gold medal. (For this exercise I just focus on gold medals. I don’t want to get into debates over the relative values of silver and bronze compared to gold.)

The traditional ranking in chart A shows that Australia punched well above its weight, coming in 4th, beating much larger countries like France, Germany, Britain, Germany, etc. A tremendous result for a country with ‘only’ 27 million people.

Adjusting for population

However chart B (above) shows how the same countries rank by the number of gold medals per million of population.

The winner of the population-adjusted ranking is Dominica in 1st place, followed by Saint Lucia. Both are tiny countries in the Caribbean, with populations of just 73,000 and 180,000 respectively.

Dominica’s Thea Lafond won gold in the Women’s Tripple Jump, and Saint Lucia’s Julien Alfred won gold in the Women’s 100m sprint.

Aussies beaten by Kiwis!

In population-adjusted terms, Australia drops from 4th to 10th place on the table in chart B and our old rivals New Zealand jumps up the table from 10th place to 3rd. New Zealand won 10 gold medals to Australia’s 18, but has only 20% of Australia’s population. Ouch!

The other, larger countries with high medal hauls end up much lower on this population-adjusted table. USA comes in at 34th place, and China is ranked 51st out of the 62 gold medal winning countries.

USA in bottom half, and China near bottom

Chart C (above) uses the same population-adjusting ranking as Chart B, but it uses USA as a benchmark and shows how each country performed on population-adjusted terms relative to the USA. (USA is assigned 1.0 in 34th position)

For example, Australia’s gold medal performance was 6.6 times that of the USA, NZ was 17 times the USA.

Canada, Japan, and most European countries did much better than USA in population-adjusted terms. China scores only 0.24 – ie only 24% of USA’s gold medal tally in population-adjusted terms, because China’s population is nearly four times larger than USA.

But USA is rich while China is still relatively poor, which brings us to. . .

Adjusting for wealth

Some countries are immensely rich and can afford expensive sporting facilities, coaching and medical staff, nutritionists, dieticians, travel budgets, sporting scholarships, tax-payer funded sporting academies, and have hoards of wealthy corporate sponsors, etc, whereas other countries are extremely poor and have none of these advantages.

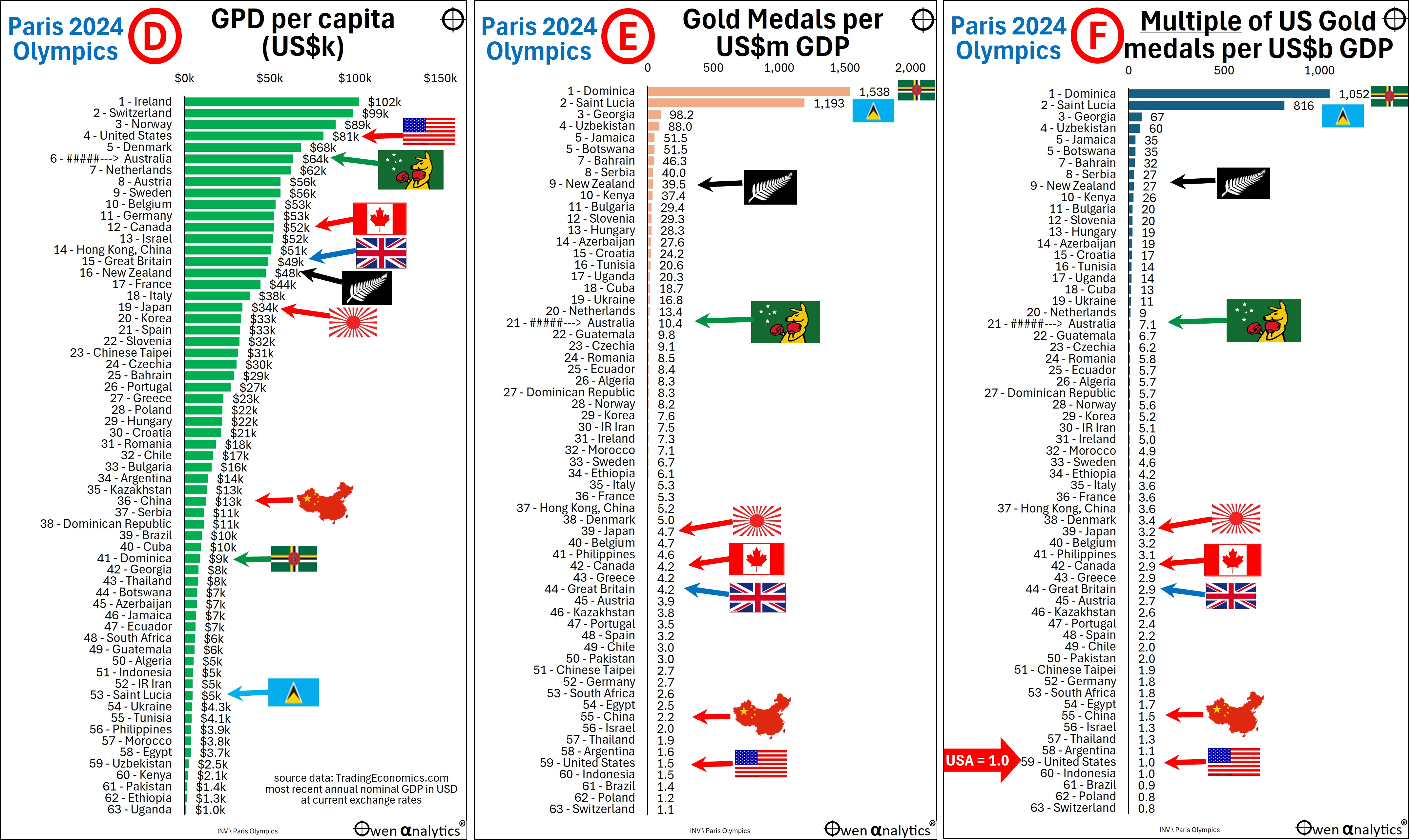

In the next set of charts, chart D ranks the 62 gold medal winning countries from richest to poorest on their national gross domestic product (GDP), measured in US dollars at current exchange rates.

Australia and the US are near the top, beaten only by Ireland, Switzerland and Norway.

Our peers and rivals Canada, Britain, New Zealand, and Japan are well below Australia. China is in the lower half, Dominica is not far behind, but Saint Lucia is near the bottom, with less than one tenth of the national wealth per capita of the rich countries.

Wealth-adjusted ranking

Chart E (above) ranks countries by the number of gold medals per country per billion US dollars of GDP. Dominica and Saint Lucia are again at the top.

But New Zealand once again does four times better than Australia! New Zealand is far and away the best of the ‘developed’ (rich) world countries at the Olympics.

The mighty US of A is almost at the bottom of the table, ranking 59th out of the 62 gold medal winning countries. China is not much better, ranking just 55th. Canada, Britain, and Japan are also in the bottom half or bottom third of the wealth-adjusted ranking, along with most of Europe.

Chart F (above) uses the same wealth-adjusting ranking as Chart E, but again uses USA as a benchmark and shows how each country performed on wealth-adjusted terms relative to the USA. (USA is assigned 1.0 in 59th position)

For example, Australia’s gold medal performance was 7 times that of the USA, and NZ was and incredible 27 times better than the USA!

Makes you think about the power of all of the money in rich countries that directly and indirectly contributes to superior sporting outcomes.

And we gotta figure out a way of beating those pesky Kiwis! Dollar-for-dollar, pound-for-pound, the Kiwis are still miles ahead!

‘Till next time – happy investing!

Thank you for your time – please send me feedback and/or ideas for future editions!